The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday uncertain.

- ES pivot 1950.25. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Two nights ago when I called Monday higher I speculated that we might see a doji day. Without committing hubris, I think Monday's lumpy spinning top for just a 19 point gain in the Dow qualifies. So with that out of the way, without further ado let's move on to Tuesday.

The Technicals

The Dow: The aforementioned Dow exhibited classic signs of ROOG Syndrome on Monday - that's Running Out Of Gas. We've been clambering up the upper Bollinger® Band (BB) for three days now with each day's advance being smaller than the day before. At some point, what goes up must come down. Monday's asymmetric spinning top is a warning of that, but one which requires confirmation so no call here.

The VIX: Once again we got an unusual positive correlation of the VIX with the market as the VIX rose nearly 4% when everything else was up too. I wasn't quite sure last night we'd see a gain on Monday but I did note that VVIX was up. And sure enough, the VIX was higher on Monday. But confusingly enough, we've now got a completed bearish stochastic crossover, a doji candle, and a rising RSI just coming off oversold. So another ambiguous chart - no call here either. I'll just note though that VVIX is once again moving higher, so the VIX bias is to the upside.

Market index futures: Last night all three futures were lower at 12:12 AM EDT, with ES down 0.13%. Monday's ES action featured a classic spinning top that broke away from the upper BB (finally). Indicators remain impossibly overbought but the new candle is forming right on the edge of the rising RTC for a bearish setup. And the overnight action so far confirms the reversal sign, so that makes this chart now look bearish.

ES daily pivot: Last night the ES daily pivot rose once again from 1945.58 to 1950.25. But this time for the first time in a while we've now crossed below the new pivot so this indicator now turns bearish.

Dollar index:Two nights ago I wrote "there's at least a chance of a move higher on Monday." And it was a good chance indeed as the dollar took a big gap up for a 0.32% gain that blasted right through the 200 day MA. It also set the stochastic in position to start forming a bullish crossover and sent momentum and RSI moving higher. So it looks like there could be more upside from here.

Euro: Two nights ago I noted that a dark cloud cover "bodes ill for the euro on Monday." This is a high-probability pattern and it paid off on Monday with a big red candle that dumped the euro right back through the 200 day MA like it wasn't even there to 1.3588. It also formed a bearish stochastic crossover. So with the lower BB not far away at 1.3559 and support at 1.3596 now effectively broken, I'd say we have a good shot at going lower again on Tuesday.

Transportation: On Monday, the trans put in a wishy-washy performance on a bearish inverted hammer that just played tag with the upper BB before backing off. Like the other charts, there's a reversal warning here, but one which requires confirmation.

So tonight we have a bunch of reversal signs plus a VIX that has apparently bounced off its lower BB from a very low level. Dr. Copper continues to look toppy and the TRIN has now turned bearish. The purely technical call at this point would be for a lower close Tuesday, but that just hasn't been working out too well lately - I've seen too many bearish setups just melt away the next day. So I'm going to content myself with just calling Tuesday uncertain.

ES Fantasy Trader

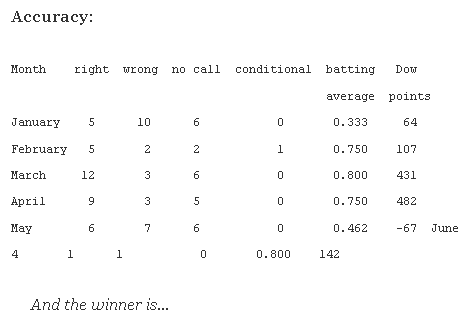

Portfolio stats: the account remains at $112,125 after six trades in 2014, starting with $100,000. We are now 4 for 6 total, 2 for 2 long, 2 for 3 short, and one push. Tonight we stand aside.