Yesterday, President Donald Trump’s eldest son released an email chain which suggests that Russia wanted to support Trump’s presidential campaign. What does it imply for the gold market?

What a twist! Ahead of the surprise dump, gold was in a downward trend. And after the release, it jumped about $8 in minutes, as one can see in the chart below. In this way gold confirmed its safe-haven status.

Chart 1: Gold Prices – Last 3 Days

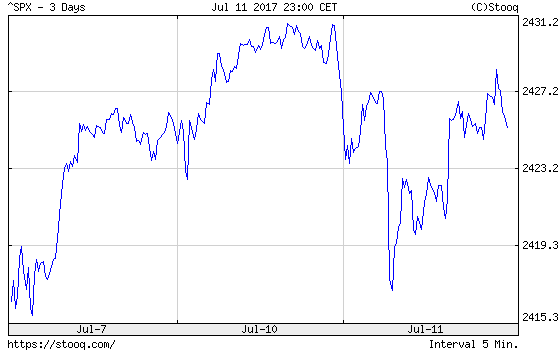

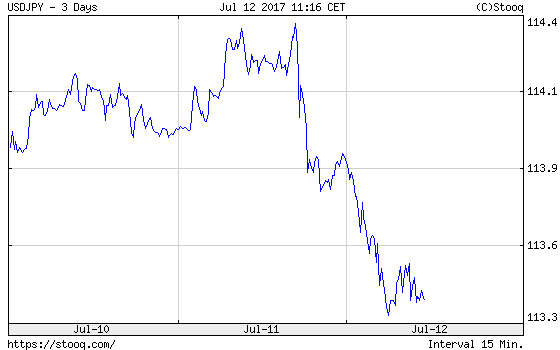

Indeed, financial markets were jarred by the sudden disclosure. The S&P 500 Index decreased about 0.6 percent in minutes, while the dx depreciated against the Japanese yen, as the chart below shows.

Chart 2: S&P 500 Index – Last 3 Days

Chart 3: USD/JPY – Last 3 Days

Investors are afraid that the surprise release may add to the political turmoil in Washington D.C. Some analysts even speculate that Trump Jr.’s behavior could lead to criminal liability and could weakened the President’s position and his ability to enact a pro-growth agenda. The most controversial passage from the email chain comes from the June 3, 2016, email to Donald Trump Jr. from publicist Rob Goldstone:

The Crown prosecutor of Russia (…) offered to provide the Trump campaign with some official documents and information that would incriminate Hillary and her dealings with Russia and would be very useful to your father. This is obviously very high level and sensitive information but is part of Russia and its government’s support for Mr. Trump

And Trump Jr. replied “if it’s what you say I love it”. Hence, for us, the whole story is a bit overblown, as there is no evidence that the President’ eldest son received any information from the Russian government. Perhaps he should not have taken this meeting, but taking meetings is not illegal, even with foreigners, as far as we know. Anyway, a serious investigation is needed to discover what really happened.

The key takeaway is that Donald Trump Jr. released emails which suggest that Russia wanted to support Trump’s presidential campaign. This shook the financial markets and boosted the price of gold. It confirms that gold is a safe-haven asset sensitive to political uncertainty in the U.S. The new ‘scandal’ may support gold prices for a while, but we are skeptical whether this will be enough to send gold surging higher. When emotions stabilize, the yellow metal may return to its downward trend. We will monitor the market closely, stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Thank you.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.