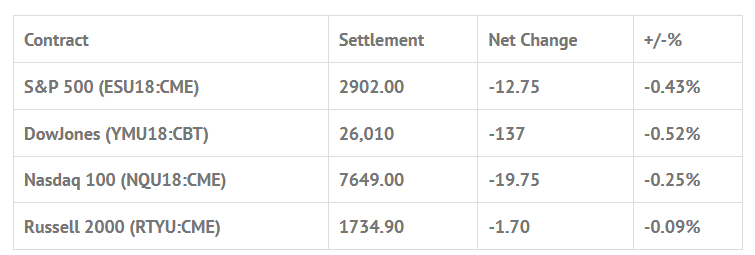

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -0.46%, Hang Seng -0.98%, Nikkei -0.02%

- In Europe 13 out of 13 markets are trading lower: CAC -1.14%, DAX -0.81%, FTSE -0.42%

- Fair Value: S&P +0.61, NASDAQ +6.30, Dow +16.42

- Total Volume: 1.31mil ESU & 501 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Chicago PMI 9:45 AM ET, Consumer Sentiment 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: After Record Highs Tariff Headlines Turn Markets Lower

If you have been reading the full version of the Opening Print lately, I have said the only thing the buyers have to worry about is a wayward headline, and thats what happened yesterday. At 1:18 CT this headline hit the tape : Pres Trump reportedly supports imposing $200B in China tariffs as soon as next week. Despite the Mexico NAFTA deal and progress with Canada, the Asian markets were weak due to uncertainty over the China $200 billion in US tariffs set to take effect next month, but the lack of negotiation progress with China pushed the president to accelerate the process.

After trading in a 9.25 handle range in the overnight session, the S&P 500 futures opened yesterday’s regular session at 2909.00. After the bell, the ES traveled up to 2911.25, and then down to the early low of 2907.25 in the first half hour, before grinding higher to 2913. After 10:00 a wave of selling brought the ES down to the morning low of 2704.00.

The afternoon saw a rally back up to 2912.75 for the midday high before 1:00, but afternoon sellers hit the tape as the ES flopped down to 2898.00 just before 1:30, and then after rallying to 2905.75, there was a 10 handle move to what became the low of day at 2895.50 early in the final hour. Late buyers took the index to 2903.00, then printed 2901.50 at 3:00, and settled the day at 2902.00, down -12.75 handles, or -0.44%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.