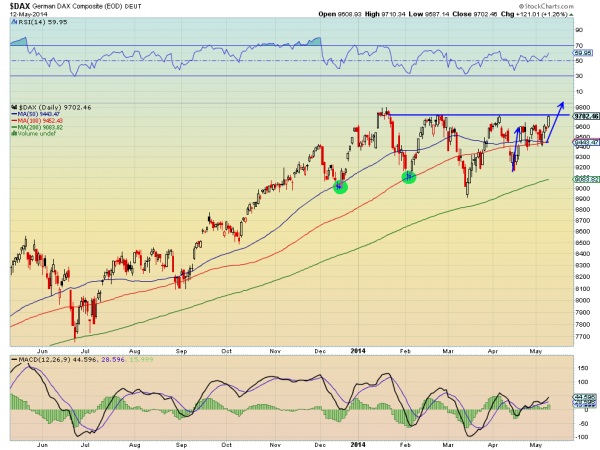

The German market has been on my radar since last October. It had a great run higher, then ran into the same consolidation that the S&P 500 has been experiencing. The DAX tried to push higher a couple times, visible on the chart as the green circles for small moves, only to see the effort stall out. But the 5 month consolidation is now producing an Inverse Head and Shoulders pattern.

You can see all this on the chart of the German DAX, below. With the neckline at 9725, a break higher carries a price objective to at least 10,550. That is worth a beer and a pretzel or two. The RSI and MACD both support a move higher and the recent short term break out targets 9840, which could get that big trigger going.

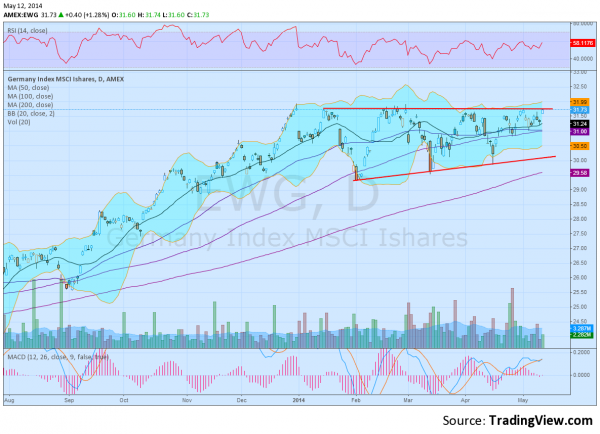

Oddly, the iShare MSCI Germany (ARCA:EWG), the German ETF, does not have the same Inverse Head and Shoulders Pattern, but it is equally attractive if you do not trade futures. The chart below shows an ascending triangle with a target of 34.20 on a break above 34.20. It also has a favorable RSI and MACD. Take your pick as to which one you prefer.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.