Special purpose acquisition companies (SPACs), which we recently covered, are currently among the hottest ways for company's to go public in equity markets. In a nutshell, a SPAC is a blank cheque company that is already listed on a stock exchange. It uses funds to acquire a private company to take it public without the traditional initial public offering (IPO) route.

Over the past several months, Palantir Technologies (NYSE:PLTR), Asana (NYSE:ASAN), Jfrog (NASDAQ:FROG), Airbnb (NASDAQ:ABNB) and DoorDash (NYSE:DASH) all took the more traditional IPO route, selling new shares in a public offering, instead of merging with an existing SPAC.

However, according to SPAC Research, there have been 234 SPAC IPOs so far in 2020. Prominent SPACs of late include Adapthealth (NASDAQ:AHCO), DraftKings (NASDAQ:DKNG), Immunovant (NASDAQ:IMVT), Repay Holdings (NASDAQ:RPAY) and Virgin Galactic (NYSE:SPCE).

A UK-based private company, Arrival, which manufactures commercial electric vehicles (EVs) is set to go public via a SPAC listing.

Arrival Wants To Grow In Commercial EV Space

On Nov. 18, Arrival announced its intention to go public in the U.S. by merging with Ciig Merger (NASDAQ:CIIC), a SPAC. According to CNBC, "the deal gives Arrival an enterprise value of $5.4 billion...with the combined company expected to raise a total of $660 million in gross cash proceeds".

Arrival was founded in 2015 and is currently focusing on commercial EVs, i.e., van and bus models. In the next few years, it plans to have four products.

It has already partnered with Hyundai Motor (OTC:HYMLY) and United Parcel Service (NYSE:UPS) for the adoption of its EVs. BlackRock (NYSE:BLK) is also a backer.

When the merger is finalized, the new, combined company will list on the NASDAQ and trade under the ticker “ARVL”. That's expect to happen in early 2021.

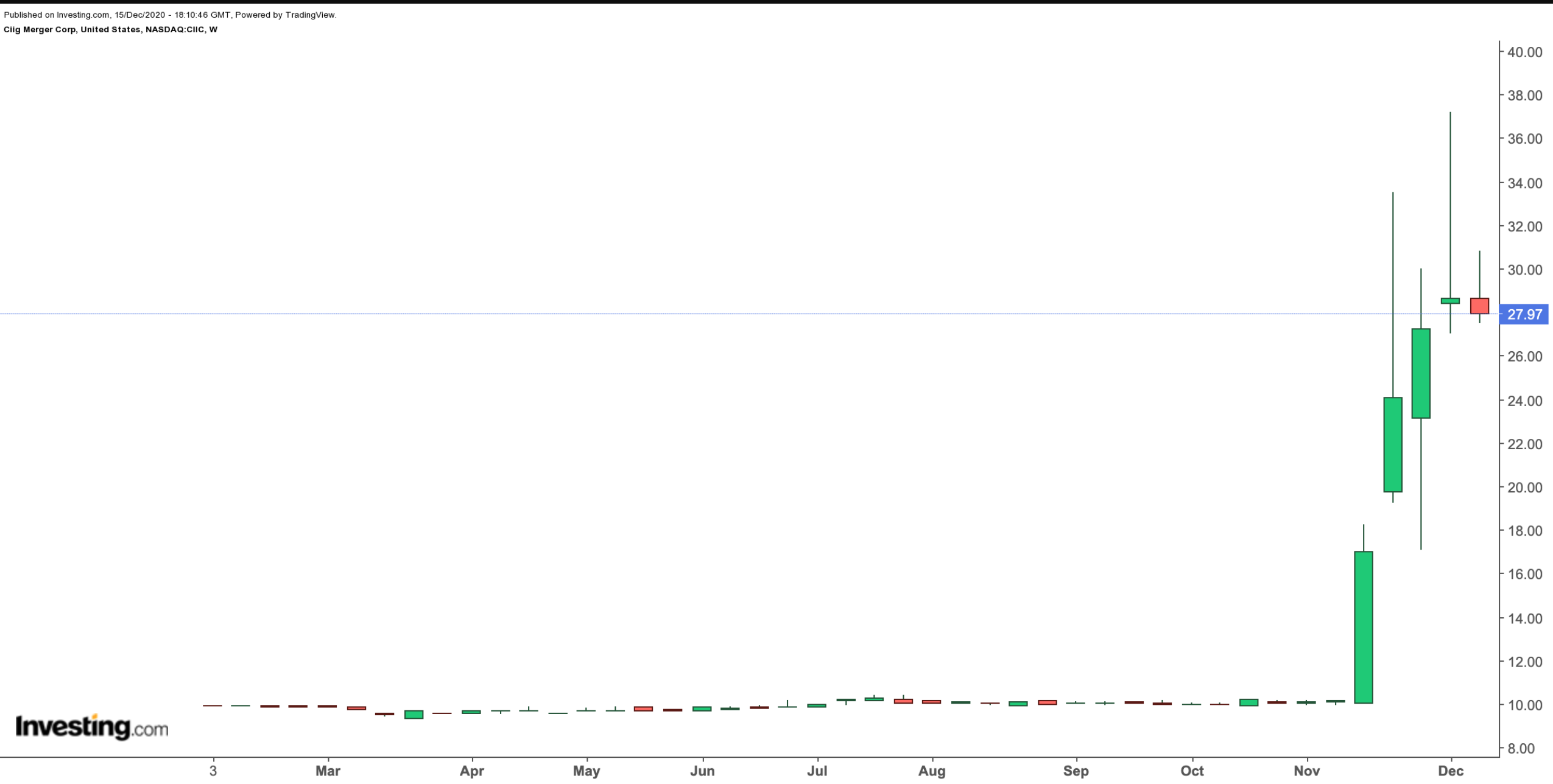

Most SPACs like CIIC start trading around $10. When a deal is announced, the stock price typically jumps. In the case of the Arrival-CIIC announcement, investors were pleased. On Dec. 7, the shares hit a record high of $37.18. Now, they are hovering at $28.

EV SPACs Are Sizzling

In early October, a new exchange-traded fund (ETF), i.e., the Defiance Next Gen SPAC Derived ETF (NYSE:SPAK), which provides exposure to companies that have gone public via a reverse-merger with a SPAC, started trading. In less than three months, the fund returned about 10%.

2020 has also witnessed significant moves upward in share prices of electric vehicle (EV) companies. Tesla (NASDAQ:TSLA) stock, which will join the S&P 500 Index on Dec. 21, is, for example, up an eye-popping 650% year-to-date (YTD).

In previous weeks, we also looked at several other ETFs in this space, such as the Global X Autonomous & Electric Vehicles ETF (NASDAQ:DRIV) or the SPDR S&P Kensho Smart Mobility (NYSE:HAIL), through which long-term investors could participate in the growth of alternative energy vehicles.

While market participants search for the next Tesla, a number of private EV companies are making the headlines as they go public via the SPAC route, too. Several of these mergers include: Fisker (NYSE:FSR), Lordstown Motors (NASDAQ:RIDE), Luminar Technologies (NASDAQ:LAZR) and (NASDAQ:LAZRW) and Nikola (NASDAQ:NKLA).

In other words, the reverse-merger between Arrival and CIIC is already joining a busy EV SPAC space.

On Nov. 9, Arrival said it was establishing its North American headquarters in Charlotte, North Carolina, where it would have around 150 employees. Although it is too soon to know if the new company will create significant shareholder value, in the short-term, the stock price is likely to be volatile.

Bottom Line

Investing in SPACs can be volatile, yet profitable, as recent SPAC mergers have shown. However, such returns typically mean a higher exposure to risks.

In a recent article, Mate Rimac, founder of EV company, Rimac, which focuses on the electric hyper-car space, expressed his concern on the number of EV businesses using the SPAC route to become public entities. He said:

“I hope that these SPACs will be successful. A lot of them won't. I hope it won't hurt the industry too much.”

We are increasingly seeing analysts and industry experts highlighting the drawbacks of SPAC investments.

Meanwhile, the U.S. Securities and Exchange Commission (SEC) has also been sharpening its focus on this hot asset class. On Dec. 10, it put out an investor alert and bulletin:

“It is important to understand how to evaluate an investment in a SPAC as it moves through these stages, including the financial interests and motivations of the SPAC sponsors and related persons.”

Before investing in any SPAC, we’d encourage investors to do due diligence first. Analyzing financial statements, getting to know the management behind the company and learning more about the points recently highlighted by the SEC could be important starting points. Investing in an ETF as opposed to a single company could offset some risk and also help retail investors diversify their long-term portfolios.