In October, I wrote that mortgage REIT dividends had stabilized and that many were trading below book value. As we enter 2015 much the same way we entered 2014–with fears of rising rates and an overheated stock market–I wanted to revisit the table I prepared in my October comprehensive portfolio review.

Mortgage REITs are not quite the value they were this time last year or even as recently as October. Taking a simple average of the mortgage REITs in the table–which represent the top ten portfolio holdings of the Market Vectors Mortgage REIT Income ETF (NYSE:MORT)–we see the sector trading at book value and yielding 10.0%.

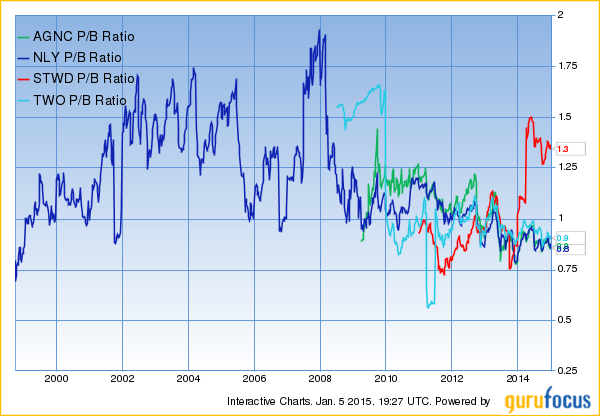

Still, even trading at book value, mortgage REITs are far from expensive. m-REITs generally trade at a significant premium to book value (see chart). Many of these m-REITs have short trading histories, but Annaly Capital (NYSE:NLY), the granddaddy of the sector and the largest by market cap, has spent virtually the entire period from 2000 to 2013 well above book value.

Dividend cuts are a distinct possibility. But worrying about those today is a case of closing the barn door after the horse has already bolted. Annaly cut its dividend in June and September of 2013 but kept it steady last year. American Capital Agency (NASDAQ:AGNC) cut its dividend aggressively in October of last year. Two Harbors Investment Corp (NYSE:TWO) modestly cut its dividend last year. Bucking the trend, Starwood Property Trust (NYSE:STWD) actually raised its dividend in 2014.

Could further dividend cuts be on the way in 2015? Sure. It’s a real possibility, particularly if the Fed follows through with raising short-term rates. But with yields averaging 10.0%, we have quite a bit of wiggle room.

I expect to see mortgage REITs deliver something along the lines of 20% total returns (capital gains + dividends) this year. Let’s say I’m overly optimistic and the returns end up being closer to 10%. That’s still better than what I expect the U.S. market to deliver given current valuations. U.S. stocks trade at 27 times cyclically-adjusted earnings, making them 63.9% higher than their long-term average and implying annual returns over the next eight years of just 0.3%. Given the choice between overpriced U.S. stocks and modestly undervalued m-REITs, I’ll choose m-REITs.

The same logic applies to business development companies (“BDCs”). Let’s look at the largest holdings of the UBS ETRACS Wells Fargo Business Development Company ETN (NYSE:BDCS).

Taking a simple average, the top BDC holdings sport a dividend yield of 8.7.% and trade slightly below book value. But as was the case with mortgage REITs, BDCs often trade at a significant premium to book value.

BDC valuations fell off a cliff during the 2008 meltdown before recovering into 2010. But the overall trend in price/book valuation has been down. As a group, this is the cheapest the BDC sector has been since the crisis.

Can cheap sectors get cheaper? Of course. But given the alternatives in a broadly overpriced market, I’ll gladly take the 8.7% dividends on offer from BDCs.