It’s time to put some ice on a hot investing topic. Some ice cube, that is.

In his 1993 hip hop anthem, O’Shea Jackson, better known as Ice Cube, raps:

“You better check yo’ self before you wreck yo’ self. Cus’ I’m bad for your health, I come real stealth.”

And that’s exactly the warning speculators in the new(ish) and wildly popular digital currency, Bitcoin, need to hear.

Otherwise, they might find their dreams dashed – or worse, their portfolios “stealthily” ruined.

Let me explain…

Desperate for An Alternative to the U.S. Dollar

Ever since the Federal Reserve embarked on its easy money campaign, everyone and their mother has been on a crusade for an alternative reserve currency.

The battle cry? Stop devaluing our money!

I hear you. But what are we going to do about it?

Several years ago, the euro was the top answer to the currency woes. Then the eurozone imploded. Game over.

China’s yuan entered as the next great contender. But let’s be real. We have a better chance of seeing Jesus tomorrow than we do of seeing the world embrace the currency of a communist government as the new reserve.

Even if the Chinese government finally decides to allow its currency to freely float – rather than controlling its value within predetermined ranges – it’s still not going to happen.

Of course, during the world’s desperate search, the Federal Reserve has just continued printing more money. And that has only intensified the desire for an alternative.

Enter, Bitcoin.

Bitcoin was envisioned in a 2008 paper by the pseudonymous developer, Satoshi Nakamoto, and launched in 2010.

It’s essentially a peer-to-peer electronic cash system that can be transferred through a computer or smartphone without an intermediate financial institution.

That sounds incredibly interesting. Or, as Jeb Terry of Aberdeen Investment Management says, “Bitcoin is a curiosity.”

Let me assure you, though – it’s nothing beyond that.

So any talk about Bitcoin being a potential alternative currency is a function of desperation, not rational thinking.

Even if it keeps garnering more and more notable support.

You Don’t Impress Me Much

Last week, BitPay – an Atlanta-based startup that processes payments merchants receive in Bitcoins – secured $2 million from a venture capital firm backed by PayPal’s founders.

A few weeks before that, Coinbase, an 11-month-old startup that also facilitates Bitcoin transactions, secured $5 million in capital from another Silicon Valley heavy-hitter, Union Square Ventures.

Despite such strong votes of confidence, though, Bitcoin stands zero chance of being a legitimate, widely adopted currency. And here are three key reasons why…

~Bitcoin Pitfall #1: In God (needs strikethrough) Nobody We Trust

No doubt, the atheists who cringe over the fact that U.S. paper money says “In God We Trust” love the fact that Bitcoins pledge no such allegiance.

In fact, many supporters of the digital currency tout the lack of any centralization or regulation over Bitcoin as a key selling point. Combine that with a finite supply of Bitcoins (21 million), and it seems like no government can inflate the currency.

I’ll concede that a world without inflation would be wonderful. And Bitcoin is set up to make that a possibility.

But without regulation, and the guidelines and legal protections that come with it, consumers have no reason to trust the currency.

And if we can’t put our trust in a currency, we won’t use it. Simple as that.

Besides, if you think governments around the world are going to sit on the sidelines and allow an unregulated, digital currency to gain momentum, you’re crazy.

The Department of Homeland Security has already dropped the hammer on Mt. Gox, the world’s largest Bitcoin exchange, for operating a money-transmitting business without a license. And that’s only a preview of what’s to come.

So this whole notion of an unregulated currency is really just a pipe dream. While citizens might want it, world governments won’t allow it.

Whether or not that’s fair doesn’t matter. It’s reality.

~Bitcoin Pitfall #2: No Guarantees

In addition to lacking trust, we have no guarantee that Bitcoin won’t be replaced. I mean, what’s going to stop a better Bitcoin from coming onto the scene?

And if the limited supply drives up prices to untenable levels, there’s nothing to stop the creators from simply creating more Bitcoins.

They say they won’t. But do you actually trust them?

Put another way, would you be willing to accept your next paycheck in Bitcoins?

Yeah, I didn’t think so.

~Bitcoin Pitfall #3: No Inherent Value

Haters continually deride the U.S. dollar because it’s not backed by anything of value.

What’s the difference with Bitcoin?

Just like there’s no inherent value in paper, there’s no inherent value in a bunch of ones and zeros in cyberspace.

That means there’s no way to figure out what a fair price is for a Bitcoin. And that’s ultimately the digital currency’s undoing. It’s nothing more than a speculation. And a wild one, at that.

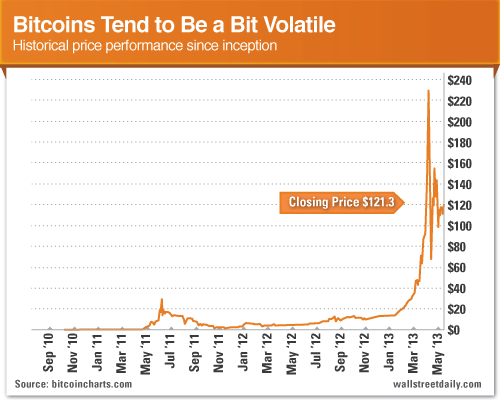

When Bitcoin first hit the market, it had little to no value. But the price of each coin quickly soared above $25. Then it collapsed back to $5 again.

After a slow and steady recovery, prices zoomed above $250 in the wake of the asset seizure in Cyprus. And sure enough, they cratered back down to Earth again.

Notice a pattern?

I’m sorry. But people want a currency with a stable value. And that’s something Bitcoin simply can’t offer.

Bottom line: The only reason people won’t stop talking about Bitcoin is because of the chart above. Forget its “sound theoretical underpinnings,” as Henry Blodget of Business Insider notes. Greed is what’s driving interest right now.

Investors see an opportunity to make a quick buck on a far-fetched “asset,” just like they’ve been doing for centuries. Tulip bulbs, anyone?

And the fringe set of retailers that accept Bitcoins are no different. They like the currency because it allows them to avoid interchange fees. And it also immunizes them to the risk of chargebacks. (Like cash transactions, Bitcoin payments can’t be reversed.)

In other words, it lines retailers’ pockets with more money.

Ultimately, it’s greed – not a genuine interest in a fundamentally stronger alternative to the status quo – that’s driving Bitcoin prices.

So forget Bitcoin being a contender as an alternative currency. At best, it’s a speculative investment. And a very speculative one at that.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin: Beware Of This Insidious New Currency Scam

Published 05/20/2013, 01:46 AM

Updated 05/14/2017, 06:45 AM

Bitcoin: Beware Of This Insidious New Currency Scam

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.