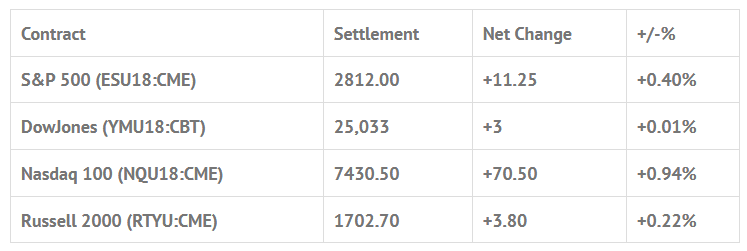

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +1.62%, Hang Seng +1.44%, Nikkei +0.51%

- In Europe 12 out of 13 markets are trading higher: CAC +0.90%, DAX +1.36%, FTSE +0.82%

- Fair Value: S&P +0.84, NASDAQ +10.67, Dow -21.04

- Total Volume: 811k ESU & 146 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, FHFA House Price Index 9:00 AM ET. PMI Composite Flash 9:45 AM ET, and the Richmond Fed Manufacturing Index 10:00 AM ET.

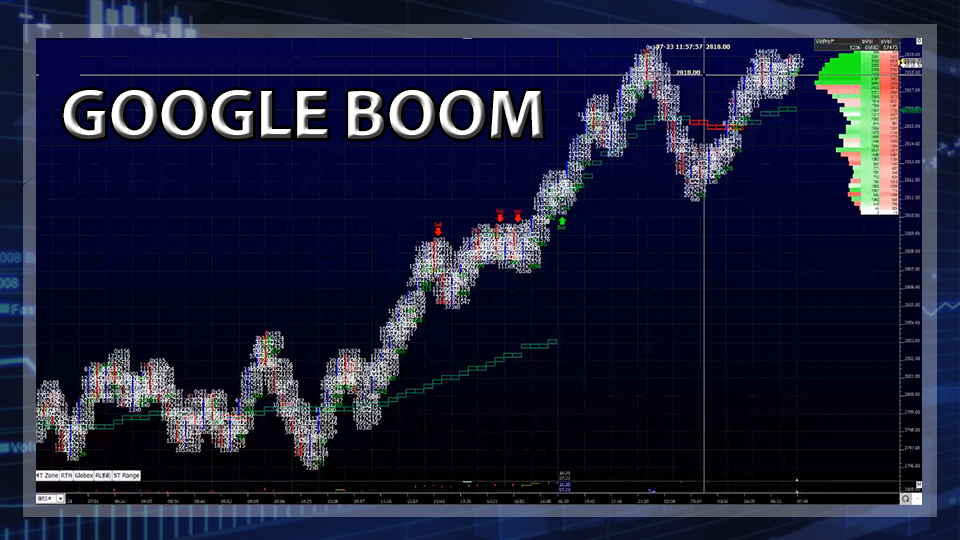

S&P 500 Futures: Big Time Summer Grind

Mondays trade started with the major Asian markets rallying and Europe trading slightly lower. On Globex, the S&P 500 futures (ESU18:CME) broke down to 2782.50 early Sunday night, with 135,000 contracts traded.

On the 8:30 CT futures open the ES traded 2800.00, then, through a series of small rallies and drops, made an early morning low of 2769.00 just after 9:30. After the low the ES made a push up to 2802.50, dropped down to 2798.25, and at 11:43 completed a MrTopStep 10 handle rule (new high) at 2808.75.

Seconds later the ES made its high I put this out in the MrTopStep forum:

Dboy:(12:59:10 PM) : es going to pull back a bit

Just after that, the ES pulled back down to 2805.00, and I put this out:

Dboy:(1:45:00 PM) : es has a shot at 2812 today

After that, the ES traded up above Friday’s high, and just under Thursday’s high, hitting my level at 2812.50.

From there, the futures traded 2808.00 on the 2:45 cash imbalance reveal when the MiM showed $523 million to buy, and then traded 2808.25 on the 3:00 cash close before settling the day at 2811.75 on the 3:15 futures close, up +11.00 handles, or +0.39% on the day.

In the end, the overall pattern is a drop on Globex followed by a rally. To me this is arting to look like a big back and fill pattern. In terms of the days overall trade, it really feels like less people are sitting in front of their screens.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.