The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday lower, medium confidence..

- ES pivot 2063.58. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Well fancy that. Mr. Market didn't give a hoot when we learned that Japan had fallen into recession. But let the price of oil keep falling, or was it the bad numbers from China, and holy moly it's the end of the world with the Dow down 106 points for its biggest drop since October 22nd. I'm glad I called Monday uncertain because I sure wasn't expecting that. The Night Owl, with my big REIT and core energy exposures, also really took it on the chin on Monday for my biggest loss of the year. Ugh. But we just have to keep on keeping on, so let's see where Tuesday's going now.

The technicals

The Dow: The Dow took a big hit on Monday with its energy components leading the way lower. A mid afternoon rally still left us down 0.59% for a red candle that just broke the latest rising RTC for a bearish setup. With overbought indicators and a bearish stochastic crossover too, this chart looks lower for Tuesday.

The VIX: The VIX had a big day, rocketing 20.22% in a gap-up candle that blasted right back up through its 200 day MA as convincingly as it fell back under it last week. It also just touched its upper BB® at 14.56 before falling back a bit. And with all this commotion, VVIX also took a big leap trading almost entirely above its own upper BB leaving it highly overbought. Unfortunately none of this implies an immediate pullback. We've seen all too often how there can be more follow-through on days like Monday.

Market index futures: Tonight, all three futures are lower at 1:49 AM EST with ES down a non-trivial0.24%. After three tepid days, ES took a decidedly bearish turn on Monday with a wicked drop back to 2060. That's a bearish trigger, RTC-wise and also a completed bearish stochastic crossover. Technically, this one just looks continued lower. And the overnight seems to be supporting that with continued downward pressure. With no support until 2050, there's still some room to run lower. One good thing though - the indicators are finally well off overbought.

ES daily pivot: Tonight the ES daily pivot drops from 2074.50 to 2063.58. After three tepid days, ES took a decidedly bearish turn on Monday with a wicked drop back to 2060. That's a bearish trigger, RTC-wise and also a completed bearish stochastic crossover. Technically, this one just looks continued lower. Only thing is that the overnight isn't supporting that. Possibly a DCB, who knows. But one must be wary of contrary signs in the overnight. I always figure that there's someone out there who knows more than me (not too hard to do).

Dollar index: On Monday the dollar put in a dark cloud cover to lose 0.35%. Trading above its upper BB and with highly overbought indicators, this one looks lower on Tuesday.

Euro: And also on Monday the euro put in a bullish piercing pattern, for what it's worth (and I suspect not much) as it continues its inexorable march to the basement. We're sitting exactly on the lows of 2012 right now. It's do or die for the euro. Any more losses and we're back to 1.2227 from July 2010.

Transportation: On Monday the Trans confirmed Friday's inverted hammer with a big 1.30% fall. You'd think lower oil would help the Trans. Go figure. That gives us a bearish RTC exit and a bearish stochastic crossover. Anyway, this one looks lower from here.

After a bunch of dojis last night warning of a reversal, I opted to wait for confirmation, given how risky the bearish call has been all year. Well we got that confirmation on Monday. And technically, the charts just look bearish tonight so the call is for Tuesday lower. I'll be happy, as always, to be proven wrong.

ES Fantasy Trader

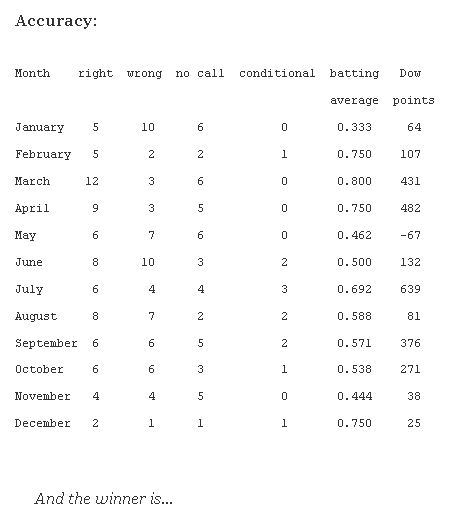

Portfolio stats: the account now stands at $110,500 after ten trades in 2014, starting with $100,000. We are now 7 for 10 total, 5 for 5 long, 2 for 4 short, and one push. Tonight we stand aside.