A military coup in a NATO member country, with hugely important geopolitical dimensions, positioned between the Middle East and Europe, sharing border with ISIS infected Syria should probably jolt markets, right? Wrong, this is 2016.

The military in Turkey has always seen itself as the guardian of the nation’s old secular establishment, pioneered by the nation’s founder and ex military leader, Ataturk. But current Turkish President Tayyip Erdogan has been seen by some as moving away from the historically secular, democratic roots of Turkey and becoming dangerously autocratic.

Domestic issues such as the role Islam should play, the strain that refugees flooding the border from Syria are causing, as well as the conflict with Turkish Kurds have seen the country’s seems stretching. This was justification for why the army felt it must step in and ‘preserve democracy’ with tanks rolling through the streets of the capital.

The coup however didn’t last the night and President Erdogan survived by calling on his people to flood the streets in a tense stand-off. Some of the images and stories are mind-blowing, but the way that the coup rolled over seemingly so easily has brought forward the conspiracy theory that the coup was a staged attempt to further strengthen Erdogan’s autocratic rule. Thisis however one for another day and another analyst.

Focusing back on markets and stock Indices that in the past would have simply rolled-over during US session trade during a geopolitical event such as this. Traders however barely batted an eyelid.

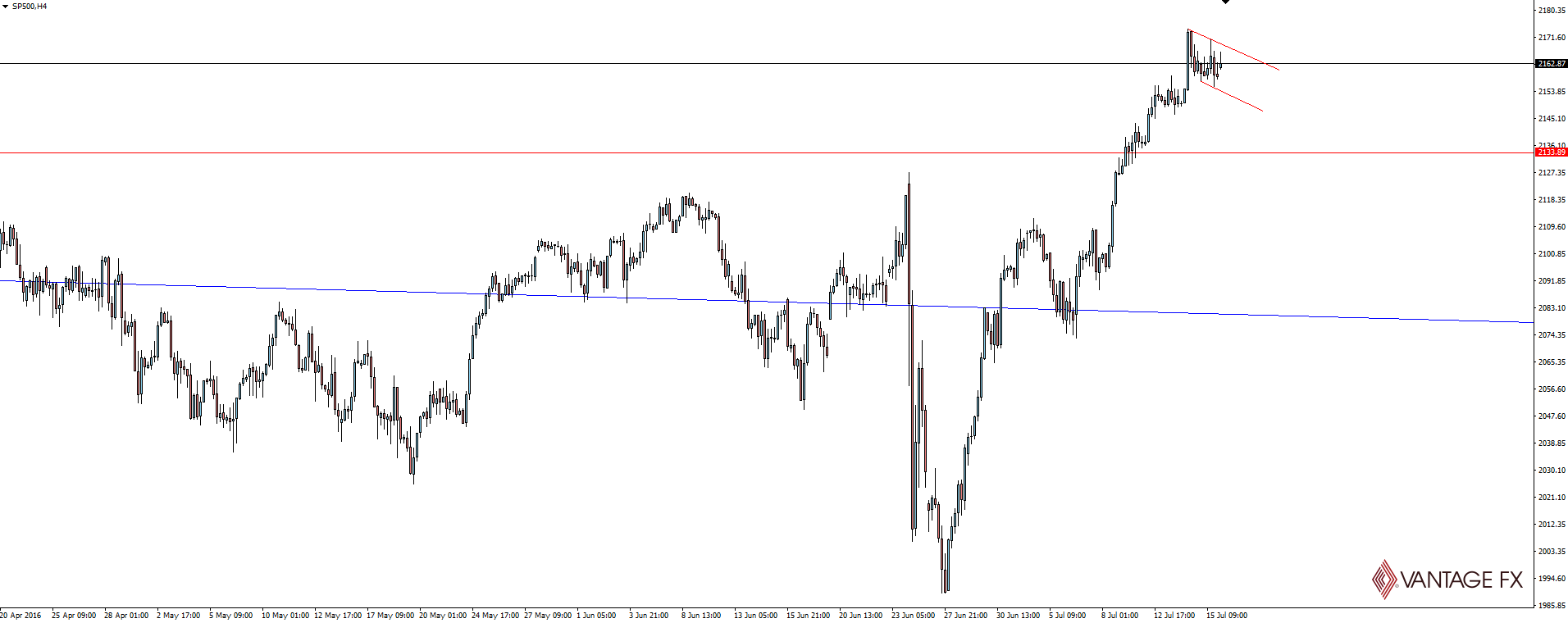

S&P 500 4 Hour:

Attention stays focused on the 4 hour S&P500 chart highlighting the major weekly breakout of resistance and is now looking to form a short term flag. In the obviously huge bullish trend that the S&P is currently in the midst of, this pattern if it plays out, could be the catalyst for the next leg higher. Plans of attack for traders are either to look at buying the bottom or waiting for breakout/retests depending on your appetite for risk.

Looking at Forex markets and the same can be said for an already jumpy, domestic stimulus threatened USD/JPY.

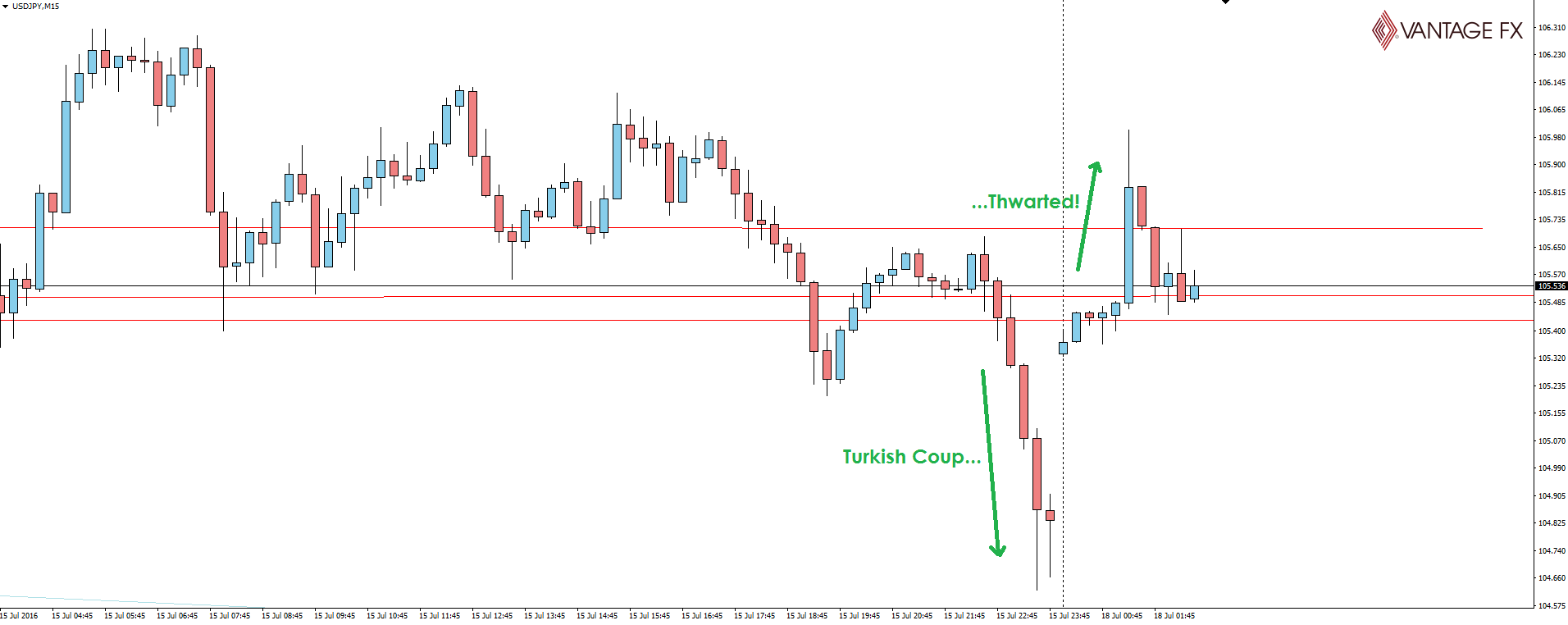

USD/JPY 15 Minute:

That daily level looks key, with those last couple of consolidation candles at resistance showing uncertainty in the market, and a possible bearish turning point. I can’t help but watch price action on the intra-day charts for opportunities to short, because as I’ve said before, I just can’t trust the BoJ’s promises.

Moving further forward and with the Aussie Dollar in focus this week thanks to Tuesday’s Monetary Policy Meeting Minutes, we received news of an interesting report into the weekend that highlights so called ‘unconventional policies’ that the RBA has looked into using in the unlikely scenario that everything starts fall to… well you know.

We re-tweeted this on Friday and it seems to have been the starting point for some interesting discussion around the topic on the weekend:

Essentially the study that the RBA has conducted shows that they COULD IF NEEDED, bring interest rates into negative territory and undertake their own asset buying program of corporate bonds. Exactly the same as that being undertaken in Europe and Japan. Because well that’s working so well for them, isn’t it…

This report is nothing more than due diligence being conducted by a risk averse central bank. The chances of a full scale global banking collapse or a drying up of Chinese demand are slim and this isn’t something that needs to be heavily analysed and read into from an AUD traders point of view.

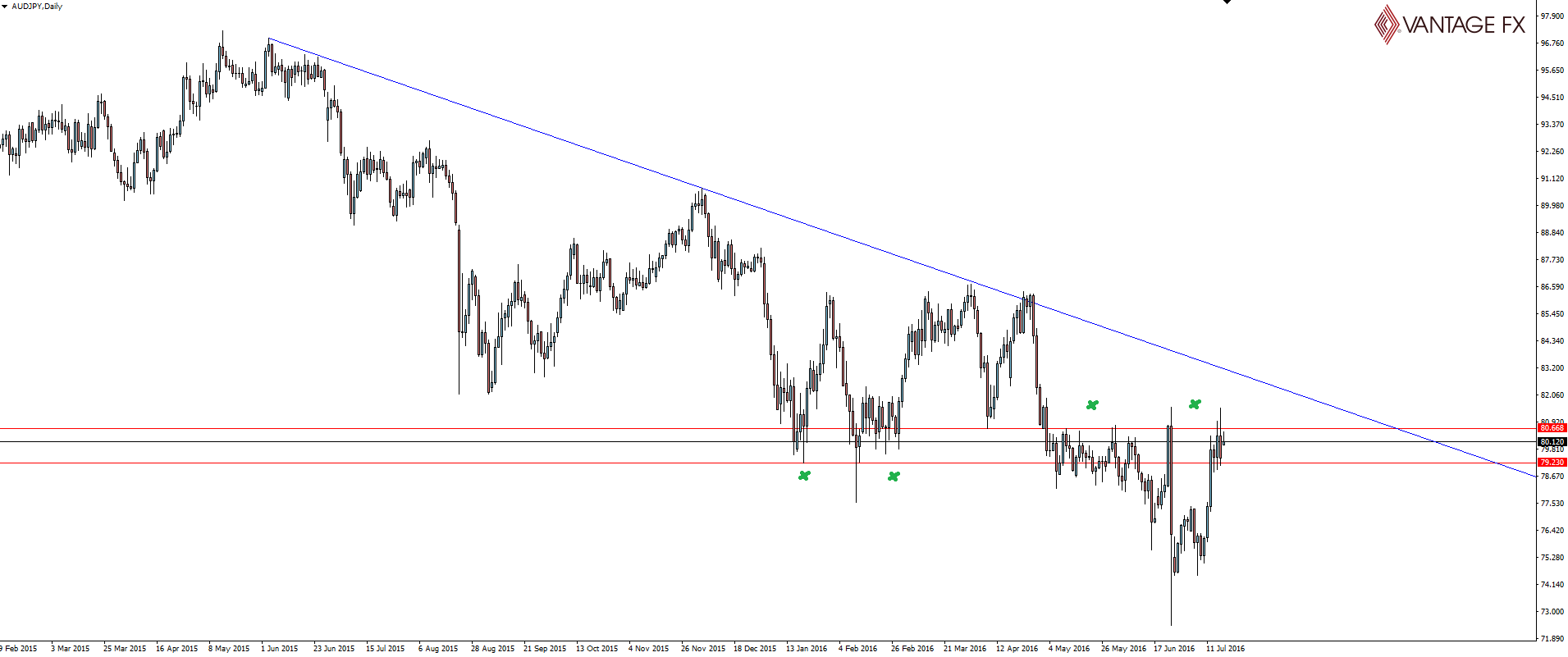

AUD/JPY Daily:

Traders do however need to consider that an August interest rate cut is all but fully priced into the Aussie and today’s Monetary Policy Meeting Minutes will be key in seeing whether this level of pricing is warranted heading into subsequent months.

With the AUD/USD still consolidating mid triangle after bouncing off support, the AUD/JPY chart looks to be the Aussie pair that’s at a key, in-play level that you can manage your risk around if things don’t quite line up. We featured this AUD/JPY daily chart before in the BOJ Helicopter Money blog last week and the level is for now proving a hard nut to crack for the bulls.

Stay safe, manage your risk and trade your levels. Enjoy the week!

On the Calendar Monday:

NZD CPI q/q

JPY Bank Holiday: Marine Day

GBP MPC Member Weale Speaks

“Marine Day, also known as “Ocean Day” or “Sea Day”, is a Japanese national holiday celebrated on the third Monday in July. The purpose of the holiday is to give thanks to the ocean’s bounty and to consider the importance of the ocean to Japan as an island nation.”

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.