Apparel retailer Urban Outfitters (NASDAQ:URBN) late Tuesday posted worse-than-expected third quarter earnings results, causing a major sell-off in its shares after hours.

The Philadelphia-based company reported Q3 net income of $0.40 per share, which was $0.04 worse than the average analyst estimate of of $0.44. Revenues rose 4.5% from last year to $862 million, also falling short of Wall Street’s view for $868.96 million.

Comparable store sales, also known as same-store sales or simply “comps,” rose 1.0% from the year-ago period in all of URBN’s various brand stores. Comps rose 5.2% at Urban Outfitters, but fell 1.5% at Free People and decreased by 2.7% at the Anthropologie Group.

On a sour note, Urban Outfitters said its gross profit rate fell by 15 basis points versus the year-ago period.

The company commented via press release:

“I am pleased to announce our teams delivered record third quarter sales,” said Richard A. Hayne, Chief Executive Officer. “These results were driven by the third consecutive quarter of positive Retail segment ‘comps’ and continued strength in our Wholesale segment,” finished Mr. Hayne.

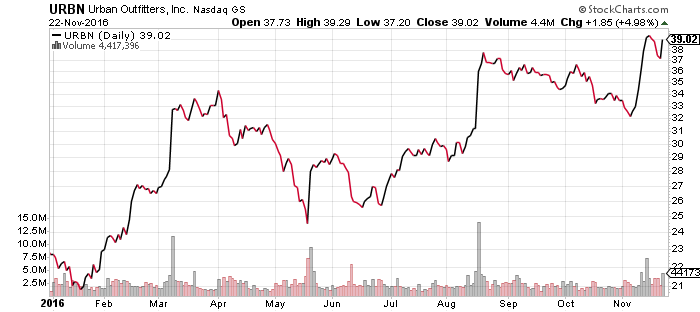

Urban Outfitters shares fell $3.74 (-9.59%) to $35.27 in after-hours trading Tuesday. Prior to today’s report, URBN had surged 71.47% year-to-date, nearly ten times the return of the S&P 500 index during the same period.