Federal Reserve Chairman Jerome Powell admitted in yesterday’s press conference that if inflation runs hotter for longer than it expects, the central bank would react accordingly by adopting a more hawkish stance. But for now, that scenario remains a low-probability scenario, he says.

“Our expectation is that these high inflation readings that we’re seeing now will start to abate,” Powell said. If that outlook turns out to be wrong, he insists that the Fed is prepared to tighten monetary policy.

“There’s a lot of uncertainty,” Powell admitted, and if the hard data on inflation, or inflation expectations continue to run hot, “we wouldn’t hesitate to use our tools to address that.”

Signs that the policy is already reacting to the recent increase in inflation data showed up in the Fed’s revised economic forecasts. Notably, the central bank’s estimate for core PCE inflation in 2021 shot up to 3.0% from 2.2% in the March projection. That may be a tame move by some accounts, but it’s a large adjustment for the Fed in the time frame of just one meeting. It’s also a sign of the times in terms of volatility and uncertainty in economic estimates.

The Fed hasn’t given up on its inflation-is-transitory guidance. After this year’s expected increase, the central bank’s estimates for core PCE inflation falls back 2.1% for 2022 and 2023, which is roughly in line with the Fed’s inflation target. That may be wishful thinking, but it’s a reminder that policymakers continue to assume that a regime change in inflation to the upside is still unlikely.

Nonetheless, the Fed pulled forward its expectations for rate hikes to as soon as 2023 vs. 2024 in the March outlook.

“This is not what the market expected,” says James McCann, deputy chief economist at Aberdeen Standard Investments.

“The Fed is now signaling that rates will need to rise sooner and faster, with their forecast suggesting two hikes in 2023. This change in stance jars a little with the Fed’s recent claims that the recent spike in inflation is temporary.”

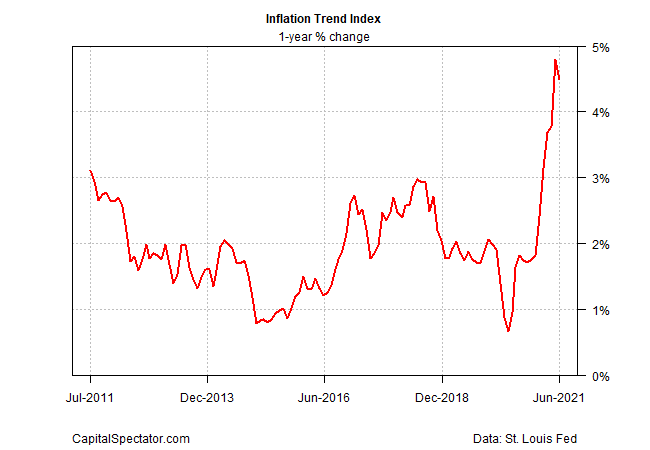

Although it’s still premature to say with any confidence where inflation is headed, The Capital Spectator’s Inflation Trend Index (ITI) continues to hint at the possibility that the recent runup in pricing pressure is peaking. ITI is designed to provide a degree of forward guidance on the directional bias of pricing activity in real time. Drawing on economic and financial indicators that are closely related to the inflation trend, ITI indicates that May will mark the high point for the current run of accelerating inflation. If so, the peaking will lend support to the Fed’s transitory inflation assumption.

Keep in mind that ITI isn’t designed to estimate the actual inflation rate, which remains substantially below the pace indicated by ITI. Rather, the goal here is provide a real-time measure of the year-over-year directional strength of the broad pricing trend. Using a mix of published and estimated numbers through the current month, ITI at the moment is posting a conspicuous downturn after spiking through May.

For details on ITI’s design, see this post at CapitalSpectator.com. Also, note that as of today, ITI includes a new input – the inventories-to-sales ratio for US businesses — that supplements the original seven-factor design. The rationale: the 12-month percentage change for the ratio, on an inverse basis, tends to track the directional bias of inflation.

ITI aggregates an eight-factor mix and uses the median as a proxy for the inflationary trend. On that basis, it appears that the official inflation numbers (currently available through May) will ease a bit in the upcoming June reports. That estimate could change, of course, depending on how the incoming numbers stack up. But for the moment, there’s a clue for thinking that inflation pressures on a year-over-year basis will start to pull back.