Developments in US-China trade negotiations have suddenly changed for the worse as the US hiked tariffs on USD 200 Bn of imported Chinese goods from 10% to 25%. The action broke the Trump-Xi trade “truce” and added to other measures imposed by the US on China last year, including tariffs on solar panel and washing machines, steel and aluminum, and on USD 50 Bnof other goods. China has retaliated by imposing tariffs on USD 60 Bn of imported US goods, adding to previous retaliatory measures. The situation may escalate further as the US is threatening to impose additional tariffs onall remaining imports from China (about USD 300 Bn).

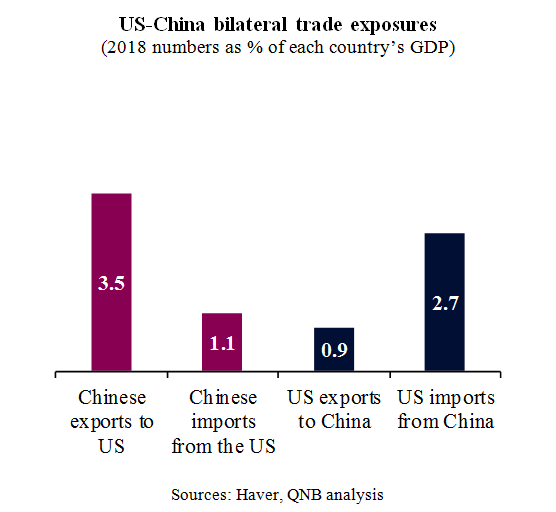

Our analysis delves into the three main channels through which tariffs are expected to affect both the US and China, including net exports, real incomes and financial conditions. First, a lift in bilateral tariffs affects net exports of both countries. This takes place through export losses and import reduction as tariffs hit export competitiveness and partially shift demand towards domestically produced goods. In this sense, from a direct trade exposure perspective, there is a considerable asymmetry between the US and China. While US exports to and imports from China account for 0.9% and 2.7% of GDP, Chinese exports to and imports from the US account for 3.5% and 1.1% of GDP, respectively. Given this relative composition of bilateral trade, the US is less affected by export losses and benefits more from import substitution.

Second, tariffs, directly and indirectly, affect price levels, pushing inflation up while real incomes go down. The effects of tariffs on inflation are relatively small and mostly temporary, but much more significant in the US than in China, given the small share of Chinese imports from the US. According to recent research from the US National Bureau of Economic Research, the costs of tariff hikes have so far fallen mostly on US businesses and households. In fact, a granular dive on US trade volumes and prices suggest that tariff-affected Chinese exports to the US did not decline in prices, i.e., the costs of tariffs have been shouldered by US corporates and consumers rather than Chinese exporters. Moreover, the price effect of tariffs on Chinese products is spilling over to prices charged by non-Chinese exporters of tariffed goods, which implies that exporters from other countries are behaving opportunistically to widen their margins at the expense of US residents. Tariffs are currently boosting core inflation by around 20 basis points (bps) in the US. Importantly, the effect will be amplified should the US decide to apply further tariffs. Consumer goods account for only about 15% of all imports subjected to tariffs so far but for about 60% of all the remaining imports from China. If the trade war escalates, the effects of tariffs on inflation will persist for a longer period and will likely be lifted by another 35 bps, eventually producing further losses in real incomes.

US-China bilateral trade exposures

(2018 numbers as % of each country’s GDP)

Sources: Haver, QNB analysis

Third, additional tariffs and bad news coming from US-China trade negotiations often produce a deterioration in sentiment that may lead to a tightening in financial conditions, i.e., lower equity prices, higher credit spreads and less availability of credit. Ever since signs of disruptions in negotiations started to come out in early May 2019, the US S&P 500 and Shanghai Stock Exchange Composite plummeted by 3.6% and 5.6%, respectively. A bout of risk-off sentiment started with widening credit spreads and tighter financial conditions in general. Should this continue, effects on growth are likely to be significant, especially given the importance of the wealth channel in the US and credit in China.

All in all, a trade war of tariffs between the US and China negatively affect both economies through different channels. China is more affected by the direct trade channel while the US is more affected by the real income and financial condition channels. Recent events suggest that a broader trade deal is rather unlikely. However, the negative effects of an escalating economic conflict may compel both parties to reach a narrower or preliminary deal. The G-20 summit in Osaka, Japan, on 28-29 June, may be an occasion to grasp further indications on the direction of bilateral discussions as Trump and Xi are expected to meet. Stakes are high and a positive outcome would likely be supportive for a global economy that is already facing a significant.