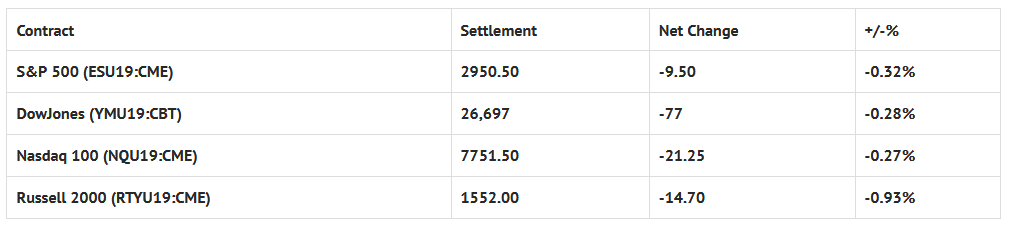

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed higher: Shanghai Comp +0.21%, Hang Seng +0.14%, Nikkei +0.13%

- In Europe 12 out of 13 markets are trading lower: CAC -0.17%, DAX -0.60%, FTSE -0.06%

- Fair Value: S&P +4.58, NASDAQ +27.88, Dow +8.33

- Total Volume: 1.5 million ESU & 524 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the Chicago Fed National Activity Index 8:30 AM ET, and the Dallas Fed Mfg Survey 10:30 AM ET.

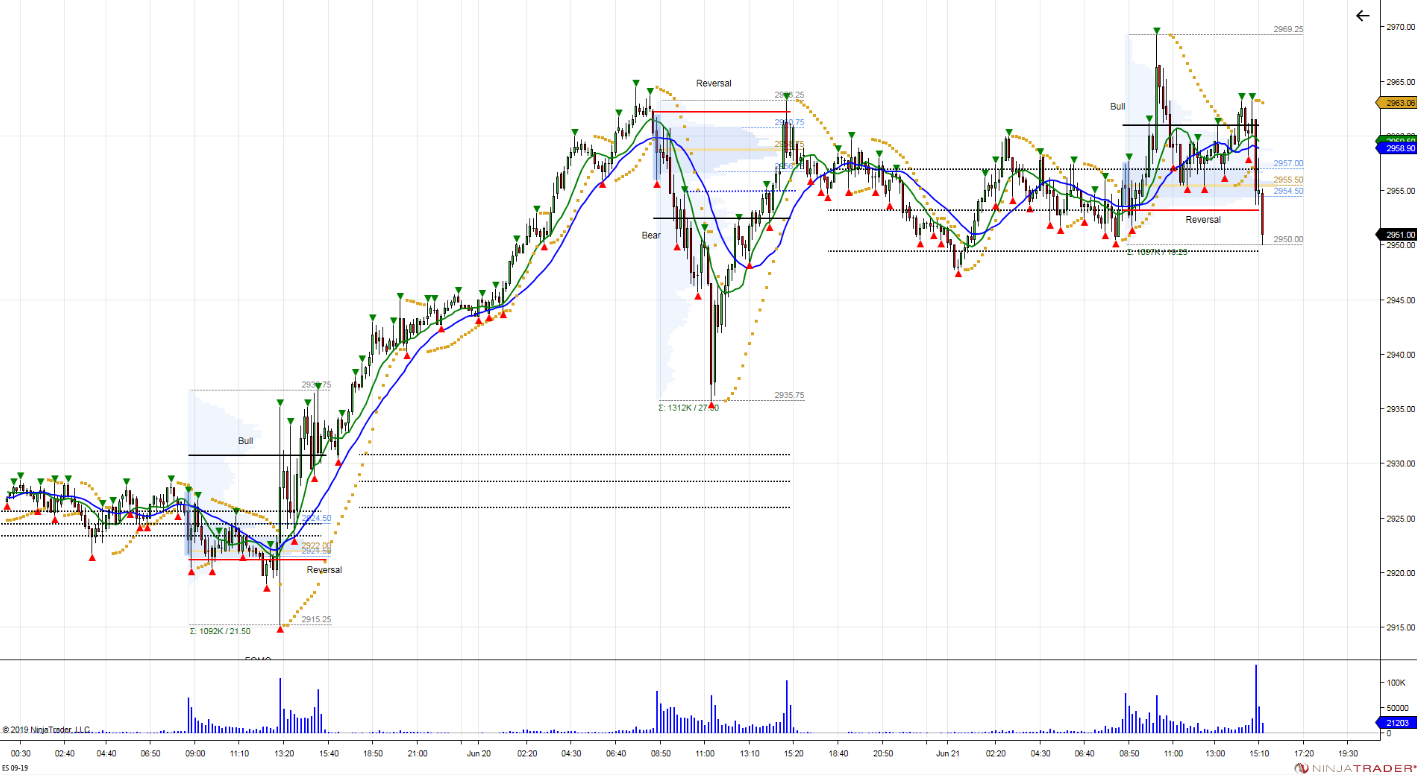

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Shorts tried yesterday w market falling below its lower vol window @ 2952, however were squeezed into the close with a V bottom. Today bull bias set > 2960 luring in buyers that failed to expand above, becoming trapped w failed test in last hour and close < reversal window.

After trading down to 2947.75 during Thursday nights Globex session, the S&P 500 futures rallied to open Friday’s regular trading hours at 2955.50. The first move after the 8:30 CT bell was a quick dip down to 2951.75, followed by a small sideways range trade to close out the first hour.

At 9:30, some positive headlines hit the tape regarding the China trade deal, and by 10:00 the ESU had rallied to print another new all time high at 2969.25. From there, sell imbalances began to increase, and they eventually took over, taking the futures back down to 2955.50.

Once the morning excitement died down, the ES drifted sideways in a 6 handle range for the rest of the day, patiently waiting for the June Quad Witch expiration to pass.

Going into the close, we were pretty much expecting a heavy MOC imbalance, due to the options expiration, and we weren’t disappointed when the MiM reveal showed close to $4 billion to buy. The futures made a counter reaction to that number though, breaking from 2962.00 down to 2955.00 on the 3:00 cash close, and finishing the day at 2951.00 on the 3:15 futures close, just a few handles off the Globex lows.