The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday lower.

- ES pivot 1929.42. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- YM futures trader: no trade.

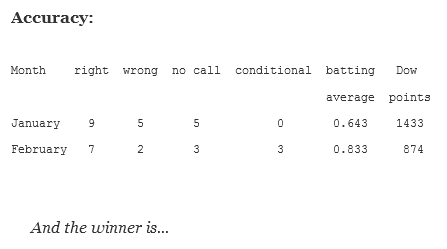

After two down days in a row, we were correct in calling Monday higher as the Dow climbed 229 points. With this new development, we have some interesting charts to sink our teeth into so let's start munching and see where Tuesday is headed.

The technicals

The Dow: On Monday the Dow put in a near-marubozu as it rang to gong with a 1.4% pop that just touched its upper BB. That sent the indicators higher into overbought territory and narrowed the stochastic around close to a bearish crossover. Right now, this chart looks like it has more downside risk than upside potential to me.

The VIX: Last night I mentioned that the VIX could test support at 19.82. Well it did, and it failed the test as the VIX sank right back to 19.38 on a fat gap-down red spinning top. Tonight we have even better support i the form of both the lower BB and 200 day MA around 18.30 so we're pretty much in the same spot as last night. I think the VIX will again test these new levels on Tuesday before reversing. Tuesday could be a bottoming day.

Market index futures: Tonight, all three futures are lower at 12:15 AM EST with ES down 0.43%. On Monday ES confirmed Friday's hammer with a big bump back to 1936.25. But that was enough to leave it at month-long resistance with indicators extremely overbought. And right now the new overnight is looking like it's had enough. This chart definitely looks toppy right here.

ES daily pivot: Tonight the ES daily pivot rises again from 1911.92 to 1929.42. And that's finally just enough to put ES back below its new pivot so this indicator now turns bearish.

Dollar index: So much for the dollar's bearish engulfing candle last night. Instead of falling further, it took a giant gap-up 0.81% pop on Monday that sent the indicators overbought as it easily vaulted over its 200 day MA. That's now looking like 2/3 of a bearish evening star

Euro: At least I got the euro right last night. It indeed was unable to advance any further, instead collapsing in a heap right back down through its 200 day MA all the way to its lower BB at 1.1031. That sent the indicators even further into oversold territory and the new overnight seems to be staging something of a comeback. I don't know that this qualifies as a reversal but we could get at least a DCB on Tuesday.

Transportation: And the trans were pretty much a carbon copy of the Dow, gaining 1.86% on Monday with a tall gap-up green near-marubozu. That leaves the indicators quite overbought and the stochastic ready for a bearish crossover nay day now. With decreased volume, I don't see the trans having that much gas left in the tank for Tuesday.

Things are starting to look a bit toppy on the charts so as the historically weak last week of February grinds on, with the futures guiding lower I'm going to call Tuesday lower.

YM Futures Trader

No trade tonight.