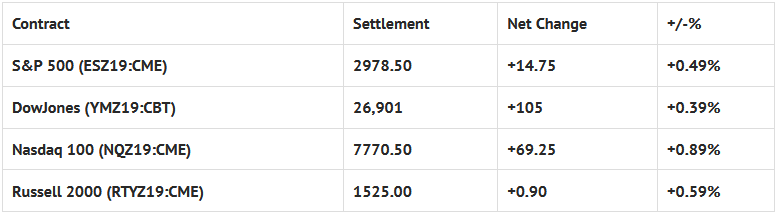

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, Charles Evans Speaks 4:15 AM ET, Richard Clarida Speaks 8:50 AM ET, Redbook 8:55 AM ET, James Bullard Speaks 9:15 AM ET, Michelle Bowman Speaks 9:30 AM ET, PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, and Construction Spending 10:00 AM ET.

S&P 500 Futures: End Of The Quarter Asset Allocation; Buy S&P / Sell Bonds

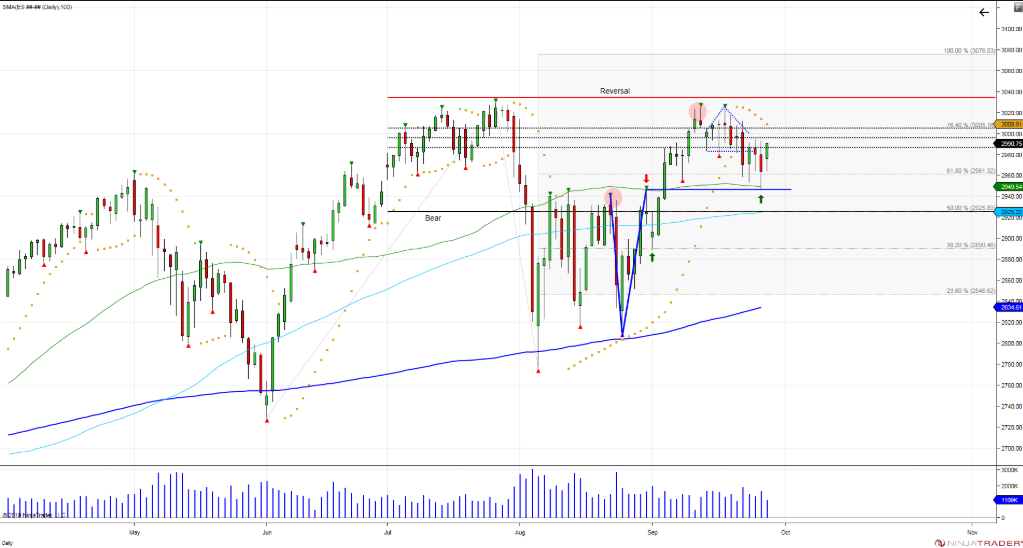

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Would you look at that. Retest 8/30 V bottom high 2946 held. Expansion of the 2810-2946 V bottom, gives room up to 3082 (2946+136) / matches 100% fib extension lvl.

After selling off hard Friday morning, and then rallying in the final hours of the week, the S&P 500 futures gapped open 12 handles higher Sunday night, and continued to rally Monday as the big investment firms and ETF’s bought stocks and sold bonds on the final day of the quarter.

After yesterday’s 8:30 CT open, the ES traded up to 2973.00, pulled back a little, then did some back and fill before trading up to 2985.25, taking out the Globex high by 7 handles. Even on the last trading day of the quarter, you could still see rotations, as the RTY started moving up and the ES pulled back late in the day.

On the 2:45 cash imbalance reveal, the futures traded 2780.25 as the MiM flipped to $1.7 billion to sell, then went on to print 2977.75 on the 3:00 cash close, and settled the day at 2978.50, up +14.75 handles.

In the end, the ES was firm all day. Clearly the big investment firms were buying stocks and selling bonds. After a small late day pullback, the ES made another rip higher.

I know my feel has been off, but despite the negative stats in the beginning of October, I just can’t rule out a big upside stop run. In terms of the days overall trade, volume was low, with 1.1 Million futures contracts traded. Thin to win definitely took over yesterday.