The big tech companies, or the so-called Mega-cap 7, do not report their Q3 ’24 financial results until Halloween week:

- Alphabet (NASDAQ:GOOGL): Tuesday, 10/29/24 AMC

- META (NASDAQ:META): Wednesday, 10/30/24 AMC

- Microsoft (NASDAQ:MSFT): Wednesday, 10/30/24 AMC

- Apple (NASDAQ:AAPL): Thursday, 10/31/24 AMC

- Amazon (NASDAQ:AMZN): Thursday, 10/31/24 AMC

Nvidia (NASDAQ:NVDA) isn’t scheduled until mid-November ’24.

The point being that’s a big chunk of the S&P 500’s market cap and earnings weight that will all get reported in a 72 hour time span at the end of October, just a week before the Presidential election.

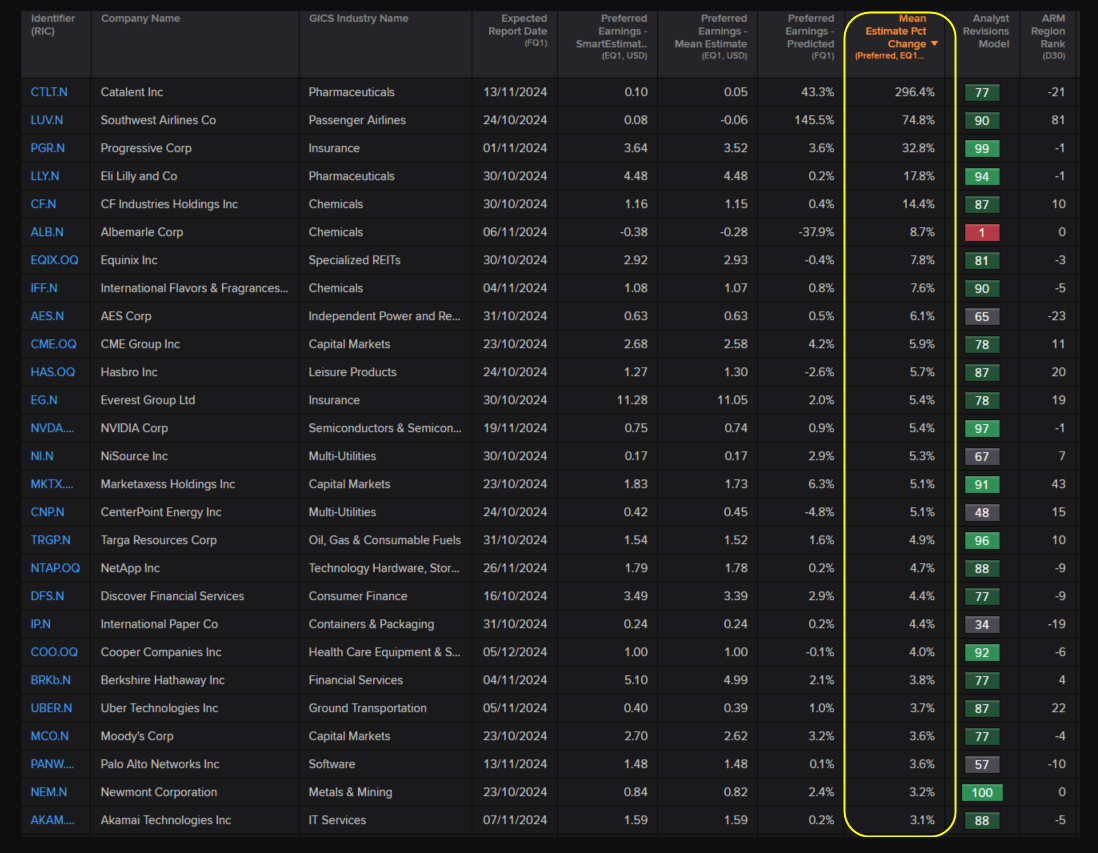

Largest “expected” positive and negative EPS surprises for Q3 ’24:

Courtesy of LSEG – click on above

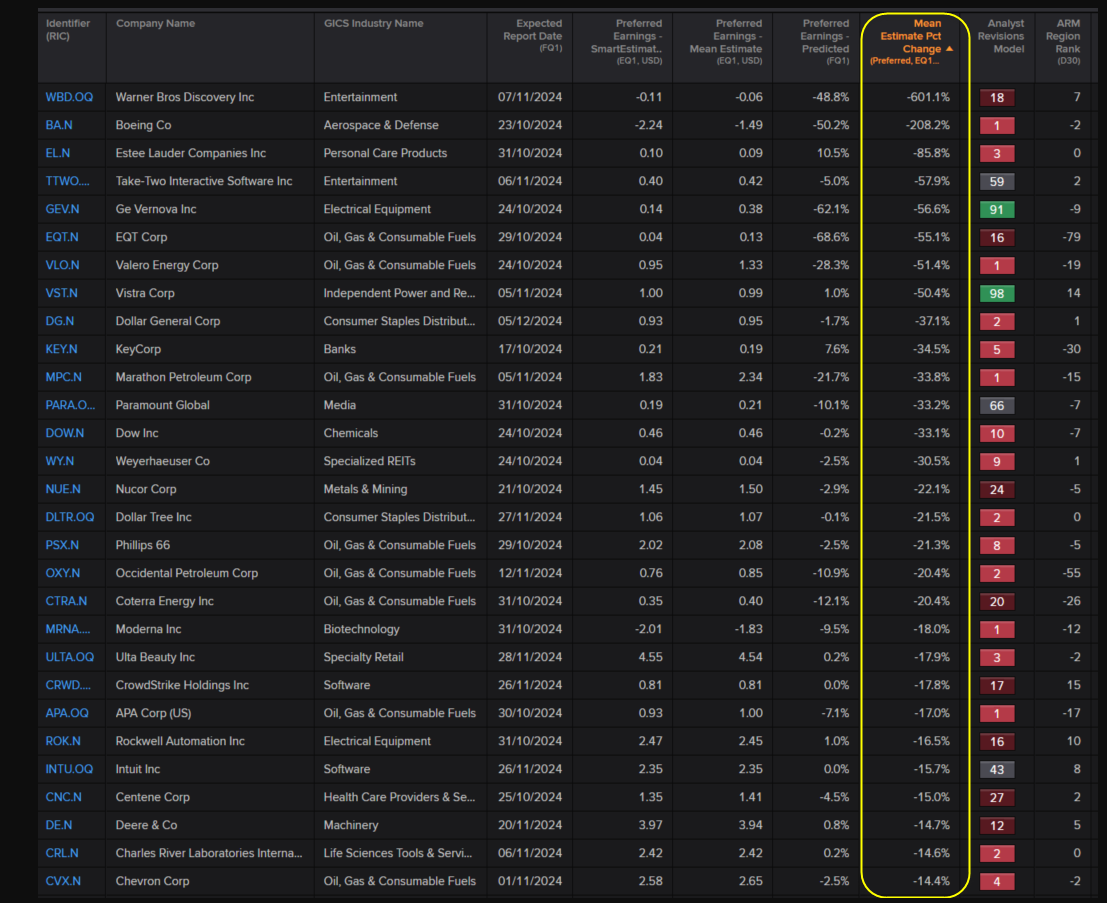

Courtesy of LSEG – click on above

Here’s a question for readers though: if the “upside” or “downside” surprise is that predictable, shouldn’t investors by buying the expected negative surprises and selling the expected upside surprises ?

The energy sector and Boeing (NYSE:BA) are certainly leading the negative revisions.

At some point Boeing (BA) will be buyable for long-term investors.

IBM (NYSE:IBM) and Tesla (NASDAQ:TSLA) will be getting the closest scrutiny from this blog come Wednesday night, October 23rd, ’24. CME Group (NASDAQ:CME) and Coca-Cola (NYSE:KO) will also be seeing their valuation model’s updated. (Tesla is now the 12th largest stock in the S&P 500 today, falling out of the top 10, so it’s pretty wrung out in terms of momentum. I worry that Elon is now getting distracted by politics. Tesla needs a lower-cost model for US consumers.)

S&P 500 data:

- The forward 4-quarter estimate ended this week at $265.72, down slightly from last week’s $266.09;

- The PE on the forward estimate 22x, vs 21.8x last week, and 21x as of June 30 ’24;

- The S&P 500 “earnings yield” is 4.53%, vs last week’s 4.58% and June 30’s 4.63%;

- There have only been 75 companies reporting Q3 ’24 to date. The EPS upside surprise is +6.4%. That’s still a little lower than Q2 ’24 at +8%, but still healthy.

Summary / conclusion:

It’s the last week of the month where we get the big mega-caps reporting so we have another week to bide our time, and watch the action.

JPMorgan is having a tough time making a new all-time high, despite it’s good quarter. There is still a wet blanket over the major banks as net interest income is expected to be lower in calendar ’25.

The surprising metric to Netflix (NASDAQ:NFLX) was that they guided ’25 revenue to be between $43 – $44 billion, or inline with the current consensus estimate of $43.5 billion, the surprise being they are giving that guidance 90 days ahead of their Q4 ’24 financial release, which is when investors and analysts usually get next years guidance.

***

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal even for short periods of time. All S&P 500 EPS and revenue is sourced from LSEG.