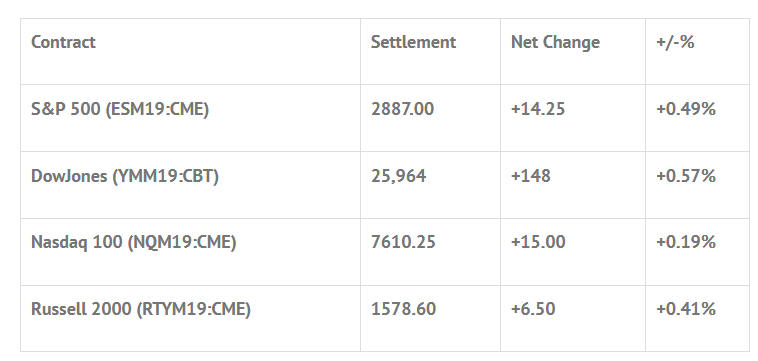

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -1.21%, Hang Seng +0.84%, Nikkei -0.72%

- In Europe 12 out of 13 markets closed higher: CAC -0.51%, DAX -0.76%, FTSE -0.08%

- Fair Value: S&P +1.19, NASDAQ +9.87, Dow -9.06

- Total Volume: 2.84 million ESM & 318 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Eric Rosengren & Richard Clarida Speak at 9:10 AM ET.

S&P 500 Futures: Just A Tweet Away

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -34 as the Trade/Headline Volatility Persists. $spx 2825 is important and $aapl around $192 area for tech $qqq.

During Thursday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2889.00, a low of 2849.00, and opened Friday’s regular trading hours at 2860.25.

The selling started just before 9:00 CT, and didn’t stop until the ES had bottomed out at 2826.00. With China headlines hitting the tape all morning, its safe to say the weakness was all headline algo driven.

After trading sideways from 9:45 until 10:45, some positive headlines started coming out, and the futures reacted in kind. By 12:15 the ES had traded back through the 8:30 opening range, and was on its way to new highs.

By 2:30 the futures had topped out at 2893.00, a 67 handle rally from the low, and began to pull back after a tweet from Trump saying the China trade talks had stalled.

When the 2:45 cash imbalance reveal came out showing $325M to buy, the ES was trading at 2877.50. It then rallied to print 2884.00 on the 3:00 cash close, and 2886.75 on the 3:15 futures close, up 14 handles on the day.

In the end, the overall tone of the ES was extremely weak in the first part of the day, and strong in towards the end of the day. In terms of the days overall trade, total volume was high, with 2.8 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.