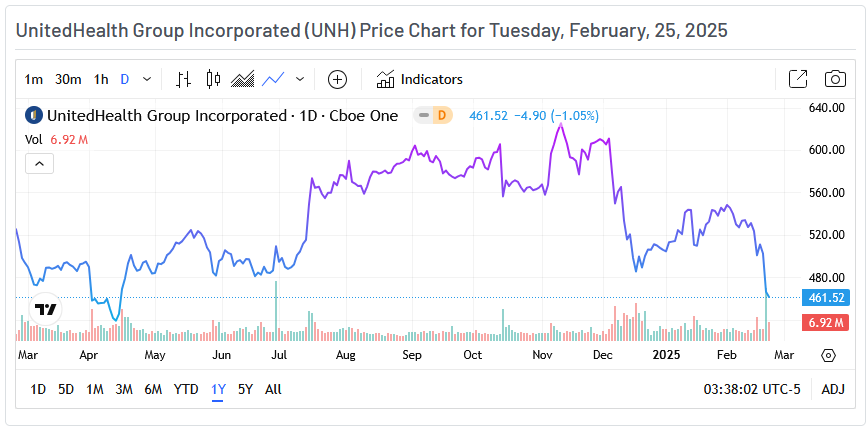

Few stocks get this oversold this quickly, especially mega-cap names like UnitedHealth Group (NYSE:UNH). After a 45% rally from March into December, the stock has now collapsed 30%, sending it back to multi-year lows.

The bulk of this drop came on Friday when shares gapped down more than 12% following a report that the Department of Justice (DoJ) has launched a new investigation into UnitedHealth’s Medicare Advantage business. The report suggested the company may have been adding questionable diagnoses to medical records to receive larger payments from the government.

That kind of headline is enough to shake even the strongest stocks, but investors may have overreacted. By the time Friday’s session closed, UnitedHealth had already rebounded 7% off its lows, a sign that buyers were stepping in. It didn’t stop the stock’s relative strength index (RSI) from dropping below 30, though, signaling extremely oversold conditions. That means for those of us on the sidelines, there’s every reason to believe this bounce has room to run into March.

Earnings Strength and Market Confidence

Lost in the noise of last week’s selloff is the fact that UnitedHealth’s fundamentals remain strong. Its January earnings report showed another earnings beat, though revenue came in slightly below expectations. That minor revenue miss broke a streak of several quarters of across-the-board beats, but it wasn’t enough to change the company’s long-term outlook.

More importantly, management delivered strong forward guidance, signaling confidence in sustained growth throughout the year. Given how heavily the stock has sold off, Wall Street may have been too quick to punish what is still a market leader in healthcare services.

Analyst Endorsements Signal More Upside

Despite the DoJ investigation, analysts remain firmly bullish on UnitedHealth. Wells Fargo, Barclays, KeyCorp, and Cantor Fitzgerald all reiterated their Buy ratings in recent weeks, with price targets ranging from $650 to $700.

Considering shares closed below $470 on Friday, those targets suggest a potential upside of over 50%. Notwithstanding Friday’s news, that kind of valuation disconnect doesn’t happen often with mega-cap stocks, making this an incredibly attractive entry point for traders and investors alike.

Risks to Be Aware Of

While the stock looks like it could be seriously undervalued in the short term, there’s no denying that another DoJ investigation is the last thing UnitedHealth needed. Investors have been rattled by multiple reports of scrutiny into the company’s business practices over the past few months, and the report of a fresh probe will do little to boost their confidence in the company, definitively dropping this frustrating habit.

It’s also worth noting that UnitedHealth is now trading back at 2021 levels, meaning long-term holders have essentially seen three years of gains erased. All the while, the S&P 500 index has soared to high after high. For those with a long-term horizon, this might not be the best stock to hold indefinitely.

Why This Setup Is Hard to Ignore

However, for those of us with a short—to medium-term view, it looks like a classic oversold bounce setup. The RSI at 27 suggests extremely oversold conditions, which almost always lead to a sharp rebound in large, fundamentally strong stocks. We already saw this beginning on Friday, with shares rallying 7% off their lows by the close.

With such a massive selloff in such a short period, short-term traders and dip buyers are likely to continue stepping in. UnitedHealth could quickly reclaim $500 if momentum builds in the coming weeks.

UnitedHealth’s massive drop has created one of the most intriguing trade setups among mega-caps right now. The stock is technically oversold, analysts still see huge upside, and its fundamental momentum is still strong. For those looking to capitalize on an overreaction-driven selloff, this could be one of the best risk-reward setups in months.