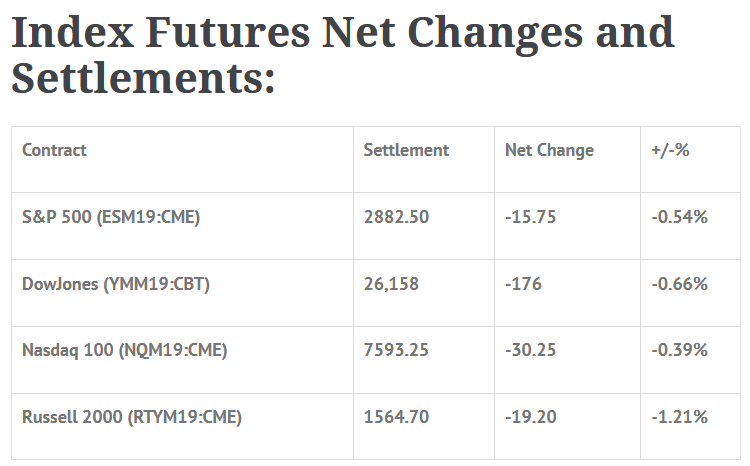

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp +0.07%, Hang Seng -0.13%, Nikkei -0.53%

- In Europe 11 out of 13 markets are trading higher: CAC +0.35%, DAX +0.46%, FTSE +0.03%

- Fair Value: S&P +4.11, NASDAQ +22.22, Dow +1.08

- Total Volume: 1.17m ESM & 217 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Jerome Powell Speaks, MBA Mortgage Applications 7:00 AM ET, CPI 8:30 AM ET, Atlanta Fed Business Inflation Expectations 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, a 10-Yr Note Auction 1:00 PM ET, FOMC Minutes 2:00 PM ET, and Treasury Budget 2:00 PM ET.

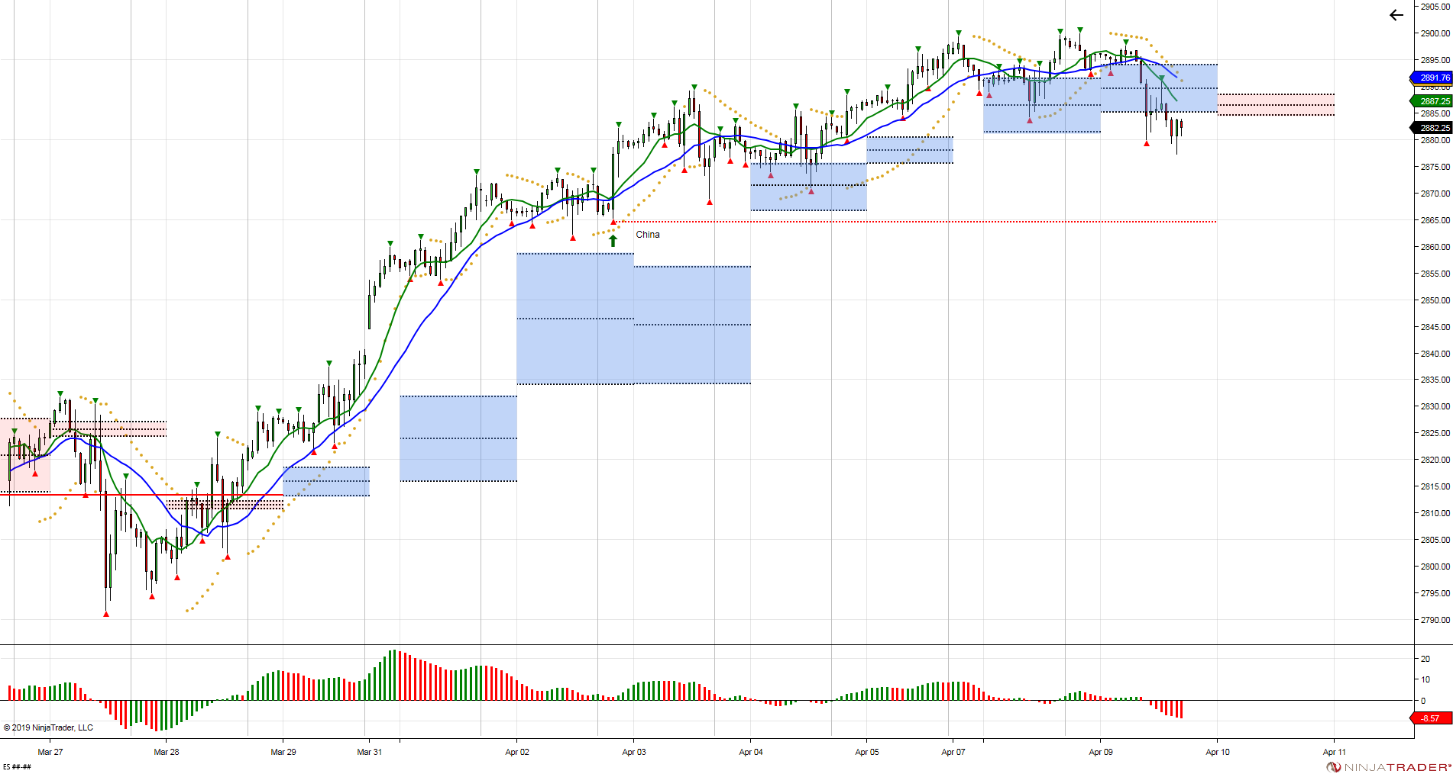

S&P 500 Futures: #ES 8 Day Rally Comes To An End

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F 1st close <3D pivot since 3/28 close above. Turns Wed pivots into resistance for sellers to defend. Can create fuel needed to get through 2900. Bear needs Follow Through w/ another daily close below to start new trend down, until then Thurs 71 low key to Defend.

During Monday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2900.00, a low of 2887.00, and opened Tuesday’s regular trading hours at 2887.25.

The first move after the 8:30 CT bell was a drop down to 2880.00, followed by a pullback up to 2888.50. From there, the ES headed back down to test the lows, but stopped short, only making it down to 2881.50. The futures then proceeded to trade sideways, in a 6 handle range, until just after 11:00 when it finally broke through the top of the opening range.

By 12:00 CT the ES had topped out at 2891.00, then began a slow grind lower, eventually trading down to a new low at 2879.25. Heading into the close, the futures staged a small pullback up to 2882.25, before once again breaking down to make a new low at 2878.50. On the 3:00 cash close, the futures spiked down for another new low at 2877.25, and then recovered a little to close the day at 2882.00 at 3:15, down -16.25 handles, or -0.56%.

In the end, the overall tone of the ES was weak. In terms of the days overall trade, total volume was higher, with 1.17 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.