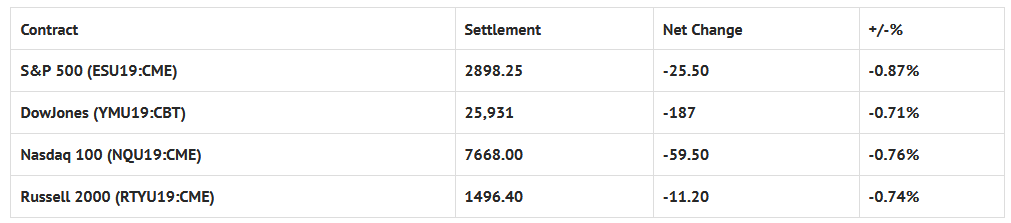

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Existing Home Sales 10:00 AM ET, EIA Petroleum Status Report at 10:30 AM ET, and the FOMC Minutes 2:00 PM ET.S&P 500 Futures: Risk On / Risk Off

During Monday nights Globex session, the S&P 500 futures (ESU19:CME) printed a low at 2916.00, a high at 2932.25, and opened Tuesday’s regular trading hours (RTH) at 2918.75

Initially, the ESU took a dive down to 2904.25 after the 8:30 CT bell, and in typical “Head Fake Fashion”, squeezed out some weak shorts by rallying back up to 2924.50 in the first 2 hours of trading. From there the momentum shifted to the downside.

Volume was fairly light, and if you’re a tape reader, then you saw the algo’s battling each other. It was a choppy grind lower.

The reality is, it didn’t matter if you were long or short, if you’re a day trader and you couldn’t sweat the heat, then you were taken out of the game. If you had a position on and worked a stop loss order, the stop probably got hit.

By the time the close rolled around, the futures had dropped nearly 30 handles from the RTH high, and with a little help from the MiM reveal revealing $1.7 billion to sell MOC, the ES ended the day on its lows.

Like I said in yesterday’s view (if you subscribe to the premium service), by all rights, the S&P should see lower prices, and it did, but the programs are designed to work against you.

Honestly, I’ve found that if you really want a fighting chance, then the micro mini futures are the tool for you. They allow you to take more risk than you’re used to, and you’ll most likely find yourself holding on to a good trade that you would normally be stopped out on.

Take that for what it’s worth…