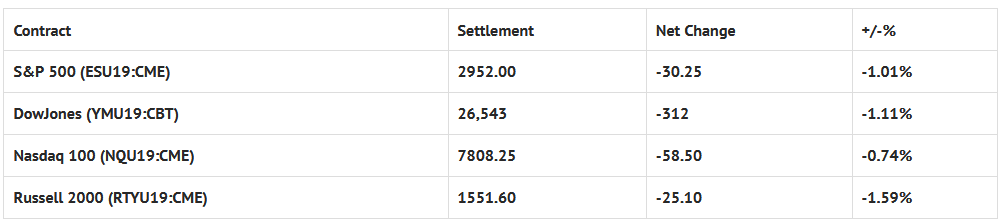

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the Employment Situation 8:30 AM ET, International Trade 8:30 AM ET, Consumer Sentiment 10:00 AM ET, Factory Orders 10:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Headline Algos Rule The Day

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -7 as upper momentum is lost and its back to risk off and Tactical. For today, see if we stay below or reclaim 2945 with 2910 below.

During Wednesday nights Globex session, the S&P 500 futures (ESU19:CME) printed a low at 2966.25, a high at 2989.50, and opened Thursday’s regular trading hours (RTH) at 2981.25, more than 23 handles higher from Wednesday’s low.

The ESU was strong overnight, and that strength bled through into Thursday’s RTH open. Immediately after the 8:30 CT bell, buy programs were activated, and they didn’t stop until the futures topped out at 3014.50 just before 11:00.

The morning session was a textbook trend day. The buying was relentless, and there were no pullbacks. Weak shorts just added fuel to the fire.

Once the high was in the ES did a little back-and-fill down to 3006.25, before settling into a 5 handle range for the next few hours.

Just before 12:30 CT, Trump sent out a tweet regarding the China trade deal, and sellers immediately stepped in. In less than 10 minutes, the entire morning rally had been wiped out, and the ES was trading below the opening range.

The futures eventually took out Wednesday’s low at 2958.00, and traded all the way down to 2944.50. Once the smoke cleared, buyers briefly surfaced, and the ES was able to rally back up to 2964.50. That would be the last push higher though.

When the MiM reveal came out showing over $1.5 billion to sell MOC, the futures traded back down to 2949.00, and would then go on to print 2954.00 on the 3:00 cash close, and 2950.50 on the 3:15 futures close, down -31.75 handles for the day.