Behind the Numbers’ Jeff Middleswart had some interesting comments on mortgage REITs in today’s Thursday Thoughts:

Update on Mortgage REITs – In our May 22 issue of Thursday Thoughts we discussed how the Mortgage REIT sector looked very cheap with stocks trading below book value and yields of 10%-12%. The low level of refinancing was no longer causing their portfolios to turn over much, and the average life had already extended out, and the companies have marked them down. Thus, interest rate risk creating average life extension was not a material risk for this sector at the moment.

They are hedged for interest rates rising as well, which also does not appear to be a sizeable risk in the near future either. Thus, their current interest spreads for the portfolio should be fairly stable.

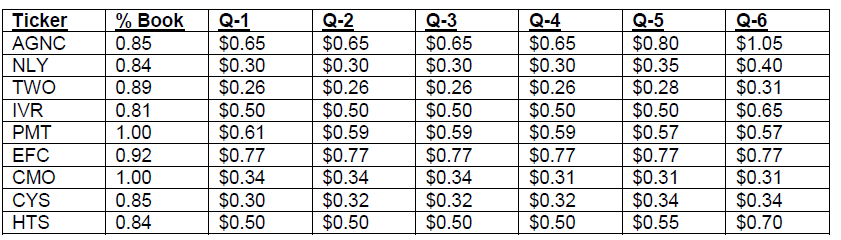

These stocks continue to get battered around on interest rate fears leading to a squeeze of margins causing dividend cuts. Those fears are not coming to pass and it is important to note that these stocks are still selling at a discount and the dividends have not been reduced in a basically a year now [emphasis mine--CLS]. 10%-12% cash returns with some capital appreciation potential of 15%-20% simply from having these stocks return to book value is a decent play in this market in our view. Here are the last six quarters of dividends for these companies. Reality is much different than the fears:

I agree completely and made similar comments in my recent comprehensive portfolio review.

With market yields easing and with the Fed not likely to raise short-term rates any time soon, mortgage REITs would seem like a smart place to park cash for the next 6-12 months.

Disclosure: Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management. Click here to receive his FREE weekly e-letter covering top market insights, trends, and the best stocks and ETFs to profit from today’s best global value plays.