Looking at the Tuesday session, the most important announcements will be the GDP numbers out of the United Kingdom, and of course the Consumer Confidence numbers coming out of the United States. With this, we believe that the FTSE and the British pound will be in focus during the session on Tuesday, as well as US stock markets.

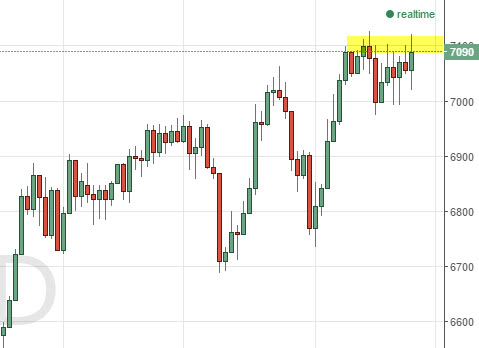

Looking at the FTSE, we have tested the 7100 level and broke through just slightly. With this, we believe that the market will continue to go much higher, and that it’s only a matter time before we break out. A move above 7110 has us buying calls as it would show a break of resistance and continued momentum to the upside. We did see a little bit of a push back during the session on Monday, but ultimately we think it’s only a matter of time before we go much higher. Above the 7110 level is a call buying opportunity as far as we can see.

ftse

The EUR/USD pair fell a bit during the session as the downward pressure continues. With that, we believe that the US Dollar will continue to strengthen overall, and as a result we are buying puts in this particular pair as we anticipate the EUR/USD pair going down to the 1.06 level and possibly even lower.

The GBP/USD pair did much the same, as we pulled back from the 1.52 handle. With this, we believe that the market will then head to the 1.50 level given enough time, as there should be quite a bit of support in that region. Once we break above 1.52 though, we believe that the market then becomes a “buy-and-hold” type of situation all the way up to the 1.55 handle although one would anticipate seeing quite a bit of volatility between current levels and that handle.