Universal Technical Institute (NYSE:UTI) , a leading provider of post-secondary education in the United States, recently announced the expansion of its new Welding Technology program to the UTI-Avondale campus located in Phoenix area.

Notably, UTI-Avondale will be the second UTI campus after UTI-Rancho Cucamonga in California to offer the program. Banking on the growing interest and student strength in the opening class of UTI-Rancho Cucamonga, the company is hopeful of impressive outcome from the program expansion.

As per the U.S. Bureau of Labor Statistics, Employment Projections, the manufacturing industry will need to fill more than 128,000 new and replacement positions between 2014 and 2024 for the major infrastructural projects. Considering this increasing demand of welders in manufacturing industries like automotive fabrication and motorsports to aerospace, the Welding Technology program, in collaboration with Lincoln Electric, adapted a comprehensive curriculum based on hands-on training and instructions.

Being the global leader in welding industry, Lincoln Electric helped the UTI team to design an exceptional curriculum. The program prepares the students for certification via the American Welding Society.

Meanwhile, from the third quarter fiscal 2017 results of Universal Technical what can be perceived is a significant drop in enrollment, mirroring an overall sluggish performance. The company’s scheme to overcome the persisting decline in enrollment was to offer new courses in Avondale and initiate need-based institutional grant. The recent launch of the Welding Technology program is most likely strategized upon the aim of student enrollment growth.

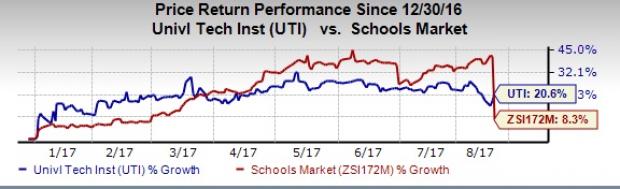

Meanwhile, shares of Universal Technical have outperformed the industry year to date. The stock has gained 20.6% as compared to the industry’s gain of 8.4%.

Given the company’s sluggish performance over the last few quarters, the latest initiative should help drive enrollments.

Zacks Rank & Stocks to Consider

Universal Technical currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the same industry are Grand Canyon Education, Inc. (NASDAQ:LOPE) , GP Strategies Corporation (NYSE:GPX) and K12 Inc (NYSE:LRN) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Grand Canyon Education’s full-year earnings are expected to increase 20.4%

.

Full-year earnings of GP Strategies are likely to increase 8.5%.

K12’s full-year earnings are expected to rise over 11%.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Universal Technical Institute Inc (UTI): Free Stock Analysis Report

K12 Inc (LRN): Free Stock Analysis Report

GP Strategies Corporation (GPX): Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE): Free Stock Analysis Report

Original post

Zacks Investment Research