For quite some time, we have been talking about weakening macroeconomic and earnings trends, which, combined with more aggressive Fed rate cuts, have historically denoted the beginnings of “bear markets.”

None of this has seemed to matter up to this point as market participants have continued focus on the “hope” of trade deals, and more importantly, further monetary stimulus from Central Banks. To wit:

“Investors are hoping a string of disappointing economic data, including manufacturing woes and a slowdown in job creation in the private sector, could spur a rate cut. Federal funds futures show traders are betting on the central bank lowering its benchmark short-term interest rate two more times by year-end, according to the CME group — a welcome antidote to broad economic uncertainty.” – WSJ

This week, we are going to deviate from our normally more macro-market/economic view to specifically delve into the S&P 500 index and the underlying sectors. We will wrap it up with a review of our reasoning why Fed actions may not have the result investors are banking on.

When looking at financial markets, price patterns can give us clues as to what the market participants are thinking as a whole. This year, has been more notable than most, as investors have continued to “crowd” into a decreasing number of sectors in the ongoing chase for returns, liquidity, and potentially some “safety” from a weakening economic backdrop. As shown below, we can define these three “price patterns” as the good, the bad, and the ugly.

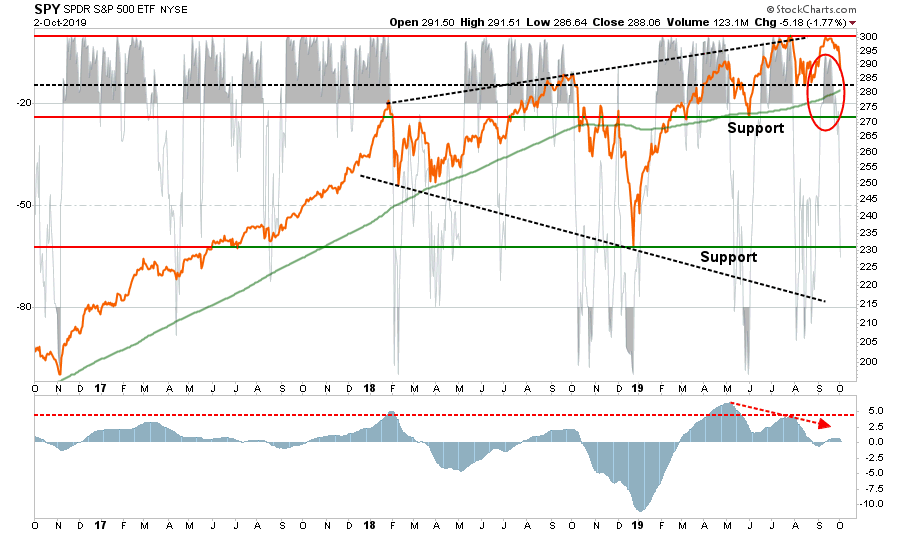

Here was our note for the S&P 500 on Thursday:

This week, we are going to review each of the major sectors as compared to the chart patterns above to determine where money is likely going to, where it is coming from, and what we need to be on the watch out for.

Let’s start with the UGLY

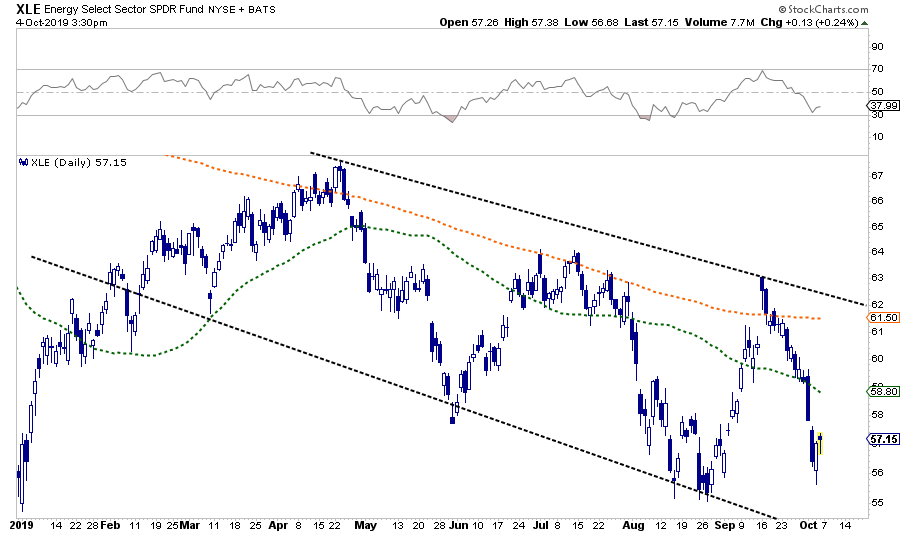

The ugliest of sectors remains Energy (XLE (NYSE:XLE)). The trend remains sorely negative, and even the recent spike due to the Saudi oil refinery explosions failed at the downtrend resistance line. With the economy slowing, particularly in the manufacturing sector, the pressure on oil prices, and the energy sector remains to the downside for now.

Current Positioning In Portfolios: No Sector Holdings, 1/4th weight XOM

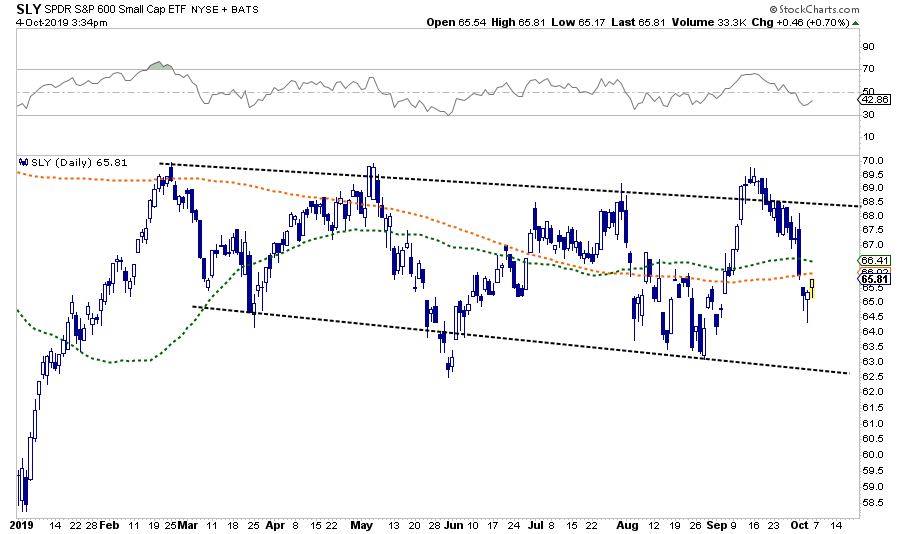

Small stocks remain in a declining trend overall. However, volatility in this market has provided some decent trading opportunities for nimble investors. However, Small Cap stocks are the most sensitive to changes in the economic environment and don’t benefit from share repurchase activity to the degree major large-cap companies do. With the small-caps trading below both their 50- and 200-dma, there is more risk to the downside currently.

There is no reason to be invested in small-caps currently as they have increased portfolio volatility and provided an additional drag on performance. Buy and hold asset allocation models are not a suitable fit for late-stage bull market cycles.

Current Positioning In Portfolios: No Holdings

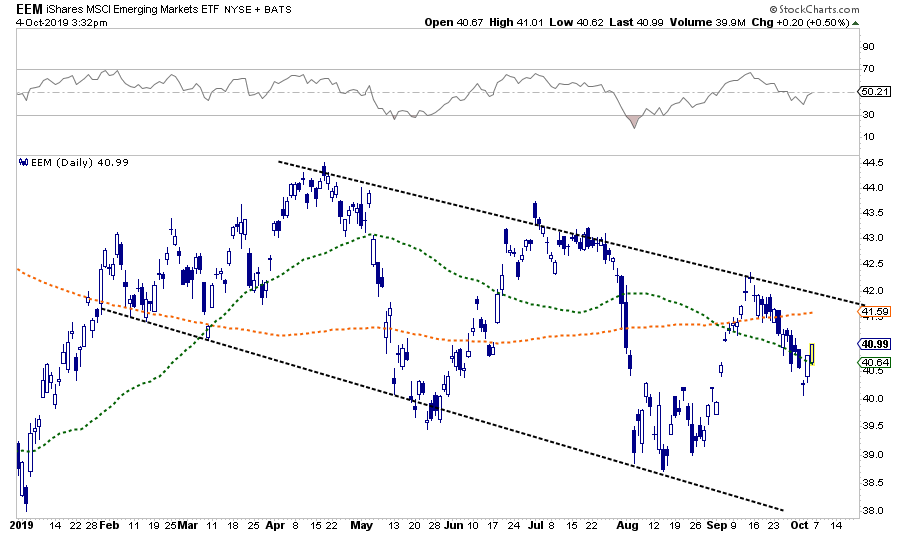

Emerging markets, like small-caps, are very subject to changes in global trade, and in this case, “trade wars” and “tariffs.”

Also, like small-caps, emerging markets have been in a long-term downtrend and have added additional drag, and increased volatility, to traditional asset-allocation models. With the 50-dma crossed below the 200-dma, the risk to emerging markets remains to the downside currently.

Current Positioning In Portfolios: No Holdings

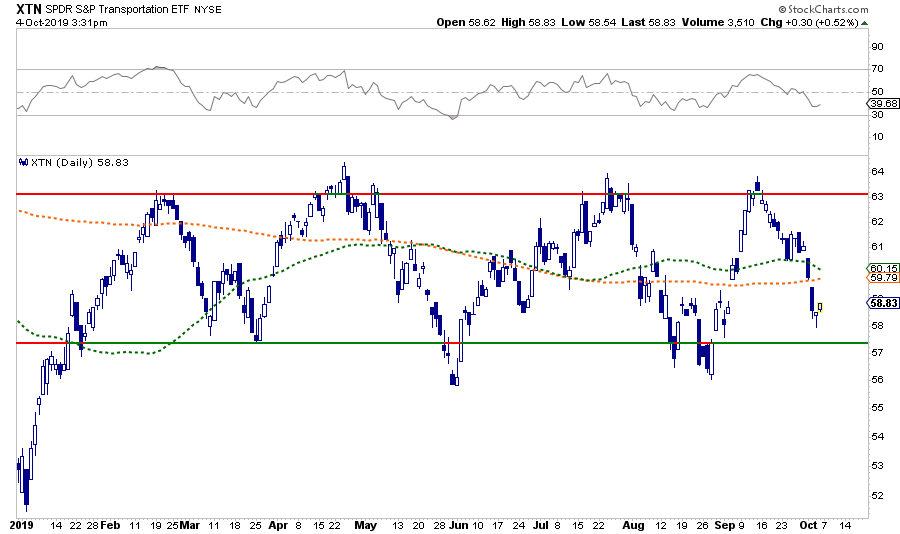

Transportation is literally the “heartbeat” of the American economy. If you eat it, consume it, wear it, watch it, or listen to it, it was transported to you by truck, train, plane, or ship at some point on its way to you. The importance of this statement is that transportation tells you a lot about the real-time activity in the economy. Currently, it is suggesting things aren’t all that great.

With transportation trading below the 50- and 200-dma, the risk is to the downside. Importantly, the 50-dma is close to crossing below the 200-dma as well. A break of lows is an important signal for the sector and the economy, so pay attention.

Current Positioning In Portfolios: No Sector Holdings, 1/2 weight NSC

Not BAD, More Okay-ish

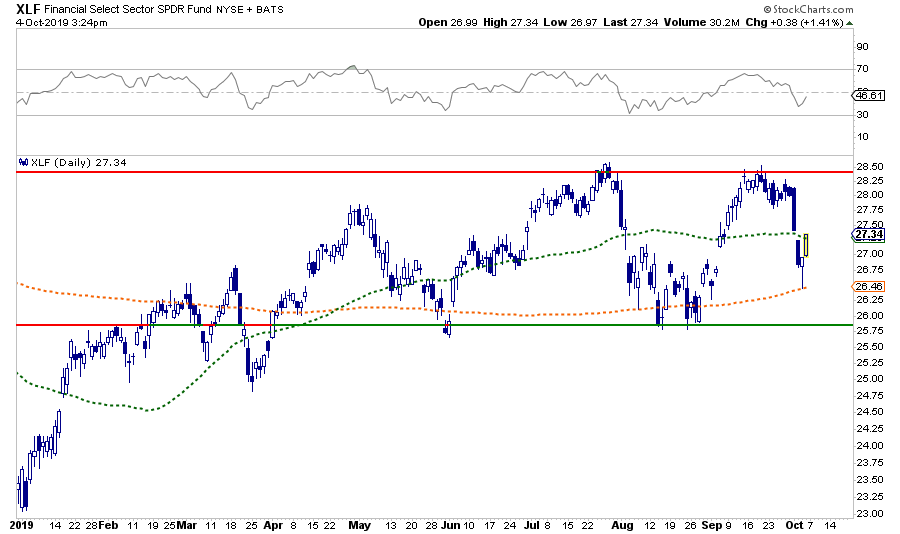

Financial’s have been trading sideways since May and have continued to consolidate. While the chart pattern doesn’t look so bad, the risk to the sector is rising as credit risk in the sector is high. There is a tremendous amount of debt sitting on the borderline between investment grade (BBB) and junk. There is also a good amount of junk debt related to the energy sector as well, and declining oil prices is accelerating that risk. If you are long the sector, that has been “okay” so far but watch lower support. A break of that level will signal a substantial increase in risk given the weighting of the sector to the overall market.

Current Positioning In Portfolios: No Sector Holdings. V

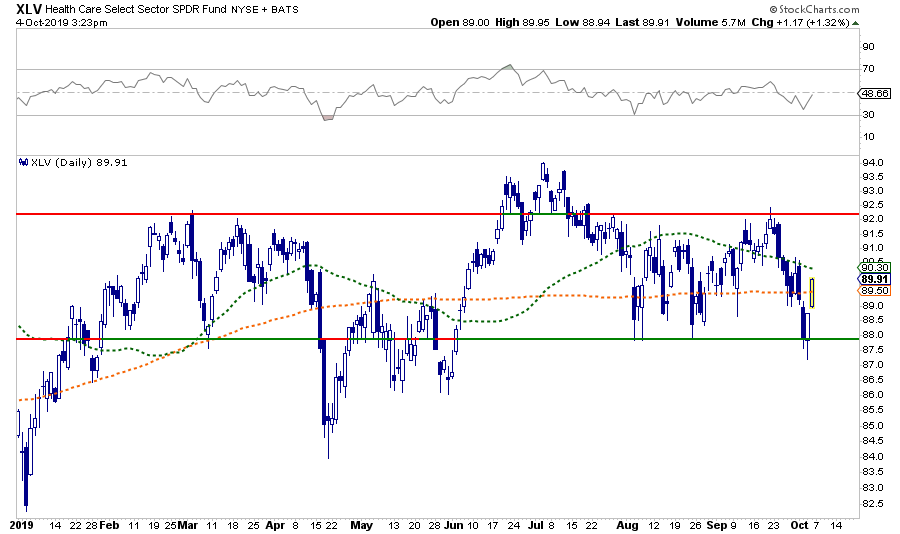

Like financials, the healthcare sector has not provided much lift to portfolios this year but has added a large amount of volatility. Support continues to hold, but the sector continues to trade below the 50-dma. Healthcare tends to be a “risk-off” sector, so we are maintaining some weighting as a defensive position, but also have a tight stop at recent lows.

Current Positioning In Portfolios: Target Weight XLV, JNJ, HCA, UNH, ABT, CVS

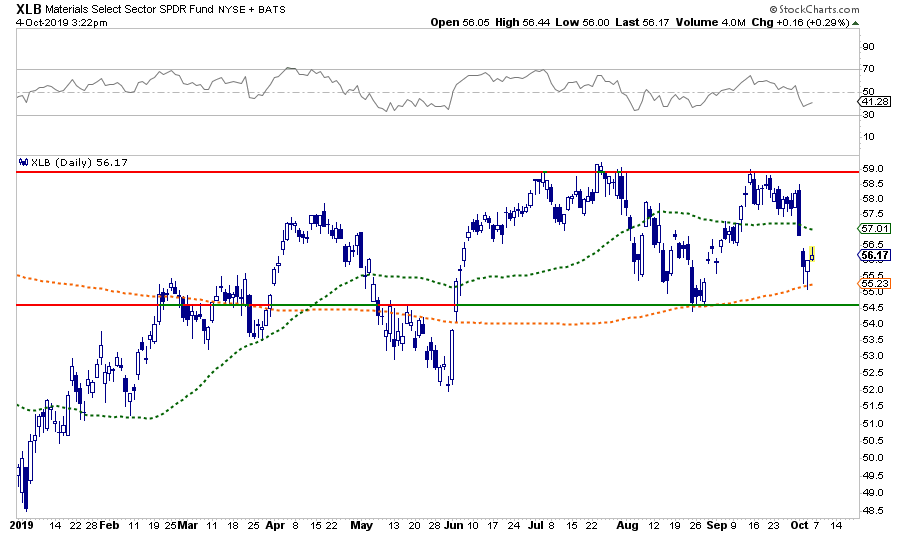

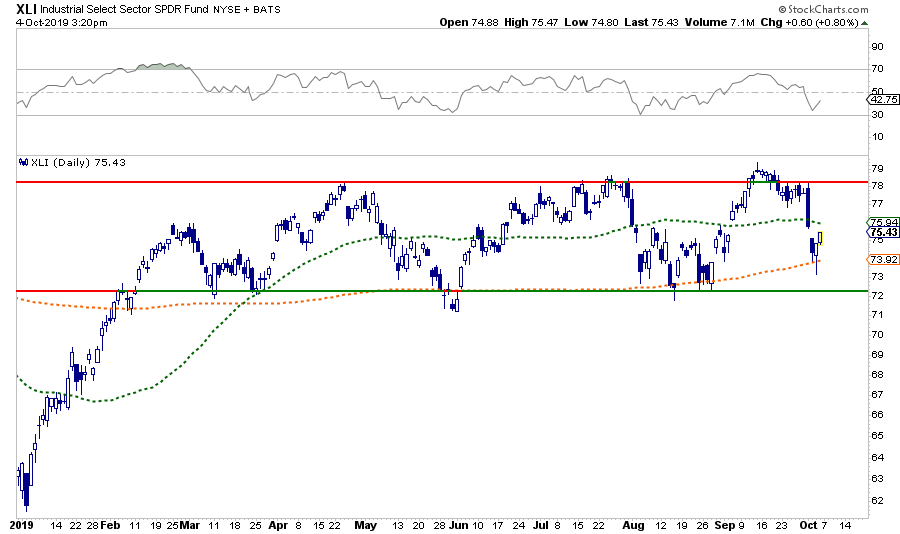

Basic Materials and Industrials have been in a long sideways consolidation waiting for a resolution to the ongoing “trade war.” The good news is that both sectors continue to defend support at the 200-dma, There is now significant overhead resistance at recent highs, which also traces back to early 2018.

As we noted in last weekend’s newsletter, we expect a trade deal to be announced, or at least the beginnings of a deal, next week. This should theoretically lift the sectors out of their slump. The risk, of course, is a disappointment which sends the sectors lower quickly, particularly if tariffs are increased further.

Current Positioning In Portfolios: 1/2 Weight XLB & XLI, Underweight VMC, DOV, UTX, BA

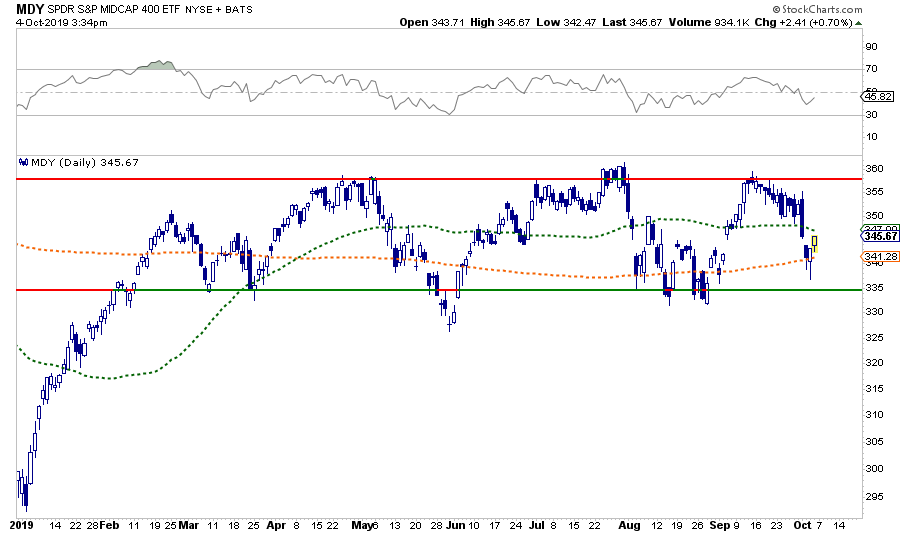

Mid-Cap stocks look much like Industrial and Basic Materials. Like Small-caps, Mid-capitalization stocks do not benefit as much from share buybacks, and are economically sensitive. If a “trade deal” is completed, I would expect to the see the sector move higher, however, a failure, or more tariffs, will likely see a break of important support.

Mid-cap stocks have provided no appreciable benefit to traditional asset-allocation models and have increased overall volatility. While mid-caps are holding support at the 200-dma, they are underperforming their large-cap brethren, and remain below the 50-dma, which has now turned lower. Some caution is advised.

Current Positioning In Portfolios: No Holdings

The Good

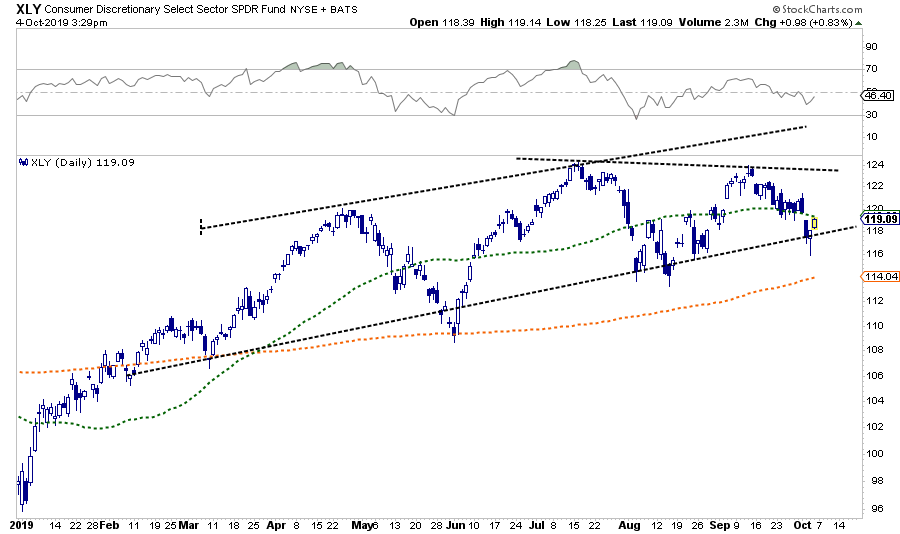

Market participants have continued to chase momentum in the market. That chase continues to confine money flows into fewer sectors which have relative strength and have high liquidity. Discretionary continues to be one of those sectors which remains in a very defined uptrend. The recent double top is a concern, and we are watching that closely as we are seeing early warning signs coming out of falling retail sector employment, and weaker core durable goods.

It is important the sector holds its current uptrend line, and climbs above the 50-dma next week. The consolidation between the lower uptrend line and the declining tops is critically important. A failure to break out of the upside of this consolidation will likely coincide with a weaker overall market.

Current Positioning In Portfolios: XLY, AAPL, MDLZ, YUM, COST

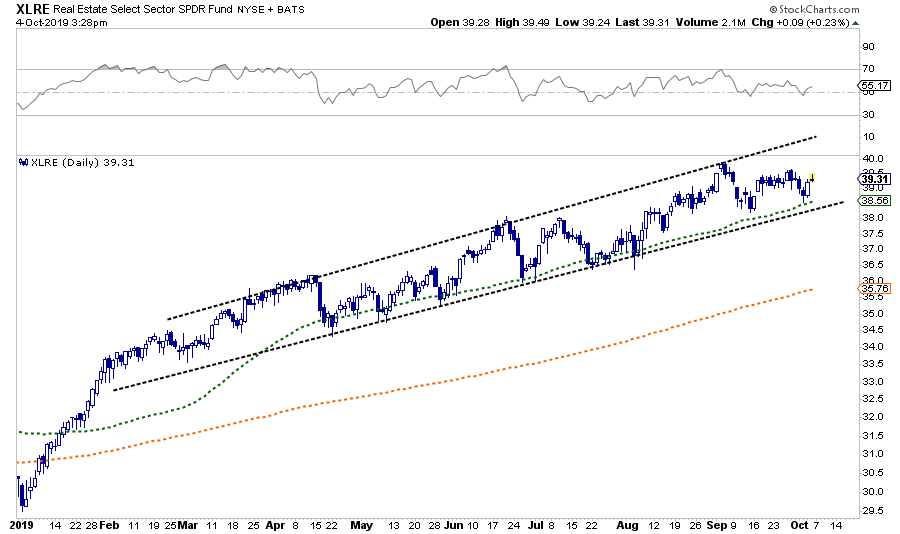

Real estate has continued to be a strong performer, and remains in a bullish uptrend as interest rates continue to fall. The sector is very overbought, and a traditional “defensive” sector has become a “momentum” trade, which is now very crowded.

For now, the trend is positive, and pullbacks to the 50-dma continue to provide “buyable” entry points. The moving average, and subsequent trendline support, are now an important “sell signal” if violated. Continue to take profits on rallies to the top of the trend channel.

Current Positioning In Portfolios: XLRE, CHCT, WELL

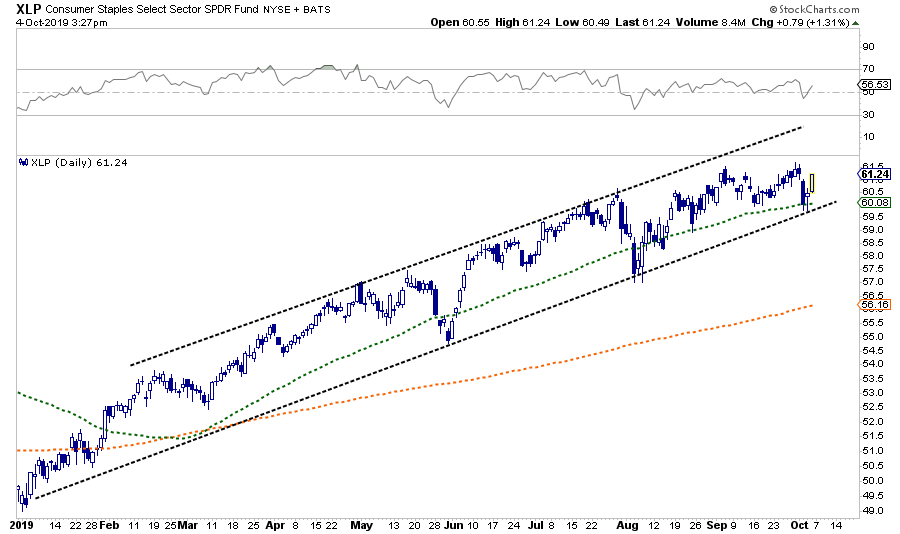

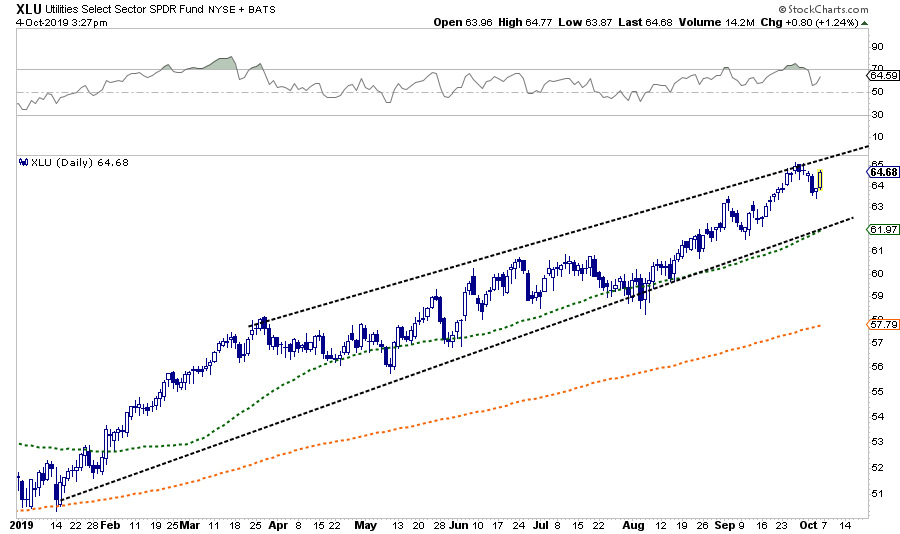

Staples and Utilities, like Real Estate, and Utilities, have also continued to be the “safe haven” trade amidst the “sea of volatility” in other sectors of the market. They are also “the momentum trade.” However, all three of these sectors share the same traits of a very defined uptrend, extreme overbought long-term conditions, are historically extremely over-valued, and have become a very “crowded” momentum trade.

As with Real Estate, a violation of the lower bullish trendline, and the 50-dma, is now a “hard stop” for the sector. A violation of both will suggest that something in the markets has changed, and likely for the worse.

Current Positioning In Portfolios: XLP, XLU, PG, PEP, AEP, DUK

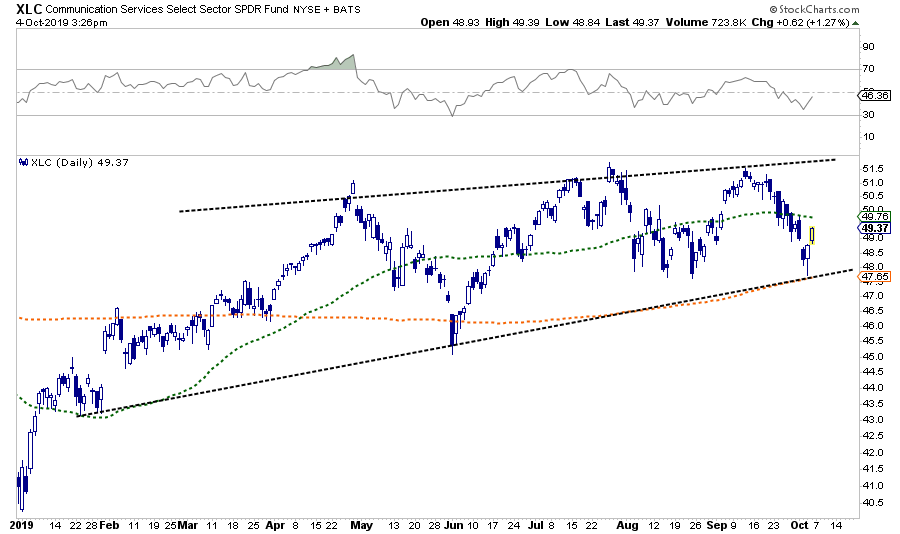

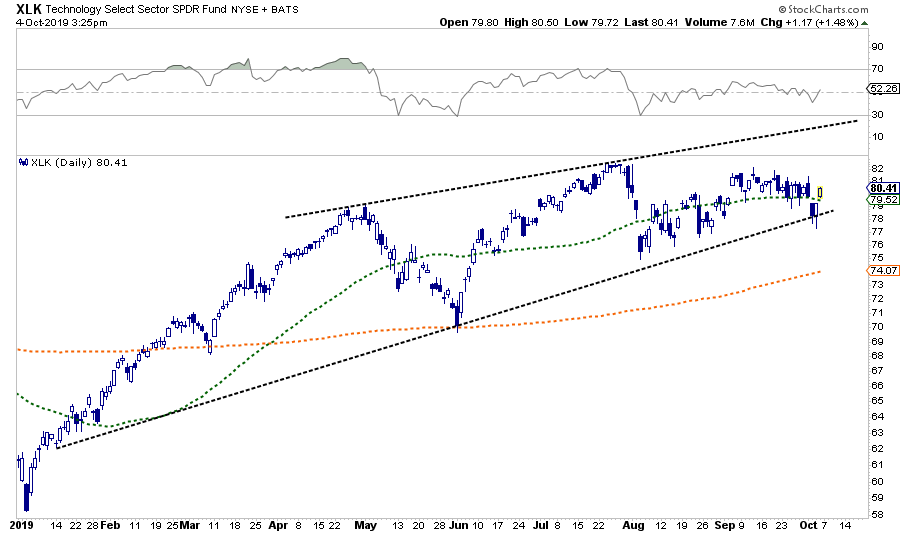

While the Technology and Communications sectors remain in positive uptrends, the performance relative to the S&P 500 has deteriorated. Both sectors are testing the lower bounds of the current uptrend, with Communications remaining below the 50-dma. Technology is in a better technical position above the 50-dma, but remains in a downtrend from the July highs.

Given that technology is a major weight of the S&P 500, a failure of its leadership is going to have a significant impact to the overall trend of the S&P 500. Stops for both sectors remain at their current uptrend lines.

Current Positioning In Portfolios: XLC, XLK, CMCSA, VZ, MSFT

Overall portfolio positioning remains slightly overweight cash, underweight equities with a bias to defensive positioning, and fixed income where we have shorted-duration a bit and improved credit quality.

Once we see the outcome of the “trade negotiations” next week, we will look to make other portfolio allocation adjustments accordingly.

The Hope Of Q.E.

The worse the economic data gets, the more the “bulls” believe the Fed will cut rates and restart QE. While the narrative is likely correct, the outcome may be not as expected.

Over the last couple of months, the Fed has not only stopped Q.T., but started to increase the balance sheet to battle the recent Repo crisis. Fed “hawks” have also turned more “dovish” with the Dallas Fed President, Robert Kaplan, seemingly open to further cuts by saying he would rather “lower rates when it matters, which I think is doing it sooner, rather than later.”

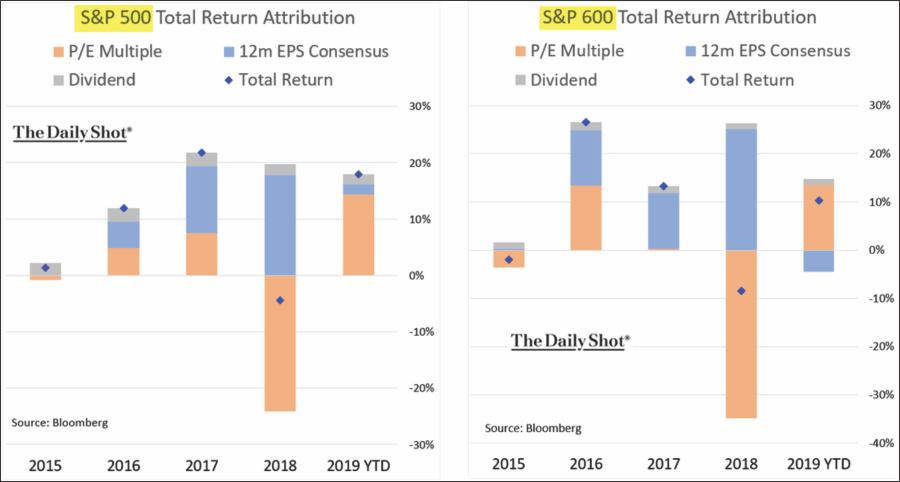

As noted, this “hope” has kept the bull market narrative alive despite weakening earnings growth and estimates. In fact, for 2019, the entirety of the increase this year has been valuation expansion, or rather, investors betting on “hope” versus the fundamentals.

The recent “Repo crisis,” a byproduct of the Fed’s “quantitative tightening,” has led to calls for a new round of QE as Michael Lebowitz recently noted:

“Brian Sack, a Director of Global Economics at the D.E. Shaw Group, a hedge fund conglomerate with over $40 billion under management, was formerly head of the New York Federal Reserve Markets Group and manager of the System Open Market Account (SOMA) for the Federal Open Market Committee (FOMC). Joseph Gagnon, another ex-Fed employee and currently a senior fellow at the Peterson Institute for International Economics, both argued in their paper the Fed should first promptly establish a standing fixed-rate repo facility and, second, ‘aim for a higher level of reserves.’”

That is code for Quantitative Easing to be introduced. Their recommendation is for the Fed to increase the level of reserves by $250 billion over the next two quarters. Furthermore, they argue for the continued expansion of the Fed balance sheet as needed thereafter.

Will Q.E. Work Next Time?

The current belief is that QE4 will be implemented sooner rather than later.

We disagree.

We think that QE will likely only be employed when rate reductions aren’t enough. In other words, the Fed will first cut the Fed Funds rate to zero before instituting further measures. This was also the assessment of David Reifschneider, deputy director of the division of research and statistics for the Federal Reserve Board in Washington, D.C., in 2016 when he released a staff working paper entitled “Gauging The Ability Of The FOMC To Respond To Future Recessions.”

The conclusion was simply this:

“Simulations of the FRB/US model of a severe recession suggest that large-scale asset purchases and forward guidance about the future path of the federal funds rate should be able to provide enough additional accommodation to fully compensate for a more limited [ability] to cut short-term interest rates in most, but probably not all, circumstances.”

The Federal Reserve is caught in a liquidity trap which has kept them from being able to raise interest rates sufficiently to reload that particular policy tool. There are certainly growing indications, as discussed previously, the U.S. economy maybe be heading towards the next recession.

Interestingly, David compared three policy approaches to offset the next recession.

- Fed funds goes into negative territory but there is no breakdown in the structure of economic relationships.

- Fed funds returns to zero and keeps it there long enough for unemployment to return to baseline.

- Fed funds returns to zero and the FOMC augments it with additional $2-4 Trillion of QE and forward guidance.

In other words, the Fed is already factoring in a scenario in which a shock to the economy leads to additional QE of either $2 trillion, or in a worst case scenario, $4 trillion, effectively doubling the current size of the Fed’s balance sheet.

The Fly In The Ointment

The effectiveness of QE, and zero interest rates, is based on the point at which you apply these measures. This was something I pointed out previously:

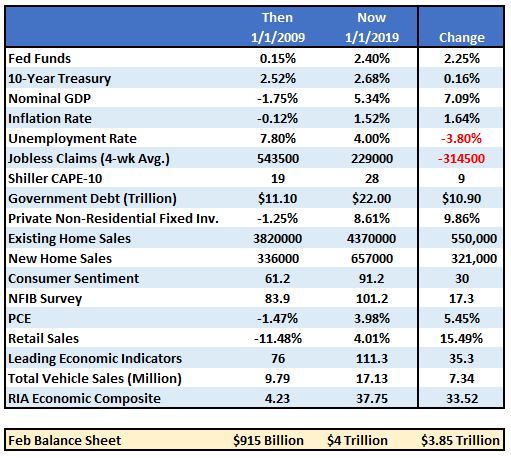

“In 2008, when the Fed launched into their “accommodative policy” emergency strategy to bail out the financial markets, the Fed’s balance sheet was only about $915 Billion. The Fed Funds rate was at 4.2%. If the market fell into a recession tomorrow, the Fed would be starting with roughly a $4 Trillion balance sheet with interest rates 2% lower than they were in 2009. In other words, the ability of the Fed to ‘bail out’ the markets today, is much more limited than it was in 2008.”

The table below compares a variety of financial and economic factors from 2009 to the present.

The critical point here is that QE and rate reductions have the MOST effect when the economy, markets, and investors have been “blown out,” deviations from the “norm” are negatively extended, confidence is hugely negative.

In other words, there is nowhere to go but up.

Such was the case in 2009. The extremely negative environment that existed, particularly in the asset markets, provided a fertile starting point for monetary interventions. Today, the backdrop could not be more diametrically opposed.

This suggests that the Fed’s ability to stem the decline of the next recession may be much more limited than the Fed, and investors, currently believe.

If more “QE” works, great. However, as investors, with our retirement savings at risk, what if it doesn’t?