Makeup retailer Ulta Beauty Inc (NASDAQ:ULTA) is slated to report first-quarter earnings after the market closes tomorrow. The beauty stock has been moving mostly higher on the charts of late, and just this morning received a price-target hike from Buckingham Research to $300 from $270 -- territory not charted in almost a year. What's more, ULTA stock tends to outperform in the month of June.

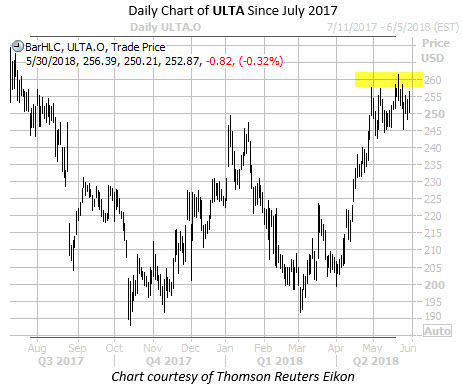

Despite today's upbeat analyst attention, Ulta Beauty stock was 0.3% lower to trade at $253.01, at last check. From a longer-term perspective, the security has rallied 32% since its March lows, but recently stalled in the $255-$260 area.

However, Ulta stock may break above that ceiling soon, if recent history is any indicator. For instance, data from Schaeffer's Senior Quantitative Analyst Rocky White shows that ULTA has been one of the best S&P 500 stocks to own in June. The beauty name has averaged a monthly gain of 3.91% over the past 10 years, closing in positive territory an impressive 70% of the time.

In terms of analyst attention, Buckingham Research is far from the only firm optimistic about ULTA's future. Of the 19 brokerage firms following the retail stock, 14 currently sport "buy" or "strong buy" ratings. However, more price-target hikes could be in store on an earnings beat. ULTA's average 12-month price target of $263.7 -- represents just a 4% premium to current levels.

Digging into its earnings history, ULTA stock has been higher 50% of the time after the company's last eight reports. Overall, the stock has averaged a one-day post-earnings swing of 5.7% over the past two years, regardless of direction. This time around, the options market is pricing in a much larger-than-usual 9.8% next-day move, per data from Trade-Alert

As for options data, the security's Schaeffer's Volatility Scorecard (SVS) stands at 89 out of a possible 100. This high ranking shows that the shares have tended to make outsized moves over the past year, relative to what the options market had priced in -- a boon to potential premium buyers.