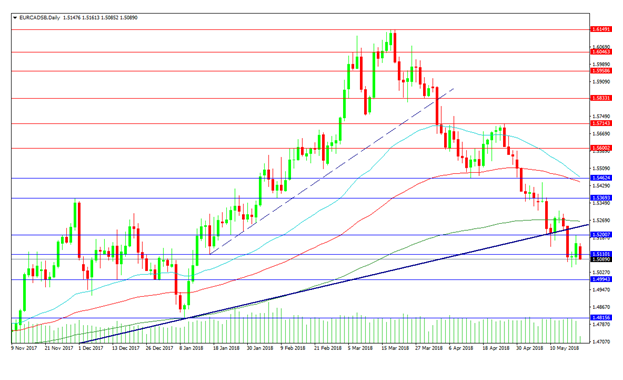

UK 100 and EUR/CAD

The UK 100 Index has put together a stellar performance, with a breakout higher today to a new high. The pre-market high comes in at 7837.5 with support in the area of the 7800.00 level. A continued bullish move would go on to test 7850.00 followed by 7900.00. Ultimately the 8000.00 level remains a major goal for bulls to reach with the possibility of a significant number of shorts waiting at that level. In the near term it is possible that the gap higher over the weekend gets filled before a new leg higher begins. A failure to do so structurally weakens the subsequent leg up and can fire the bellies of bears around 8000.00.

Support comes in at the close from Friday at 7775.0 with further support positioned around the 7750.00 area. A break down to the 50 period MA at 7716.00 could provide a decent opportunity for bulls. The bullish trend line can be encountered at 7633.30 with the 100 period MA at 7628.80 close-by. A loss of the 7600.00 level can alter the dynamic of the market with a retest of the 200 MA at 7500.00 needing to hold to prevent a deeper retracement to 7400.00.

UK 100 4 Hour chart

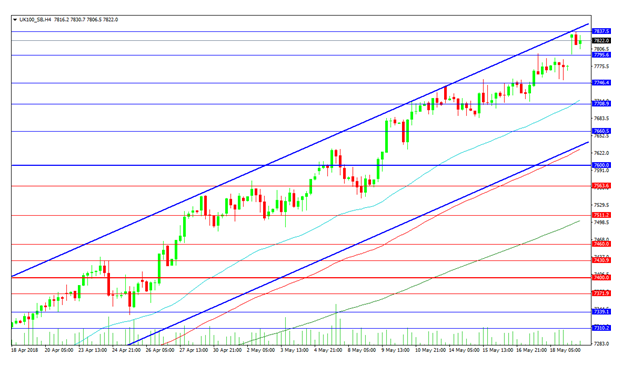

EUR/CAD

The EUR/CAD pair has seen a loss of its trend line support last week with the EUR exerting influence on the chart in the face of rising Oil prices and NAFTA headlines. The pair rallied on Friday but the 1.52000 level has become too strong and price is now trading down at 1.50890. This leaves the 1.50000 area to do the heavy lifting and prevent a full rout in the pair. This could turn out to be too much for the pair with the January low being eyed by shorts at 1.48156. Further losses could see the September swing low at 1.44413 tested.

Resistance at the trend line comes in at 1.52355 with the 200 DMA at 1.52640. The 1.53693 level also forms resistance and a swing high from late 2017 with a move above this level targeting the 100 and the 50 DMAs around the 1.54624 area. A successful move above this area would see the late April high at 1.57143 tested as resistance.

EUR/CAD Daily chart