The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday uncertain.

- ES pivot 1964.00. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- Single stock trader: NYSE:VZ still not a swing trade buy.

Recap

Last Friday was something of a question mark as all the charts were posting reversal warnings. But in the end, I was correct in ignoring those because on Monday the Dow posted a big 304 point pop that extended its winning streak to essentially five in a row. The market is now clearly on a roll, so we need to see how much longer this can go on as we move ahead to the charts for Tuesday.

The technicals

The Dow: The Dow was quite impressive on Monday, putting in a 1.85% gain on a tall green marubozu that took it all the way to its upper BB. That also sent the indicators overbought for the first time in three weeks, and caused the stochastic to show the first signs of curving around for a bearish crossover. So those are warning signs of a move lower, but they all require confirmation. Basically, it's still too soon to call this one lower for Tuesday.

The VIX: Last night I called for the VIX to hit it lower BB at 19.30 one on Monday. Turns out the low for the day was actually 19.14 as the VIX put in a stubby red gap down hammer. We have now bounced off the lower BB, but the indicators continue to fall and have not yet reached oversold. And the stochastic has still not begun to curve around for a bullish crossover. So while we do have a reversal warning now, it is a weak one, and I need some confirmation of a move higher on Tuesday before calling an end to the current decline in the VIX.

Market index futures: Tonight, all three futures are lower at 12:48 AM EDT, with ES down 0.20%. ES had a great day on Monday, making this rally now four in a row. It is now quite clearly more than a relief rally or a DCB, as September's big descending RTC is definitely done for. We are still a ways from resistance at 1988, but after having run hard for four days in a row and with the indicators just short of overbought and a stochastic beginning to curve around for a bearish crossover, I'm starting to wonder if ES has enough gas left in the tank to continue moving higher on Tuesday.

ES daily pivot: Tonight, the ES daily pivot rises again from 1923.25 to 1964.00. That once again leaves ES above its new pivot, so this indicator continues bullish.

Dollar index: On Monday, the dollar confirmed Friday's giant gap-down doji star in a big way as it gained 0.28%, stopping only at its 200-day MA. Indicators are now wandering around halfway between oversold and overbought, so there's not much guidance there. However, the Friday reversal followed by a nice bullish confirmation makes it look like the dollar still has enough gas in the tank to put in another advance on Tuesday.

Euro: Last night, I said there continued to be no direction in the euro, and Monday's action did nothing to change that view as the euro gave up all of last Friday's gains and then some, falling right back down to 1.1192 and stopping exactly on its 200-day MA. The indicators are now halfway between oversold and overbought, so there is nothing to learn from them. The question is will the MA provide support or not. Right now it's looking in the overnight as though it just might. Still, with a bearish candle on the books on Monday, it's not at all clear that the euro won't continue lower on Tuesday.

Transportation: I wasn't ready to commit to the trans last night either, which is too bad because they outperformed even the Dow on Monday with a giant 2.31% green marubozu. That was enough to send the trans overbought even though the stochastic is still rising and has not begun to curve around for a bearish crossover. My only concern right now is that this chart looks like it is going exponential, and that would make it ripe for a pullback, which could come any day at this point.

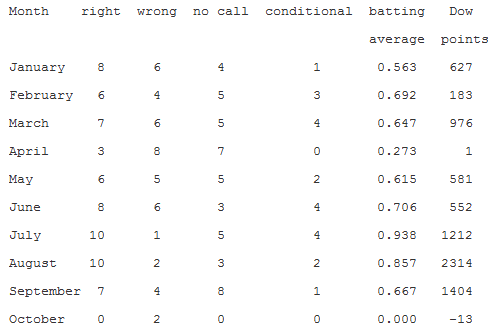

Accuracy:

Technically tonight most of the signs remain bullish, but there are a few areas of concern, like the VIX and the futures. So I'm hesitant to call the market higher again, particularly after such a nice run. On the other hand, there's not really enough bearish signs to call it lower. So I guess all that leaves is Tuesday uncertain.

Single Stock Trader

Last night I was playing it conservatively after watching Verizon bleed for more than two weeks straight. But on Monday, it turned out that last Friday's hammer was in fact the bottom, as Verizon posted a big 2.71% gap-up marubozu on Monday. That was enough to vault it right out of its two week long descending RTC, send all the indicators rising off of oversold, and confirm the bullish crossover from the stochastic. So while we missed the bottom on this one, this chart now looks like a buy to me.