Risky assets rebounded, while safe havens pulled back yesterday and today in Asia, following reports that some Russian troops were returning to their bases after exercises near Ukraine, which eased fears of further escalation for now.

Today, we will pay extra attention to the FOMC meeting minutes and Canada’s CPIs, as we could get a better picture with regards to expectations around the Fed’s and the BoC’s plans.

Sentiment Improves on Easing Geopolitical Tensions, FOMC Minutes on the Agenda

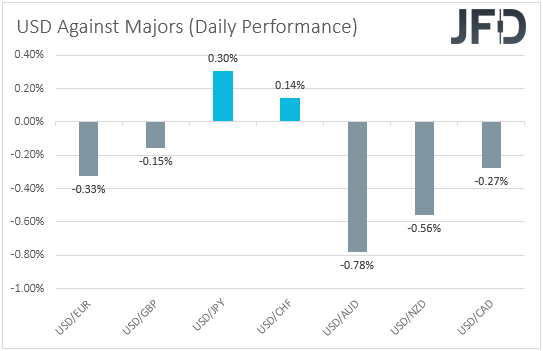

The US dollar traded lower against all but two of the other major currencies on Tuesday and during the Asian session Wednesday. It gained only versus JPY and CHF, while it lost the most ground versus AUD and NZD.

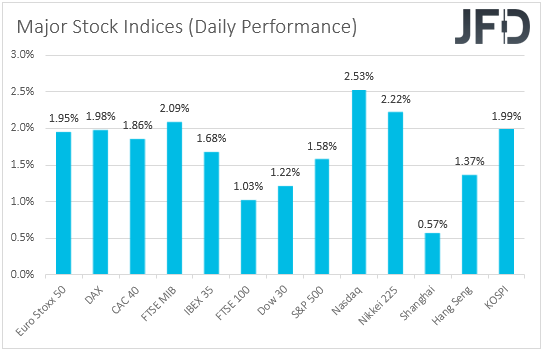

The weakening of the US dollar and the other safe havens, yen, and franc, combined with the strengthening of the risk-linked Aussie and Kiwi, suggests that market sentiment took a 180-degree spin at some point yesterday. Indeed, major EU and US indices were a sea of green, averaging gains of 1.77%, with the positive appetite rolling into the Asian session today.

Once again, the driver was developments surrounding the geopolitical tensions in Ukraine. Remember that on Friday and Monday, investors were spooked by headlines that Russia could attack Ukraine any day, with the most possible one being today.

However, yesterday, reports said that some Russian troops were returning to their bases after exercises near Ukraine, which eased fears of further escalation for now. However, NATO said that it had yet to see any evidence of a de-escalation, while US President Joe Biden warned that more than 150k Russian troops remained near Ukraine's border. Therefore, we are reluctant to say that the matter is resolved and behind us.

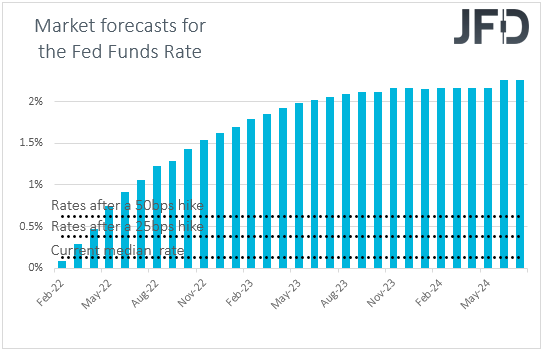

Besides developments surrounding geopolitics, market participants have also been paying particular attention to headlines, events, and data, which could affect the Fed’s future course of action. Today, we have the minutes from the latest FOMC gathering, from which we got the message that a hike is coming in March and that there is a decent likelihood for more lift-offs this year than the December “dot plot” suggested.

Now, following a strong employment report, accelerating inflation, and Bullard’s hawkish remarks in the aftermath of the gathering, market participants are fully pricing in around six quarter-point hikes by the end of the year.

Thus, we will scan the minutes for clues as to whether this number is logical or not. Anything confirming that the Fed is willing to proceed as aggressing as the current market pricing suggests could support the US dollar and perhaps result in a new retreat in equities. The opposite could be possible if the minutes reveal a more cautious picture than Fed Chair Powell presented at the press conference following the decision.

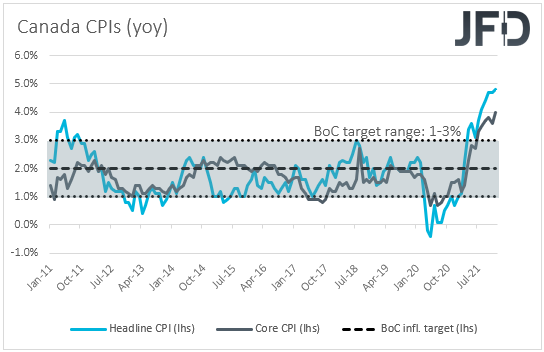

Ahead of the minutes, we get inflation data for January from Canada. The headline CPI rate is expected to stay at +4.8% YoY, while the core one could slide to +3.5% YoY from 4.0%. At its latest gathering, the BoC decided to keep interest rates untouched at 0.25%, at a time when the financial community was expecting a hike.

In the statement accompanying the decision, it was noted that the Council expects rates to increase and that the overall economic slack is now absorbed, which means that they are more likely to hit the hike button in March.

However, they again noted that the Omicron coronavirus variant is weighing on activity, with Governor Macklem adding that hikes will not be automatic. They will take decisions at each meeting, he added. With all that in mind, we don’t expect slowing core inflation to stop BoC officials from pushing the hike button in March, but it could prompt market participants to scale back their bets regarding upcoming lift-offs.

Something like that could weigh on the CAD.

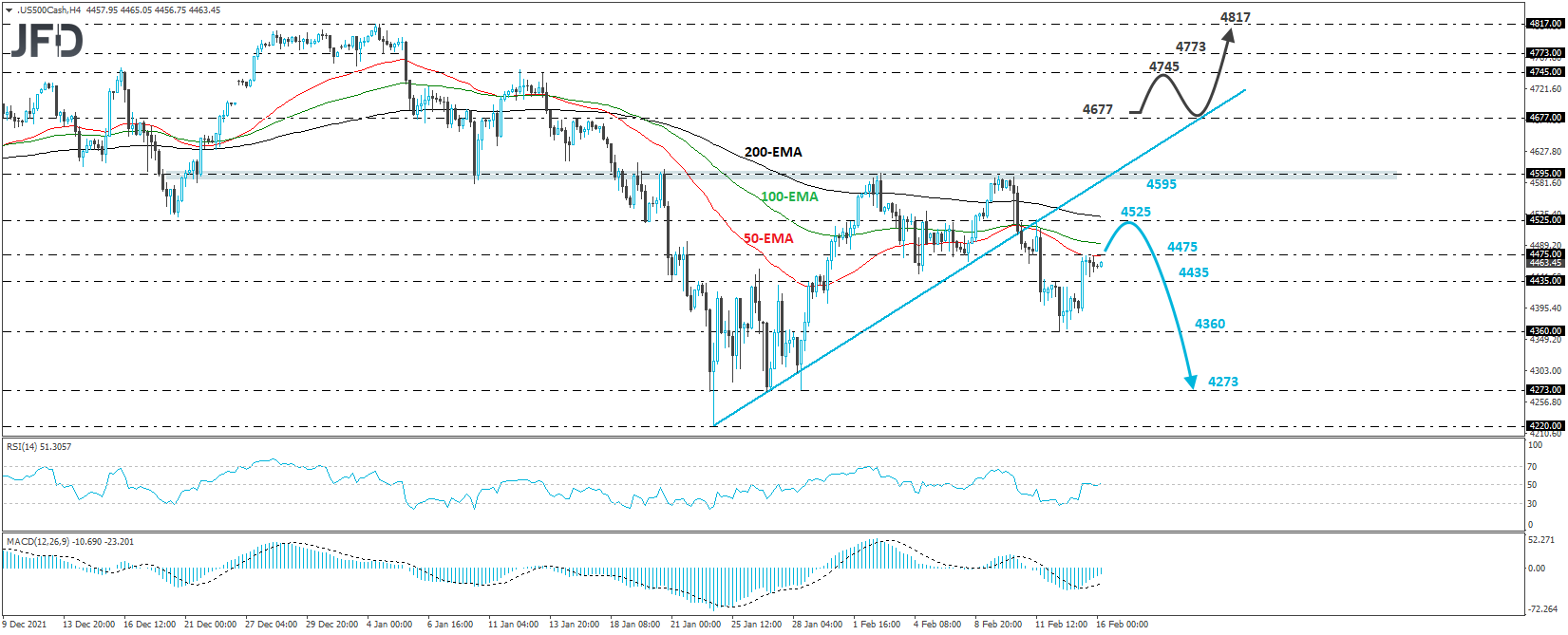

S&P 500 – Technical Outlook

The S&P 500 cash index traded higher yesterday, but the advance remained limited near the 4525 zone. Even if the index continues a bit higher, since it remains below the upside line taken from the low of Jan. 24, we will consider the short-term picture to be still cautiously pessimistic.

The bears may retake charge from near the peak of Feb. 11, at around 4525, and drive the action back near the low of Feb. 14, at 4360. If they decide to break lower, this will confirm a forthcoming lower low and may see scope for declines towards the 4273 territories, marked by the lows of Jan. 26 and 28. Slightly lower lies the 4220 barrier, marked by the low of Jan. 24, which could also get tested.

To start examining the bullish case again, we would like to see a strong recovery above the 4677 zone, marked by the high of Jan. 16. This could confirm the index’s return above the aforementioned upside line and may initially aim for the peaks of Jan. 12 and 13, at 4745, or the inside swing low of Jan. 4, at 4773. If participants are unwilling to stop there, we could see them aiming for another test at the index’s record high of 4817, which hit on Jan. 4.

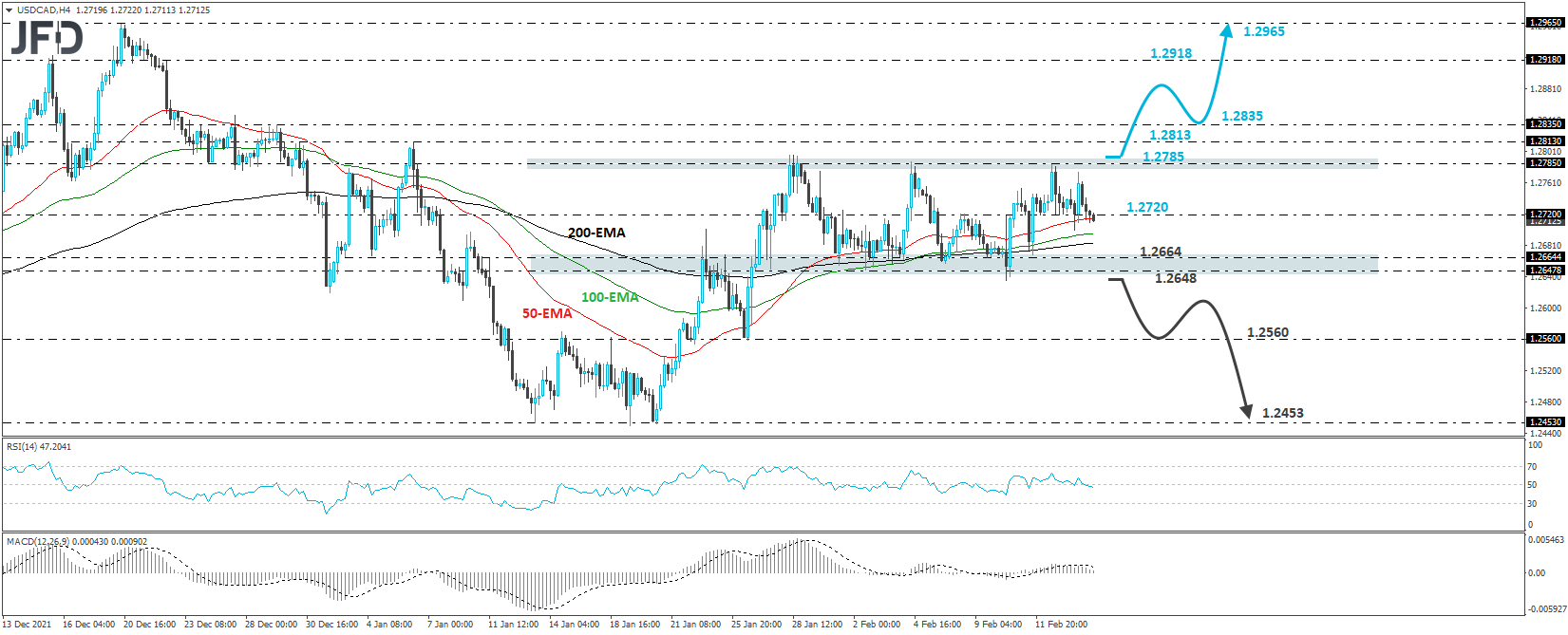

USD/CAD – Technical Outlook

USD/CAD traded lower after it hit resistance slightly below the 1.2785 zone, acting as the upper end of the sideways range that’s been containing the price action since Jan. 26. The lower end is the area between the 1.2648 and 1.2664 levels, and as long as the pair is trading between those boundaries, we will hold a flat stance.

The outlook could turn positive upon a break above 1.2785. this will signal the upside exit out of the range and may initially target the 1.2813 or 1.2835 barriers, marked by the highs of Jan. 6 and Dec. 29, respectively. A break higher could pave the way towards the 1.2918 zone, where another break could target the peak of Dec. 20, at 1.2965.

Alternatively, if the rate falls below the 1.2648 zone, this would paint a negative picture, with the bears perhaps pushing the battle down to the low of Jan. 26, at 1.2560. If that barrier cannot halt the fall, its break could set the stage for more significant declines, perhaps towards the 1.2453 zone, which acted as a floor between Jan. 13 and 20.

As for the Rest of Today’s Events

During the early European morning, we already got the UK CPIs for January, with both the headline and core rates rising slightly more than expected. The pound strengthened slightly as this keeps the door open for a double hike at the BoE’s upcoming gathering. Remember that officials voted 5-4 for a hike by 25 bps at the last one, with the 4 dissenters calling for a 50 bps increase. Thus, only one member needs to be convinced for that to happen in March.

From the US, apart from the FOMC minutes, we also have the retail sales for January, with both the headline and core rates expected to have rebounded, as well as the industrial production for the same month, which is also expected to have rebounded somewhat.

As for tonight, during the Asian session Thursday, Australia releases its employment data for January. The unemployment rate is expected to have held steady at 4.2%, while the net change in employment is forecast to show that the economy has lost 15k jobs after adding 64.8k in December.