Ulta Beauty Inc. (NASDAQ:ULTA) just released its second quarter fiscal 2017 earnings results, posting earnings of $1.83 per share and revenues of $1.29 billion. Currently, ULTA is a #4 (Sell) on the Zacks Rank, and is down 3.3% to $226.00 per share in trading shortly after its earnings report was released.

Ulta:

Beat earnings estimates. The beauty giant reported earnings of $1.83 per share, topping the Zacks Consensus Estimate of $1.78 per share. Net income was $114 million.

Beat revenue estimates. The company saw revenues of $1.29 billion, just beating our consensus estimate of $1.28 billion and growing 21% year-over-year.

Ulta said that comparable store sales rose 12%, lower than the 14% growth reported in the second quarter of 2016. This was driven by 5.5% transaction growth and 6.2% growth in average ticket.

E-commerce sales grew 72.3% to $96.3 million from $55.9 million in the second quarter of fiscal 2016, representing 340 basis points of total comps.

Looking ahead, Ulta expects net sales in the range of $1.33 billion to $1.35 billion for the third quarter and comps to increase 9% to 11%.

“We accelerated our market share gains while continuing to reduce promotional intensity and increase personalized offers through our industry leading loyalty program. Product category strength was broad based, with prestige cosmetics still driving the majority of our growth, and with skincare, fragrance, and haircare all gaining momentum. We are also benefitting from continued success of our marketing programs, rapid growth in e-commerce, and solid operational execution across the enterprise,” said Mary Dillon, CEO.

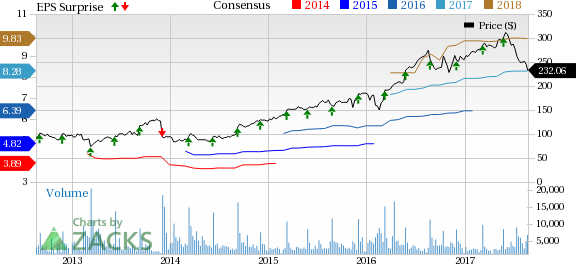

Here’s a graph that looks at Ulta’s price, consensus, and EPS surprise:

Ulta Beauty, Inc. is a beauty retailer primarily in the United States and the premier beauty destination for cosmetics, fragrance, skin, hair care products and salon services. Ulta Beauty, Inc., formerly known as Ulta Salon, Cosmetics & Fragrance Inc., is based in Bolingbrook, Illinois.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Ulta Beauty Inc. (ULTA): Free Stock Analysis Report

Original post

Zacks Investment Research