Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -0.56%, Hang Seng -1.73%, Nikkei -0.35%

- In Europe 11 out of 13 markets are trading lower: CAC -0.79%, DAX -0.54%, FTSE -0.77%

- Fair Value: S&P +0.51, NASDAQ +2.58, Dow +7.35

- Total Volume: 1.37 million ESM & 627 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, CPI 8:30 AM ET, Atlanta Fed Business Inflation Expectations 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, 10-Yr Note Auction 1:00 PM ET, and Treasury Budget 2:00 PM ET.

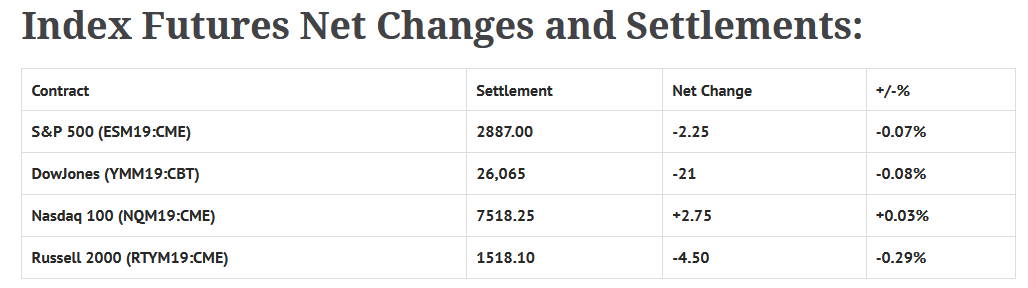

S&P 500 Futures: Buy #NQ / Sell #ES

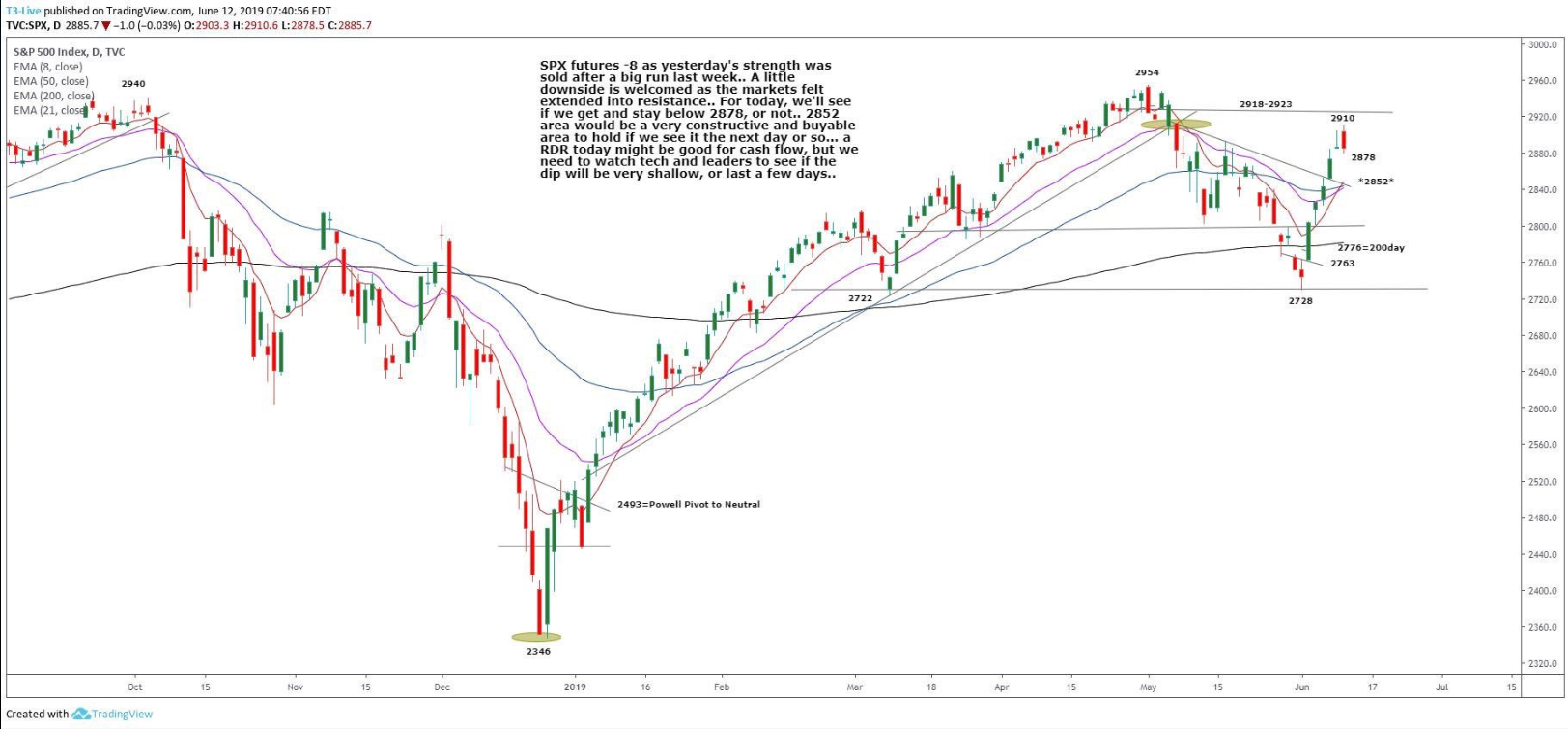

Chart courtesy of Scott Redler @RedDogT3 – $spx futures -8 as most wanted a breather after 6-7 days of strength.

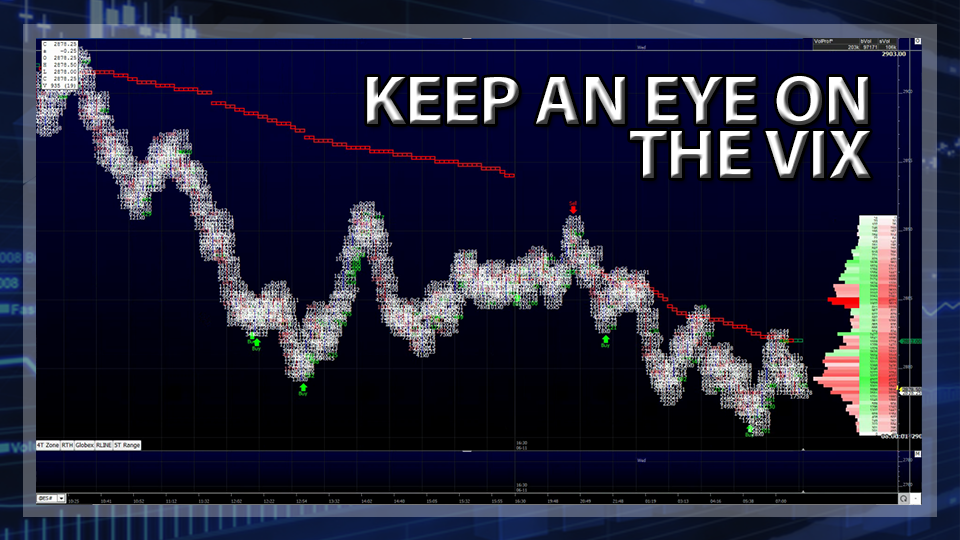

The S&P 500 futures (ESM19:CME) rallied during Monday nights Globex session to open Tuesday’s regular trading hours at 2907.25, and quickly printed a new high 2911.50 just after the 8:30 CT bell. Buyers ran out of bullets after that though. Sellers stepped in and took over the tape for the rest of the morning, first taking the ES down to 2897.00, then 2893.50, and eventually to a new low at 2879.25.

Just after 12:30, a series of buy programs simultaneously triggered in the ES, NQ, RTY, and YM, confirming that the low had been established. From there, the futures turned around, and by 1:00 had rallied 13 handles off the low.

Going into the final hour, the ES had run out of gas, and drifted sideways in an 8 handle range. The MiM was little help in pushing the futures any higher, and the ES went on to print 2886.00 on the 3:00 cash close, and 2886.75 on the 3:15 futures close.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.