- US NFIB Small Business Optimism Index expected to remain unchanged in July

- NIESR’s UK GDP estimate offers an early test of post-Brexit recession risk

- Will Brazil’s retail sales report show signs of life?

An early test of post-Brexit recession risk for the UK arrives in today’s GDP estimate via the National Institute of Economic Social Research. We’ll also see new July numbers on sentiment for the US small-business sector and retail spending in Brazil.

Doom and gloom ahead? If the UK is heading for a recession

post-Brexit, then today's GDP number should provide a hint. Photo: iStock

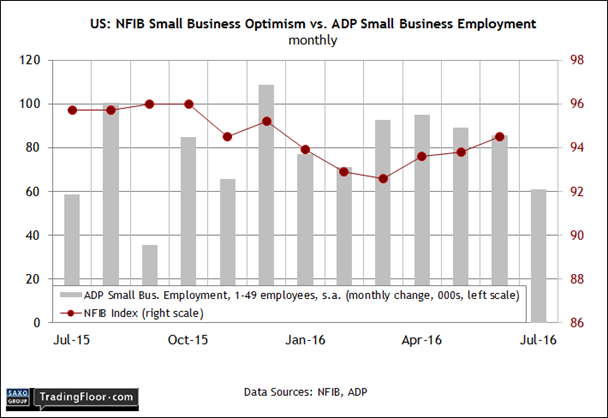

US: NFIB Small Business Optimism Index (1000 GMT) Last week’s upbeat news for payrolls in July has renewed faith in the US economy's capacity for growth, which in theory should boost sentiment in the small-business sector. Why, then, are economists expecting no change in today’s July release of the Small Business Optimism Index? Part of the answer may be linked with the fact that employment growth at small firms has slowed.

ADP estimates that firms with fewer than 50 employees added 61,000 new positions last month, the slowest pace in 10 months and well below June’s 86,000 rise. “As the labour market continues to tighten, small businesses may increasingly face challenges when it comes to offering wages that can compete with larger businesses,” explained the head of the ADP Research Institute.

A month ago, NFIB’s chief economist advised that “small businesses are in maintenance mode [and] experiencing little growth.”

Today’s sentiment update is expected to reaffirm the point. Econoday.com’s consensus forecast sees NFIB’s index holding steady at 94.5 in July. Although the benchmark has posted a modest recovery in recent months, today’s release looks set to remind the crowd that the small-business sector’s growth outlook is still modest at best.

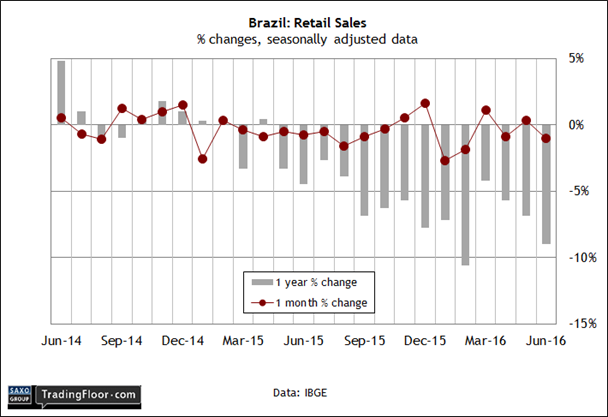

Brazil: Retail Sales (1200 GMT) South America’s largest economy is still struggling with a deep recession, but the stockmarket is pricing in better days ahead. At midday on Monday, the Bovespa Stock Index was trading near its highest level in over a year.

The market’s upbeat mood of late follows hints that the economic downturn may end soon. Last week’s July reading of the Consumer Confidence Index, for instance, posted its fourth straight increase. “The increase in consumer confidence in the last three months was almost entirely determined by improved expectations, advised FGV/Brazilian Institute of Economics, which publishes the data.

Today’s question: Is there any support in the hard data for thinking positively? Recent history offers little if any assistance for the bulls. Retail spending in June fell in monthly and year-over-year terms. In fact, other than two monthly gains earlier in the year, the negative trend has dominated the consumer sector when it comes to actual spending.

Another slide in today’s report will throw cold water on the idea that Brazil’s recession is about to end.

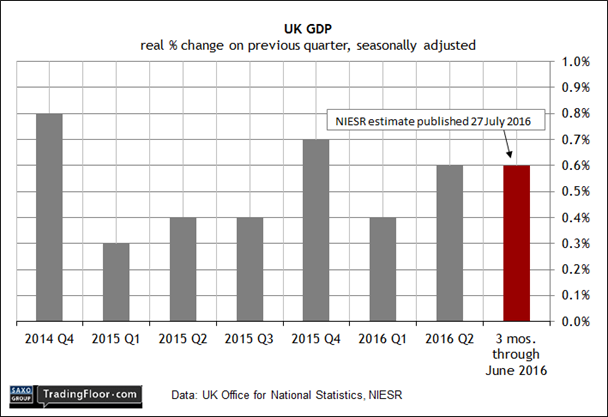

UK: NIESR GDP Estimate (1400 GMT) If the UK is headed for a recession, as many economists predict, today’s GDP estimate for the three months through July may provide a hint of things to come.

The rearview mirror, by contrast, still looks encouraging, although the rumblings of trouble are visible just below the surface. Although economic activity increased 0.6% in the second quarter, today’s estimate will factor in data for July, the first month after the Brexit vote, which is widely expected to trigger economic contraction.

Yesterday’s release of survey data for the UK labour market certainly offers little room for optimism.“The UK jobs market suffered a dramatic free-fall in July, with permanent hiring dropping to levels not seen since the recession of 2009,” said a spokesman for the Recruitment & Employment Confederation, which co-produces the monthly payrolls survey with Markit Economics. The update follows last week’s news that Britain’s services and manufacturing sectors contracted in July, according to PMI data.

Today’s release from the National Institute of Economic Social Research (NIESR) will provide a hard-data preview of post-Brexit economic conditions. Note that while NIESR’s three-month GDP estimate last month through June looked solid, trouble was lurking. As a research fellow at the consultancy explained:

"Our monthly estimates suggest that April saw a large expansion in GDP, which then stagnated in May. The estimate for June is one of an intensifying contraction across the board, but this is not enough to offset the very strong April numbers. What it does suggest is that when April drops out of the three-month calculation we should see a quick deterioration of growth, especially if the estimated contraction in June persists or accelerates into July and beyond."

Disclosure: Originally published at Saxo Bank TradingFloor.com