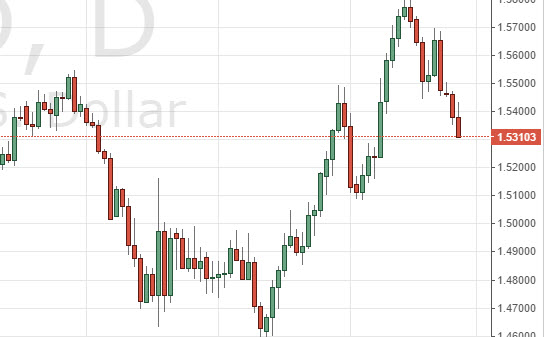

Looking at the upcoming session for Thursday, without a doubt, the GDP numbers coming out of the United Kingdom are probably the most important to pay attention to. With that being said, we pay attention to the British pound, and the fact that it is falling during Wednesday trading. We initially tried to break above the 1.54 level, but found too much resistance and fell back down. The resulting candle suggests that the GBP/USD pair is heading down towards the 1.51 handle given enough time.

GBP/USD

Looking at the S&P 500, we did bounce enough during the session on Wednesday for us to be believers in the 2100 level as support. Because of this, we look at short-term pullbacks as call buying opportunities and have no interest whatsoever in buying puts in this marketplace. We believe that the S&P 500 will break out to fresh, new highs eventually, but also recognize that there will be a bit of volatility in the meantime.

Silver markets sat still just above the $16.50 level, and that, of course, is very positive, as it shows that the previous support level is starting to act supportive yet again. With this, we feel that the market will eventually bounce and head towards the $17 level, but we need to break the top of the range for the session on Wednesday. In fact, we believe that the market will probably go all the way to the $17.25 level given enough time.