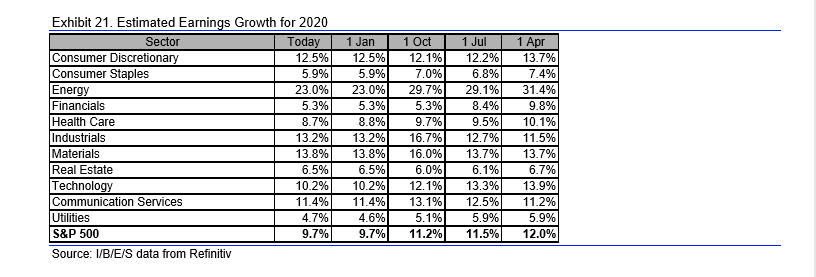

This table was sent out to readers on December 1 (here) and once in November ’19 (here).

On December 1, readers were told to keep an eye on Consumer Discretionary and Real Estate.

It’s not negative revisions that worry us – it’s expected that analyst estimates erode as we get closer to a quarter (Ed Yardeni has written about this for years) – it’s positive revisions to sectors even as the rest of the S&P 500 typically sees downward revisions, that provide a positive tell for investors.

Financials – per the above table – have been stable now since October 1 ’19 (i.e. the expected 2020 growth rate has been stable) which is a positive.

Consumer Discretionary, Real Estate and Financials – the revisions portend positively for each of the these sectors.

Summary / conclusion: As a whole, the SP 500 looks pretty good heading into Q4 ’19 earnings in a week or so. “Degradation” or erosion hasnt been too bad since October 1 of 2019. My guess is Q4 ’19 earnings and revenue will come in a little ‘hot” (good upside) and 2020 guidance will be tempered. Like overall stock market sentiment, no one wants to be bullish.

2019 was a good year.