Most of the talking heads on TV are constantly focused on the federal government’s debt - which currently stands at a stunning $17 trillion.

But what about assets? Who is talking about the largest (positive) line item on Uncle Sam’s balance sheet?

We are. Because for those who know how to spot it, there is huge profit potential...

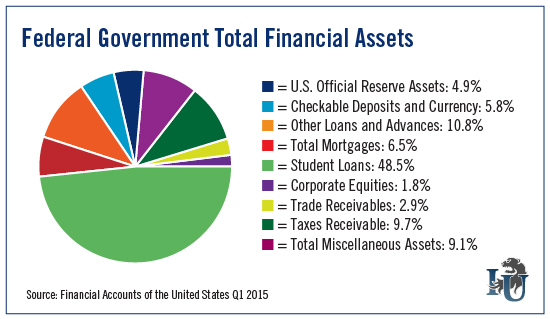

In this week’s chart, we lay out Uncle Sam’s total financial assets. And as you can see, student loans make up 48.5% of the pie.

This is five times larger than Taxes Receivable, which clocks in at just 9.7%.

Now we have arrived at something the media actually has been squawking about: our rapid growth in student debt.

It’s astounding. Since the Great Recession of 2007, the federal government’s student loan balance has risen 662%. Today, total student loan debt is around $1.16 trillion. That is more than four times the size of Greece’s gross domestic product.

This is good news for Uncle Sam, sure, but horrible news for graduates and their families. Nowadays, student debt averages $29,000 per person. So it’s no surprise that student loan forgiveness has become such a hot topic.

We could entertain the classic debate between good and bad debt - something our Editorial Director Andrew Snyder touched on earlier this year - but let’s instead focus on the opportunity...

Student loan stocks.

SLM Corporation (NASDAQ:SLM), better known as Sallie Mae, and Nelnet Inc (NYSE:NNI) are two of the top student loan servicing companies in the country.

Both stocks have seen strong growth as student loans balloon to new heights.

Over the last five years, SLM and Nelnet have seen their stocks gain 164.78% and 154.68%, respectively. During the same period, the S&P 500 has returned 112.56%.

These market-beating returns have a lot to do with both companies raking in huge profits. Since 2010, Sallie Mae has seen average earnings-per-share (EPS) growth of 17.16% per year. Nelnet has averaged EPS growth of 8.51%.

I mentioned above that student loan debt is around $29,000 per graduate. Meanwhile, median starting salaries for graduates today average $46,000. Think that’s bad? By 2023, median salaries are expected to be equal to outstanding loans.

Bad news for students? Absolutely. But it’s great news for educational lending stocks. Based on these figures, Sallie Mae and Nelnet are all but assured to continue their upward climb.

As for the public side... don’t be surprised to see student loans dominate more than 50% of Uncle Sam’s assets by year end.