For most people, Friday is just the day before the weekend.

But in the Wall Street Daily Nation, it’s the day we ditch the long-winded analysis and let some graphics talk for us.

This week, I’m serving up a limbo edition. I’m going to profile just how low Snap Inc.’s (NYSE:SNAP) newborn stock can go. (I warned you!)

I’m also revealing the world’s best performing currency for the past two years. Is it time for me to eat crow for predicting its ultimate demise nearly four years ago? Hardly!

Read on to find out why…

How Low Can SNAP Go?

That didn’t take long!

In a matter of days, the euphoria over the biggest U.S. technology IPO since Facebook Inc (NASDAQ:FB)'s $16 billion offering in 2012 turned into outright fear.

All the clichéd “Snap, Crackle, Pop” headlines were instantly supplanted by “Snap, Crackle, Drop” headlines.

Why? Because, as we predicted, shares of the new public social media company, Snap Inc. (SNAP), tripped and fell. Hard.

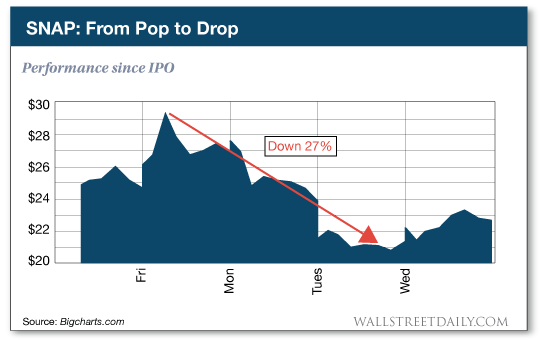

After surging 73%, to a high of $29.44, in the second day of trading, the stock is officially in a bear market now. Shares dropped as much as 27.6% from the all-time high.

Mind you, investors who were afraid of missing out — and piled into the stock at the peak — have once again become Wall Street’s bag holders.

Two observations here:

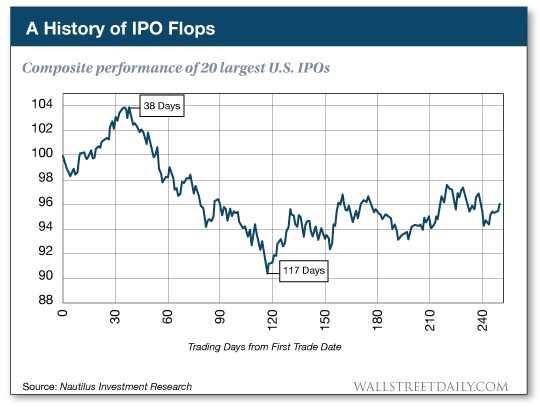

1. The wheels are falling off this IPO bus faster than normal

As you can see in the chart below, the typical hot tech IPO begins its descent to reality 38 days after going public. And the selling doesn’t relent for 117 days, on average. Snap decided to break down in just three days. Not a good sign.

2. It’s only going to get worse

Consider:

- As of Wednesday, speculators could officially begin selling short the stock. Bloomberg estimates that up to $1 billion worth of stock will be sold short.

- Options become available today.

- Not a single sell-side analyst issued a buy rating on shares. In an uncharacteristic brew of negative groupthink, all eight have slapped a sell or hold rating on the stock. (In case you didn’t know, hold is a euphemism for sell on Wall Street.)

Combined, these factors promise to intensify the selling pressure.

Look out below! And look to buy some cheap put options to profit from the descent.

How Low Can Bitcoin Go?

Unlike many stubborn analysts, I have no problem admitting when I’m wrong.

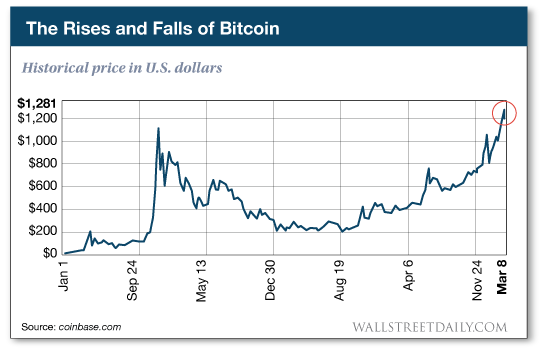

Long ago, I predicted the demise of cryptocurrency bitcoin. Didn’t happen.

After flirting with death in 2014, bitcoin staged a mighty comeback. In fact, it ended up being the best performing currency in both 2015 and 2016.

It even crossed an eye-catching and interesting — but nonetheless arbitrary — threshold. It reached parity with a single ounce of the barbarous relic, gold.

But before you rush out to stockpile bitcoins, be wary. It could turn into a Hotel California investment.

In a matter of minutes on Tuesday, bitcoin plunged more than $100 on news leaks that China’s three largest bitcoin exchanges will keep blocking withdrawals.

There could be more negative pressure coming next week if the SEC doesn’t approve one of the three proposed bitcoin-focused ETFs by the March 11 deadline. That’s tomorrow.

So I was wrong about bitcoin. But that doesn’t mean the time is suddenly right to pile into the enigmatic cryptocurrency. Not yet, unless you enjoy taking undue risk.