Investing.com’s stocks of the week

Stocks are rising today, with the (NYSE:SPY) up about 70 basis points, building on yesterday’s late-day surge. But today is going to be a big day when it comes to economic data.

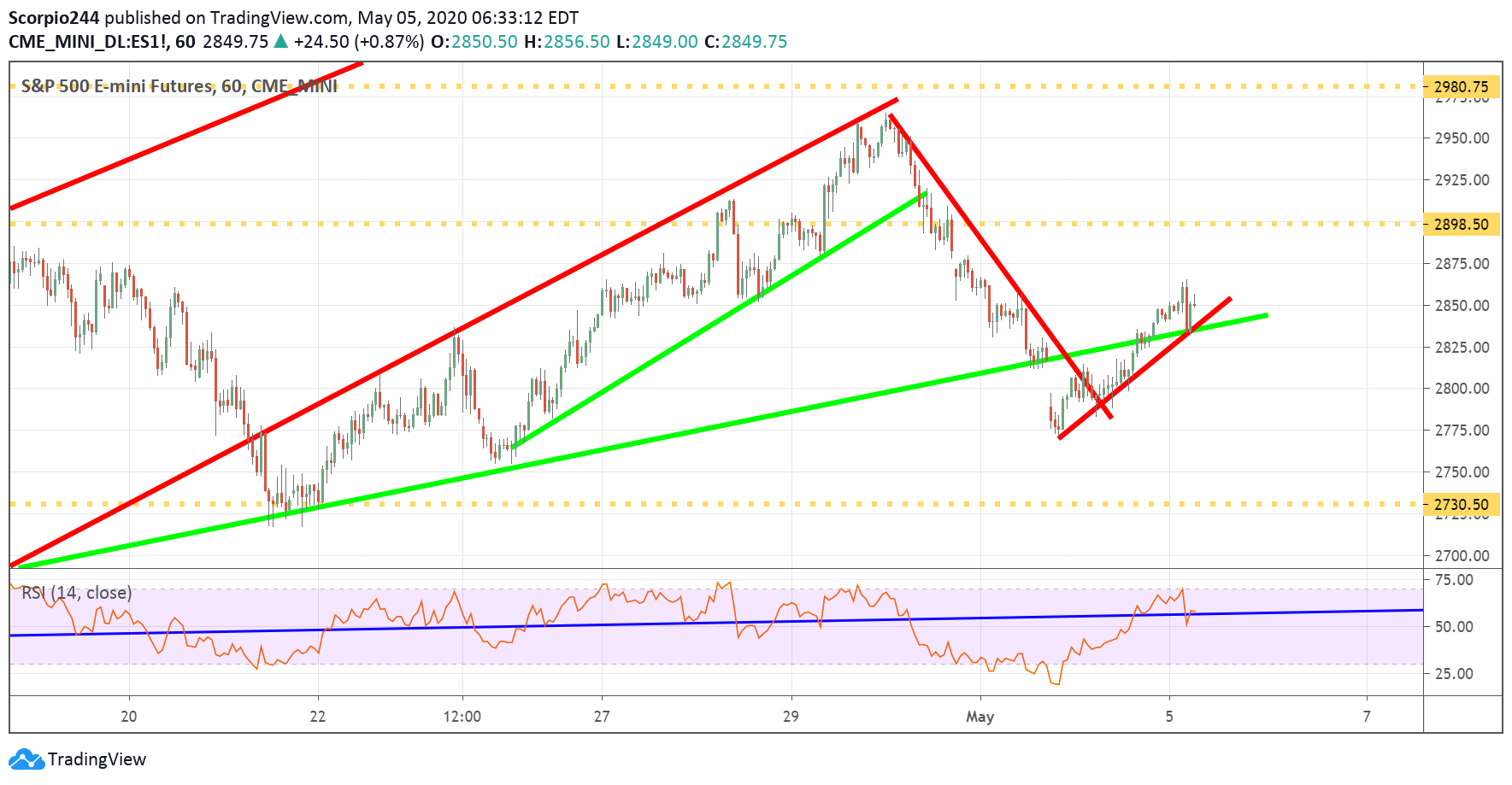

S&P 500

We can see that the S&P 500 Futures, for now, are trending higher and trying to recoup some of the loss from late last week, but again the long-term uptrend is broken, and 2,900 is the big resistance level, and 2,800 the significant support level.

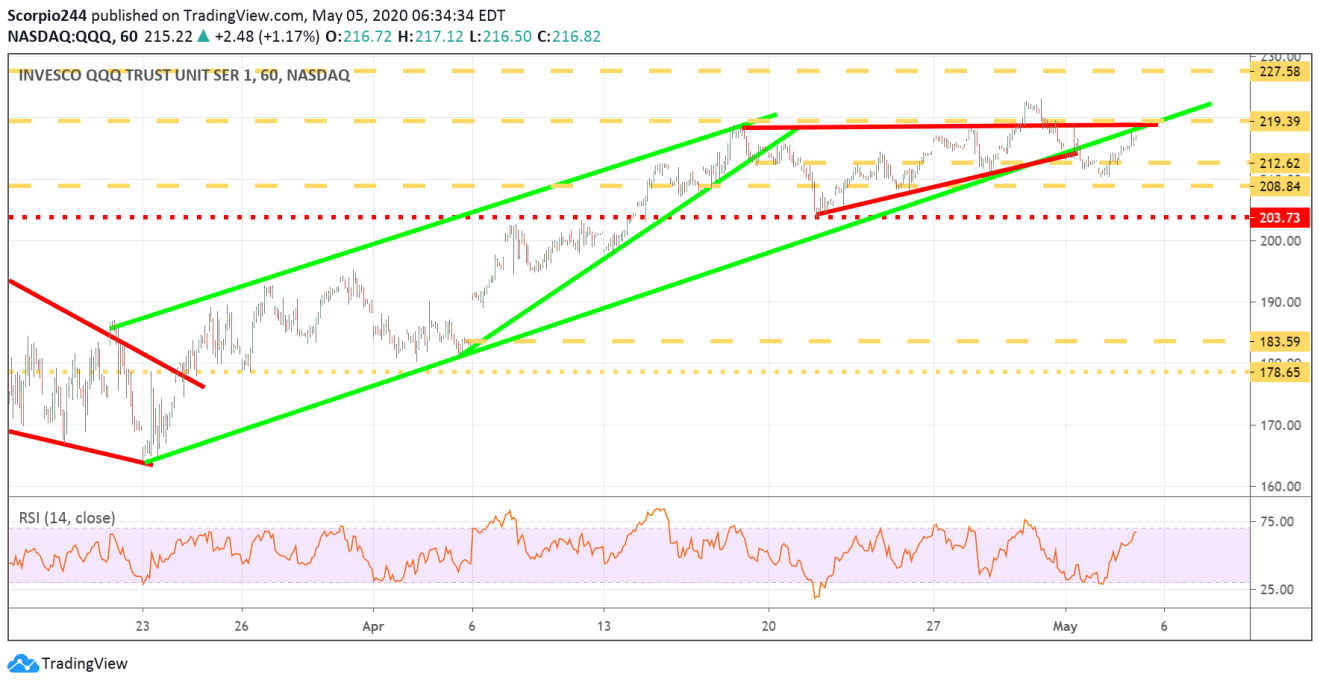

Nasdaq 100 (NASDAQ:QQQ))

The Qs are approaching resistance, which is the uptrend up for the March lows.

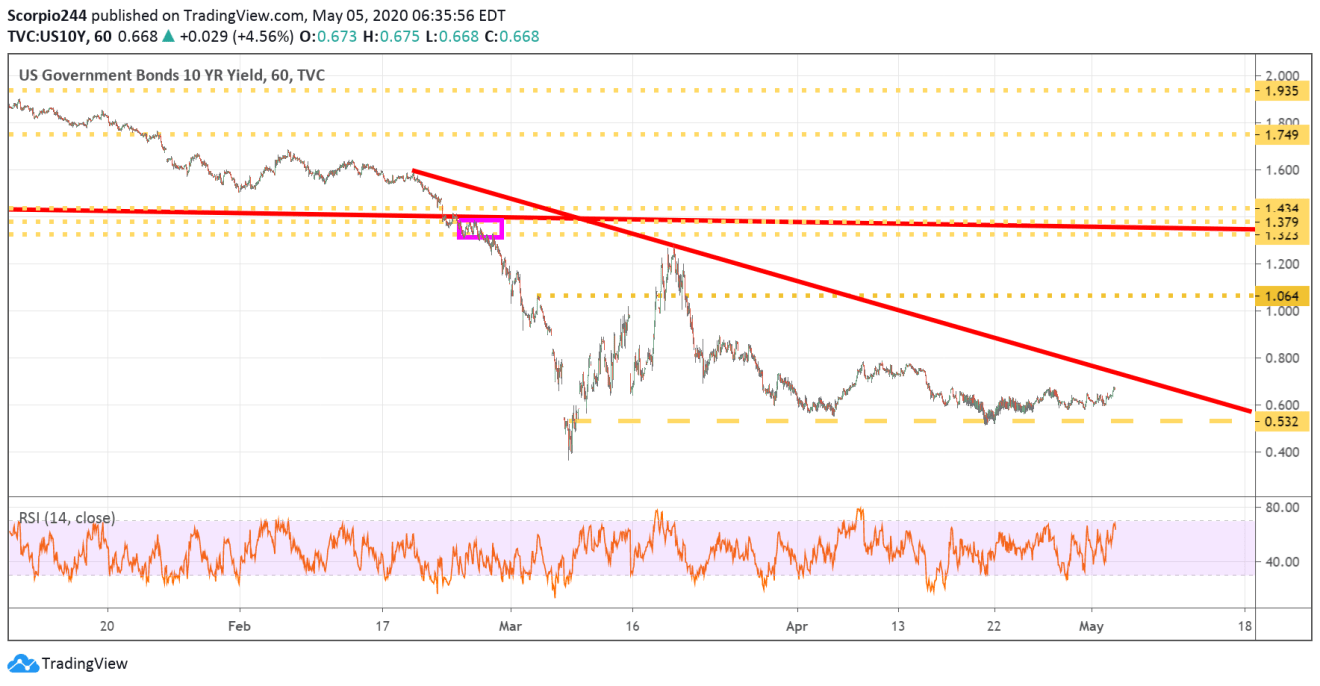

10-Year

I will continue to be watching the 10-year yield, and its potential for a move lower towards 0%. A drop in the 10-year would not be a good sign for the bank stocks.

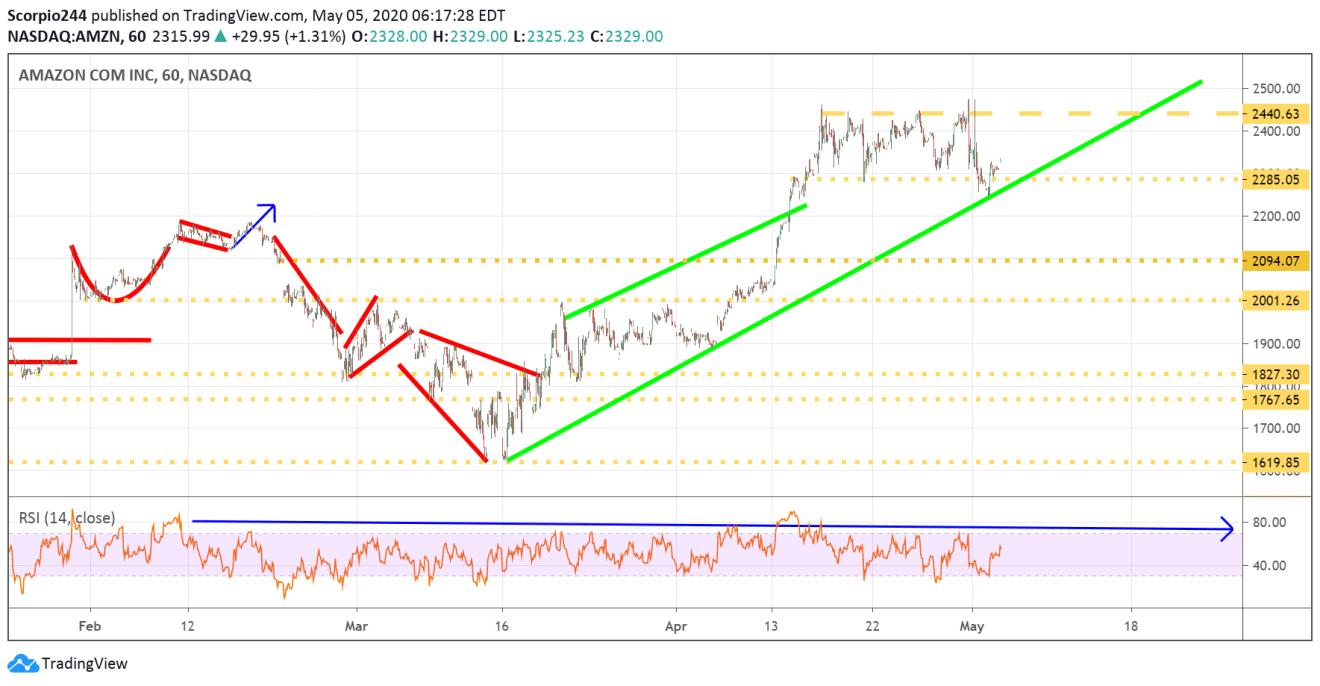

Amazon

Amazon (NASDAQ:AMZN) is trying to bounce, holding the uptrend, but that means resistance is at $2,440.

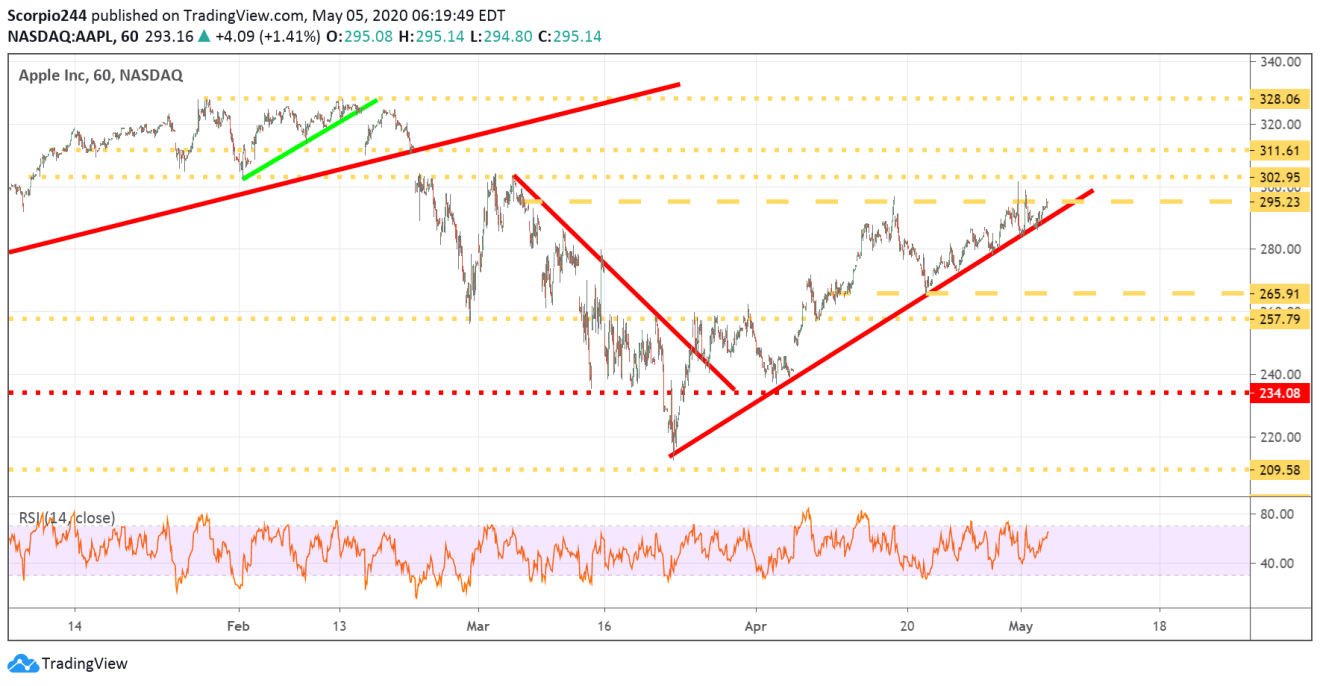

Apple

Apple (NASDAQ:AAPL) appears to have an ascending triangle, with the next level of resistance around $305.

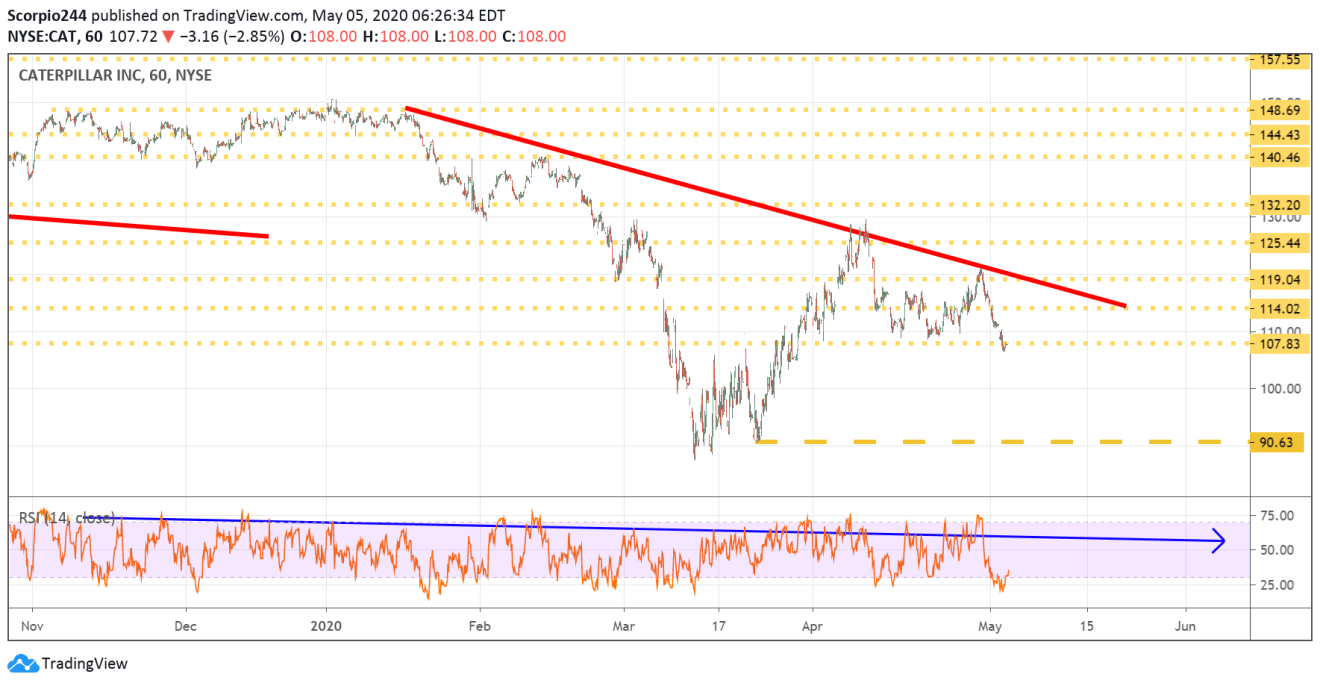

Caterpillar

Meanwhile, support for CAT (NYSE:CAT) must hold at $107 to avoid a drop to $91.

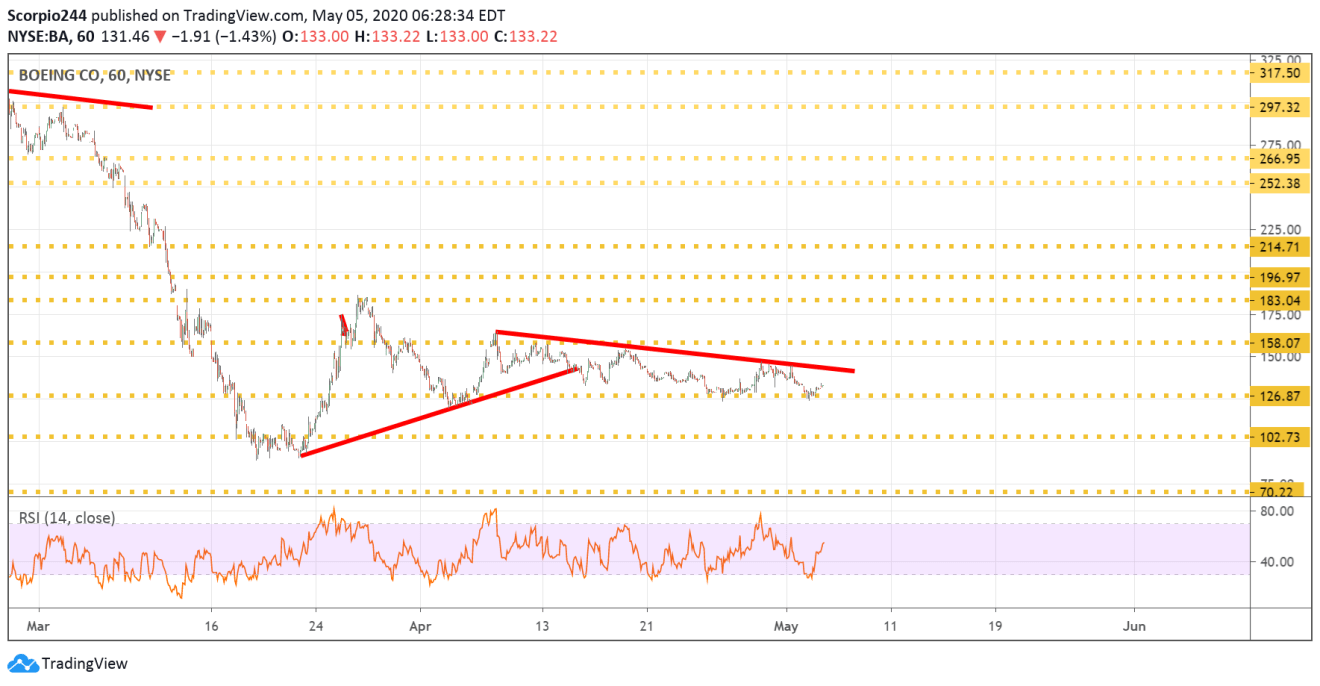

Boeing

Finally, Boeing (NYSE:BA) appears to be forming a descending triangle, and a potential drop to around $102.