Wednesday’s policy meeting was supposed to be a non-event. The Federal Reserve was widely expected to leave interest rates pinned near zero while the central bank reaffirmed that its view that the recent surge in inflation is temporary. Both forecasts proved to be correct, but the Fed hinted that it is considering raising rates sooner than expected. The news sent markets reeling and analysts reconsidering how vulnerable the economy is to tighter monetary policy.

Although there’s no sign that the central bank will raise rates any time soon, the mere hint that higher inflation may change the calculus triggered volatility across global markets yesterday (June 18). Notably, the reflation trade that has dominated trading this year came under fresh scrutiny.

“The surprise shift [of] more hawkish [comments] from the Fed on risk management grounds Wednesday reverberated through financial markets globally Thursday, with violent moves across and within asset markets as investors liquidated inflation hedges and faded reflation trades,” says Krishna Guha, vice-chair of Evercore ISI.

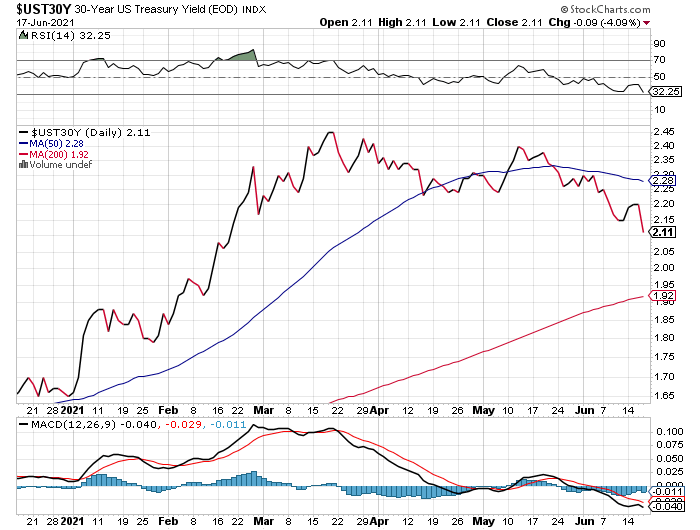

Indeed, the US dollar surged while US interest rates retreated. Meanwhile, commodities took a hit, including gold and energy. Stocks buckled, too. The slide in the 30-year Treasury yield is particularly striking. Presumably, this long maturity bond is highly sensitive to inflation expectations. If so, this rate is sending a message that the reflation trade is fading. In the wake of Wednesday’s Fed meeting, the 30-year rate fell to 2.11% (June 17), a four-month low.

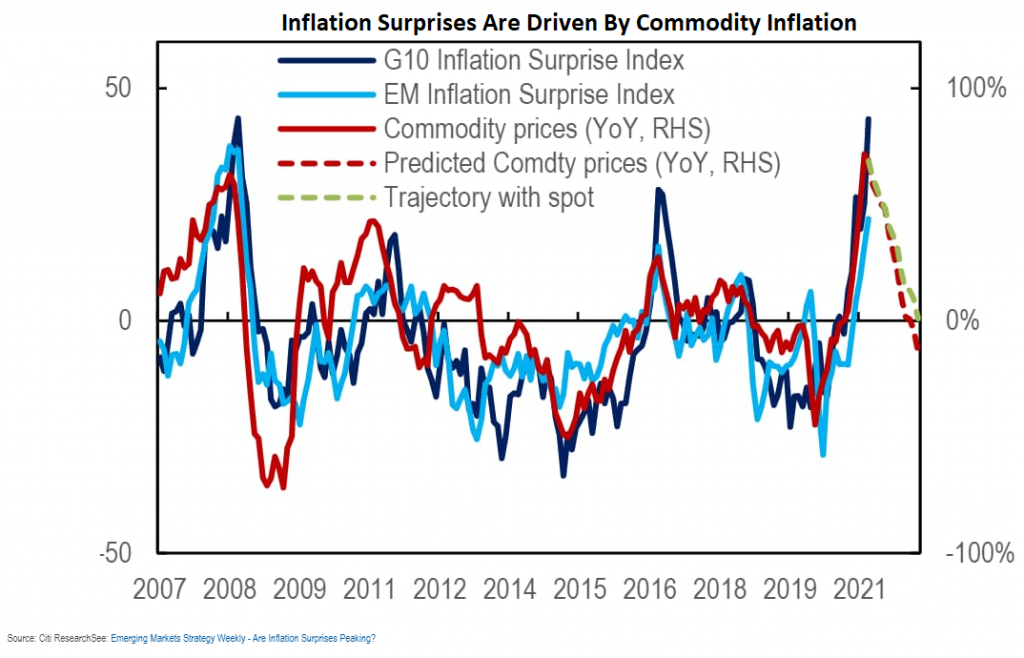

The decline in the 30-year yield, if it continues, would be a strong sign that the market’s recent anxiety about higher inflation is due for an attitude adjustment. The same applies to interpreting prices for commodities, which tumbled yesterday. As research from Citigroup indicates (via John Authers at Bloomberg), an extended decline in materials prices could be a sign that the recent runup in inflation is set to reverse.

On that basis, watching how commodities move in the days and weeks ahead may lend critical perspective on whether the recent reflation trade is rolling over. A few days of weakness in CRB Index, a broad measure of raw materials prices, doesn’t mean much, but an persistent slide would be hard to ignore.

There are hints in other data that suggest the rebound in inflation is peaking, as discussed at CapitalSpectator.com yesterday. But that’s just a side dish to a bigger macro question: How vulnerable is the economic recovery to tighter monetary policy?

Answering is mostly speculation at this point, but it’s reasonable to wonder if some of the more extreme bullish forecasts for the economy are due for a downgrade. To be clear, strong growth remains the consensus outlook for the near term, and for good reason: the forecast enjoys clear support in a broad set of indicators. The Atlanta Fed’s GDPNow model, for instance, is currently estimating that GDP in the second quarter will increase by a sizzling 10.3%, based on the June 16 estimate.

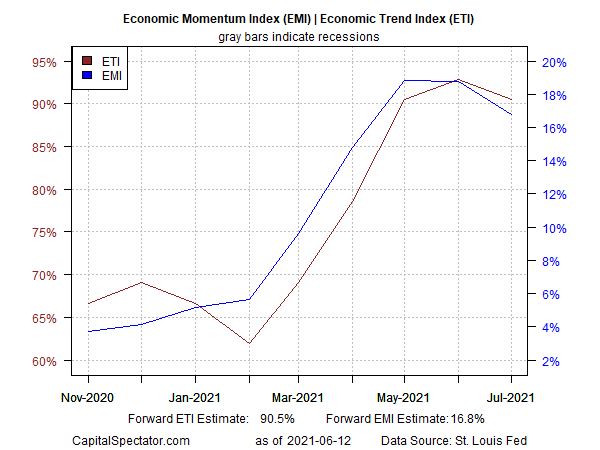

Looking beyond Q2, however, opens the floor to debate. It appears that the US economic trend has peaked. As shown in this week’s issue of The US Business Cycle Risk Report, the recent upside momentum in output has probably reached a high point and is now poised to ease in the months ahead, based on a set of proprietary indexes that track 14 key economic and financial indicators. (Note: ETI indicates expansion with readings above 50%; EMI indicates growth for readings above 0%.)

The odds are still high that the economy will continue to expand at a healthy pace for the foreseeable future. But if government stimulus is fading and monetary policy is moving closer to a slightly more hawkish stance, a period of turbulence may be brewing for global markets as the crowd reassesses macro risks. A macro trend that’s decelerating, even as growth runs relatively hot, is a different animal from an economy that’s accelerating after an unusually deep recession.

Markets seem to be refocusing on such issues after the central bank’s published new economic projections this week. Few expected that Wednesday’s Fed meeting would unleash such a dramatic change in sentiment, but ready or not the potential for regime shift may be bubbling anew.

A key proxy to watch for how expectations are evolving: Treasury yields. But even here, there’s still a lot of churn that’s muddying the waters.

“The bond market narrative has been changing on a whim quite often,” notes Tatjana Griel Castro Muzinich, an investment firm focused on public and private credit.

“First we had this idea [coming out of the Covid-19 crisis] that inflation will be permanently high. Then the story was that this was the top and [inflation] would be going down, and I think the story keeps changing because we just don’t know yet.”