The Bank of Japan has, this morning, decided enough is enough and thrown the kitchen sink at the Japanese economy in the form of far looser monetary policy than the market had expected.

Rules, such as the so-called ‘banknote rule’, surrounding the maximum level of bond purchases, were torn up as the newly installed Governor Kuroda got near unanimous support for his plans. The largest gesture came in the form of a pledge to keep the increased asset purchases on course until the 2% target on inflation is hit and beyond; something Kuroda thinks will happen over the course of the next 2 years and he’s at the optimistic end of things.

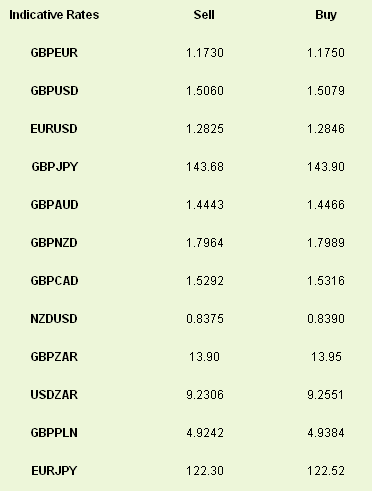

Needless to say XJPY has gone ballistic on this news with USD/JPY 2.2% higher on the session already with EUR/JPY, KRW/JPY and GBP/JPY pushing higher by a similar amount. The key will be whether this can generate longer term gains in inflation and growth in Japan or whether the monetary policy machine is a busted flush.

It is likely however, that that is the most interesting of the central bank announcements given we have the ECB and the striking sloth that is the Bank of England. If Q1 was the quarter where everyone talked about GBP and JPY then Q2 could easily be the quarter when the euro is in everyone’s crosshairs. Questions around Cypriot banks and the upcoming MOU, Italian political manoeuvres that are likely to result in nothing but higher yields in the periphery, and an on-going recessionary malaise in places like Spain and France, will test the resolve of Draghi’s “whatever it takes” pledge.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

We’re not going to see a rate cut today, or maybe next month either, but the inflationary picture cannot be upheld as a central reason for tight monetary policy forever, especially with unemployment so high and growth so poor.

Here in the UK, market sentiment on sterling is still very poor and this will only turn around after an extended run of good data, you’re more likely to be booking a beach holiday in Britain than seeing that at the moment. In the absence of good numbers you have to look at the central bank to support the currency via monetary policy and the Bank seems to the most split it has been in a while on this; something that will likely only be extended under Carney’s leadership when he eventually arrives.

Yesterday’s construction PMI data was poor here in the UK. This is the 5th consecutive month of contraction for the construction index but I think it is only fair that a large proportion of this recent weakness is attributed to the unseasonably cold weather, although the lack of strong demand won’t have helped matters either. On-going confidence issues in the UK economy as a whole were also likely drags on investment while industry could also have been forgiven for waiting on the Budget and hoping for favourable terms from the Chancellor before expanding capital expenditure. New work also fell which will put pressure on jobs going forward.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

We therefore expect holds in policy from both the BOE and ECB and both decisions to be slightly supportive of their respective currencies. Shifts in data from the US have also been taking the market by surprise recently, with yesterday’s ADP report acting as a rather depressing curtain raiser for a couple of days of important jobs data. ADP showed an increase of only 158k vs the 200k that had been expected and has caused predictions for tomorrow’s NFP release to be revised from 199k to a 195k consensus. Sequestration effects on the consumer are being worked through the macro data at the moment and could be extended by debt ceiling negotiations in May if they turn into the bunfight that they did last time. From the Fed’s point of view jobs are obviously still the laser focus and I cannot see the Uber-doves (Bernanke, Yellen, Kocherlakota) pulling back from the cliff of further printing until we see at least of 6 consecutive months of above trend increases in NFP. A poor figure is likely to ‘reset the clock’ on these.

Apart from the central bank announcements today we of course have services PMIs from the UK and various Eurozone countries to contend with.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.