Forex News and Events

Turkish lira stabilises after hitting all-time low

The Turkish lira has been on a rollercoaster ride over the last few days as political uncertainty rose another notch amid the arrest of dozens of MPs from the HDP (pro-Kurdish Peoples’ Democratic Party). Last Friday, the TRY fell to a new all-time low against the greenback with USD/TRY hitting 3.1714. Since the failed coup on July 15th, the lira has fallen more than 10% as Turkey’s credit rating was cut to junk. The current political uncertainty and upside risk in inflationary pressure will likely keep international investors away from the Turkish lira and from local investments in general. In the event that this situation endures it would make it more complicated for Turkey to finance its current account deficit, especially against the backdrop of rising tensions in the Middle East and rising commodity prices - since Turkey imports more than 92% of its annual consumption. However, the currency stabilised on Monday after Standard & Poor’s upgraded Turkey’s outlook from “negative” to “stable”. USD/TRY eased at around 03:15 this morning.

US Election: Rally proves Clinton's “Candidate of Wall Street" moniker

Heading into the final stretch before Nov 8th, media speculation has reached fever-pitch. The hype has been driven by the unprecedented collapse of Hillary Clinton polling numbers when the FBI reopened investigation into Clinton about emails found in Anthony Weiner’s laptop. The cost of this black swan event for Hillary Clinton was a heavy one. Very surprisingly, the FBI has found no criminal wrongdoing in the 650’000 emails found. Therefore, the FBI’s conclusion will remain the same as the first investigation with no charges being brought against the candidate.

Yet, this event had consequences. Financial markets started to price a possible Trump victory and the S&P suffered a streak of nine consecutive losses for the first time in 36 years. Investors have shifted into a near-panicked safe haven trading pattern. Long US equity positions are being aggressively, EM currencies sold and gold seeing solid demand.

On the eve of election day, our predictive analytic tool supports a Clinton victory, yet Trump is only slightly behind - 46.6% vs. 44.8% (at time of writing). A Clinton victory is the high probability trade. Investors should view the risk-off trade as an opportunity to go long on risky assets in the expectation that Clinton will gain the necessary 270 Electoral College votes to ensure a smooth democratic transition even though it is the first time that polls are showing that Clinton fell below the threshold of 270 electoral votes.

This morning, the US elections is definitely the financial markets’ barometer. Futures on the S&P are up 1.3% at the moment and we should see a good day on stocks. This relief rally is definitely proving the fact that markets are clearly supporting Hillary, justifying her “Candidate of Wall Street” moniker. Consequently, a Clinton win would spark a significant relief rally in overly-bearish positioned markets. In the short-term we advise to buy S&P 500 index, MXN and sell gold and VIX.”

EUR/JPY - Bullish.

The Risk Today

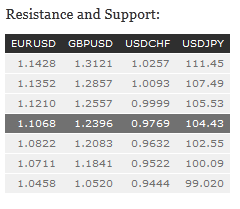

EUR/USD is trading around 1.1100 without direction. Hourly resistance is given at 1.1145 (06/11/2016 high). Key resistance is located far away at 1.1352 (18/08/2016 high). The short-term technical structure suggests further strengthening. In the longer term, the death cross indicates a further bearish bias despite the pair is increasing since last December. Key resistance holds at 1.1714 (24/08/2015 high). Strong support is given at 1.0458 (16/03/2015 low).

GBP/USD is going lower. Hourly resistance is given at 1.2557 (04/11/2016 high) while hourly support is given at 1.2083 (25/10/2016 low). Yet, strong resistance stands far away at 1.2620 then 1.2873 (03/10/2016). Expected to further decline. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY has reversed away from hourly support lies at 102.55 (03/11/2016 low). Hourly resistance is given at 105.53 (28/10/2016). Next key resistance lies at 107.49 (21/07/2016 high). Key support can be found at 100.09 (27/09/2016). The medium-term momentum is positive. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF has gained a figure over the weekend. Strong support lies at 0.9632 (26/08/2016 base low) while resistance area is given around the parity. Time to reload bearish positions. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.