The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Tuesday higher, low confidence.

- ES pivot 1932.25. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Well Monday played out according to the technicals nicely enough although the Dow did sag a bit into the close. Still, a 16 point advance after Friday's big run-up isn't bad. So now let's figure out whither Tuesday.

The technicals

The Dow: The daily candle on the Dow isn't quite as nice as I'd like to see - an inverted hammer. However, it did trade entirely outside the descending RTC so that trend is most likely now over. And the indicators continue to rise smartly off oversold towards overbought. But I can't really give the Dow the green light here right now - not with that reversal candle hanging there. We need confirmation on Tuesday. I might have just been a pause at the 15,571 resistance level but we'll have to see.

The VIX: Last night I wrote "this chart looks like it has more downside for Monday." And it sure did with the VIX down another 10% on a fat gap-down hammer that nearly touched the 200 day MA which is now serving as support at 13.63. But with the indicators continuing lower but still not yet oversold and with VVIX in a similar spot, I'd expect the VIX to at least take a second look at its 200 MA on Tuesday.

Market index futures: Tonight all three futures are higher at 12:13 AM EDT with ES up 0.10%. ES did quite well on Monday, exiting its descending RTC for a clear bullish setup. The recent downtrend is now over. Indicators are now more than halfway from oversold to overbought but there's still no bearish signs on this chart.

ES daily pivot: Tonight the ES daily pivot jumps from 1914.08 to 1932.25. Even after that big move, we're still above the new pivot so this indicator remains bullish.

Dollar index: Last night we noted the development of a rare bullish tri-star pattern in the dollar.Well it didn't quite work out. While day three was in fact higher, it wasn't a star. But the 0.10% gain could certainly be viewed as confirmation of Friday's tall star so my bet here would be for continued higher on Tuesday.

Euro: Well I figured the euro was going to pause on Monday. But it actually sank, retracing half of Friday's gains to end at 1.3384. That still leaves it just outside of the descending RTC nominally for a bullish trigger. But it's not clear that that's going to come off since the indicators remain mixed and the overnight doesn't seem to have much mojo going.

Transportation: On Monday the Trans continued to outperform the Dow in a big way (+0.79% to 0.10%) with a tall gap-up stubby inverted hammer. Indicators though are all still just coming off oversold and with Monday's action being a descending RTC bullish trigger, I'd have to say that there's more upside left to come on Tuesday.

Despite the Dow looking a bit tired on Monday, there are generally bullish technical signs across the charts tonight, and certainly an absence of bearish signs so the only logical course is to call Tuesday higher.

ES Fantasy Trader

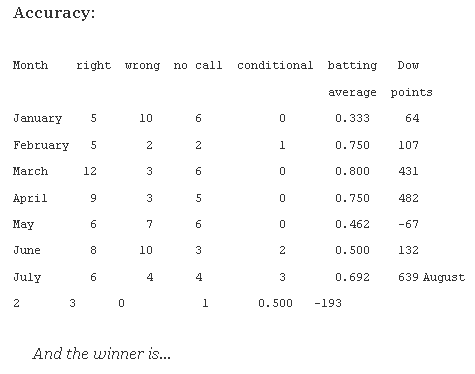

Portfolio stats: the account remains $114,250 after eight trades in 2014, starting with $100,000. We are now 6 for 8 total, 4 for 4 long, 2 for 3 short, and one push. Tonight we stand aside.