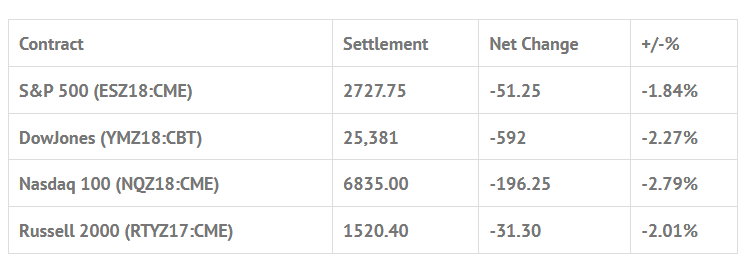

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 5 out of 10 markets closed higher: Shanghai Comp +0.93%, Hang Seng +0.62%, Nikkei -2.06%

- In Europe 10 out of 13 markets are trading higher: CAC +0.44%, DAX +0.82%, FTSE +0.07%

- Fair Value: S&P +0.48, NASDAQ +7.10, Dow -12.45

- Total Volume: 1.91mil ESZ & 737 SPZ traded in the pit

As of 7:00 am CST

Today’s Economic Calendar:

Today’s economic calendar includes NFIB Small Business Optimism Index 6:00 AM ET, Redbook 8:55 AM ET, Neel Kashkari Speaks 10:00 AM ET, Lael Brainard Speaks 10:00 AM ET, Treasury Budget 2:00 PM ET, Patrick Harker Speaks 2:20 PM ET, and Mary Daly Speaks at 5:00 PM ET.

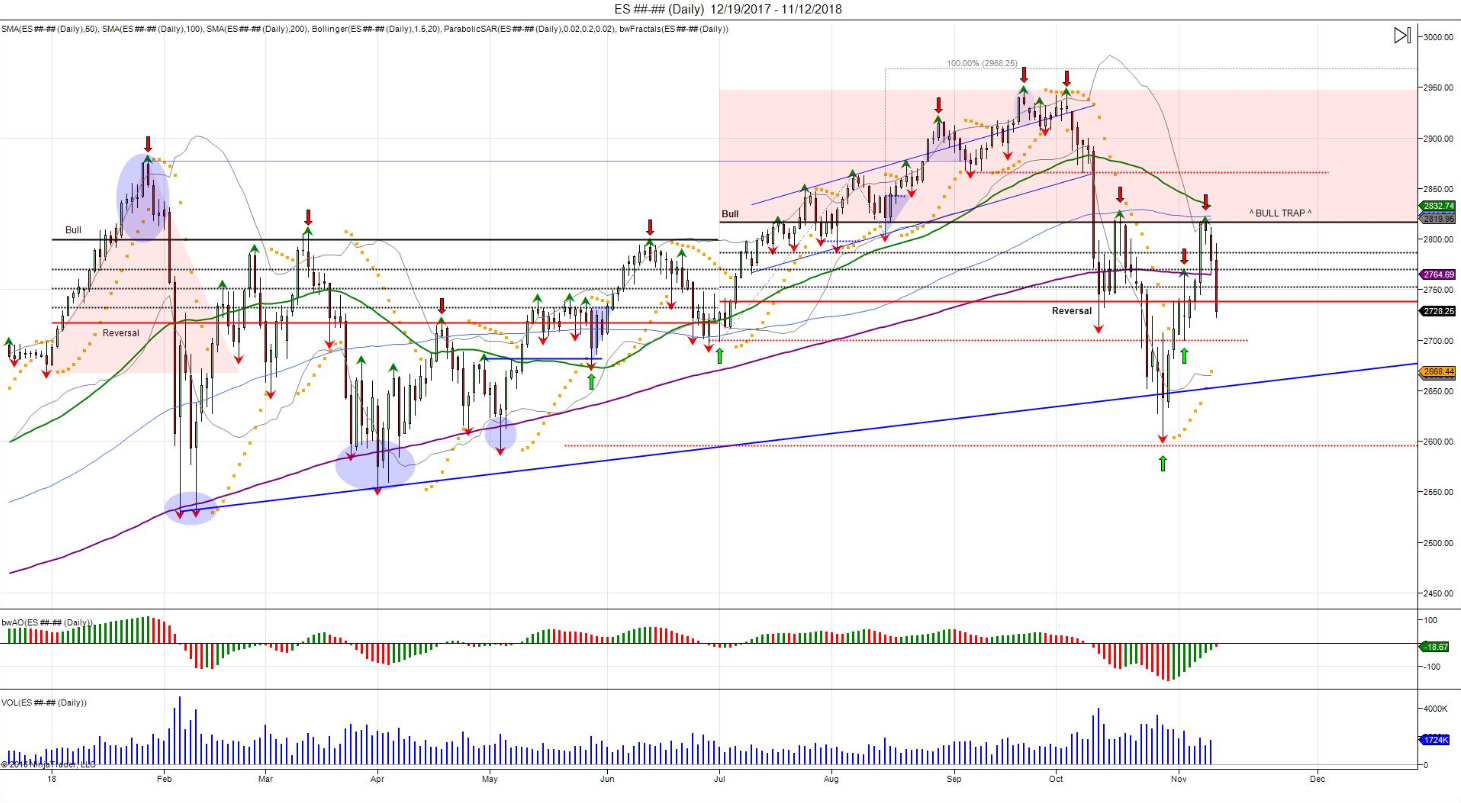

S&P 500 Futures: Mondays ‘Flunk-A-Dunk’ No News Is Good News

Things have not gone well since the election rally. It has clearly turned into a “sell the news” event, but is the recent selloff just due to the election? I don’t think so, I think it’s a resumption of the downside trend that started over a month ago. While historically November starts the best 6 month for stocks, several negatives continue to haunt the S&P.

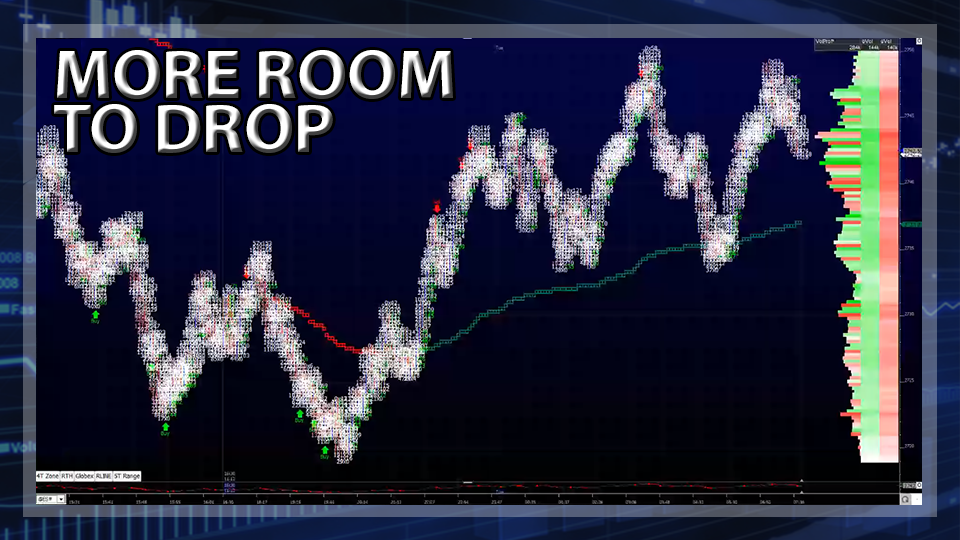

Yesterday the ES sold off on Globex before the open. The low on Globex was 2768.40, and the first print on the 8:30 open was 2774.25. After the open the ES up ticked to 2775.75, and then in came the first set of sell programs that pulled the ES down to 2753.75. After a small push back up to 2762.50, the ES got hit by another wave of sell programs that knocked the futures all the way down to 2733.50 at 10:32 CT.

The next move was a grind up to 2742.25, followed by a drop back down to 2734.75, and then a push up to 2752.00. After the rally the ES traded lower through the afternoon and into the close, trading down to 2722.25 late in the session, before printing 2727.75 on the 3:00 cash close, and settling the day at 2728.75, down -50.25 handles, or -1.81%.

Plain and simple… the overall tone of the markets acted like crap. There is no other way to say it. In terms of the days overall trade, the ES volume was on the light side until the late day headlines hit about President Trump talking about implementing 20% tariffs on European car imports. It really is one big mess after another.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.