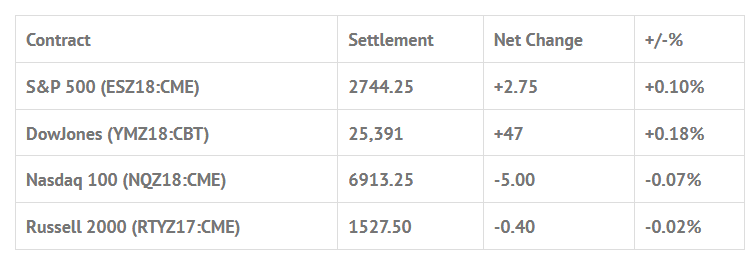

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +0.81%, Hang Seng +0.21%, Nikkei +0.40%

- In Europe 12 out of 13 markets are trading lower: CAC -0.37%, DAX -0.58%, FTSE -0.70%

- Fair Value: S&P +0.67, NASDAQ +5.06, Dow +17.48

- Total Volume: 1.48mil ESZ & 569 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes a 2-Yr Note Settlement, a 5-Yr Note Settlement, a 7-Yr Note Settlement, a 10-Yr TIPS Settlement, John Williams (NYSE:WMB) Speaks at 9:00 AM ET, Chicago PMI at 9:45 AM ET, and the Baker-Hughes Rig Count at 1:00 PM ET.

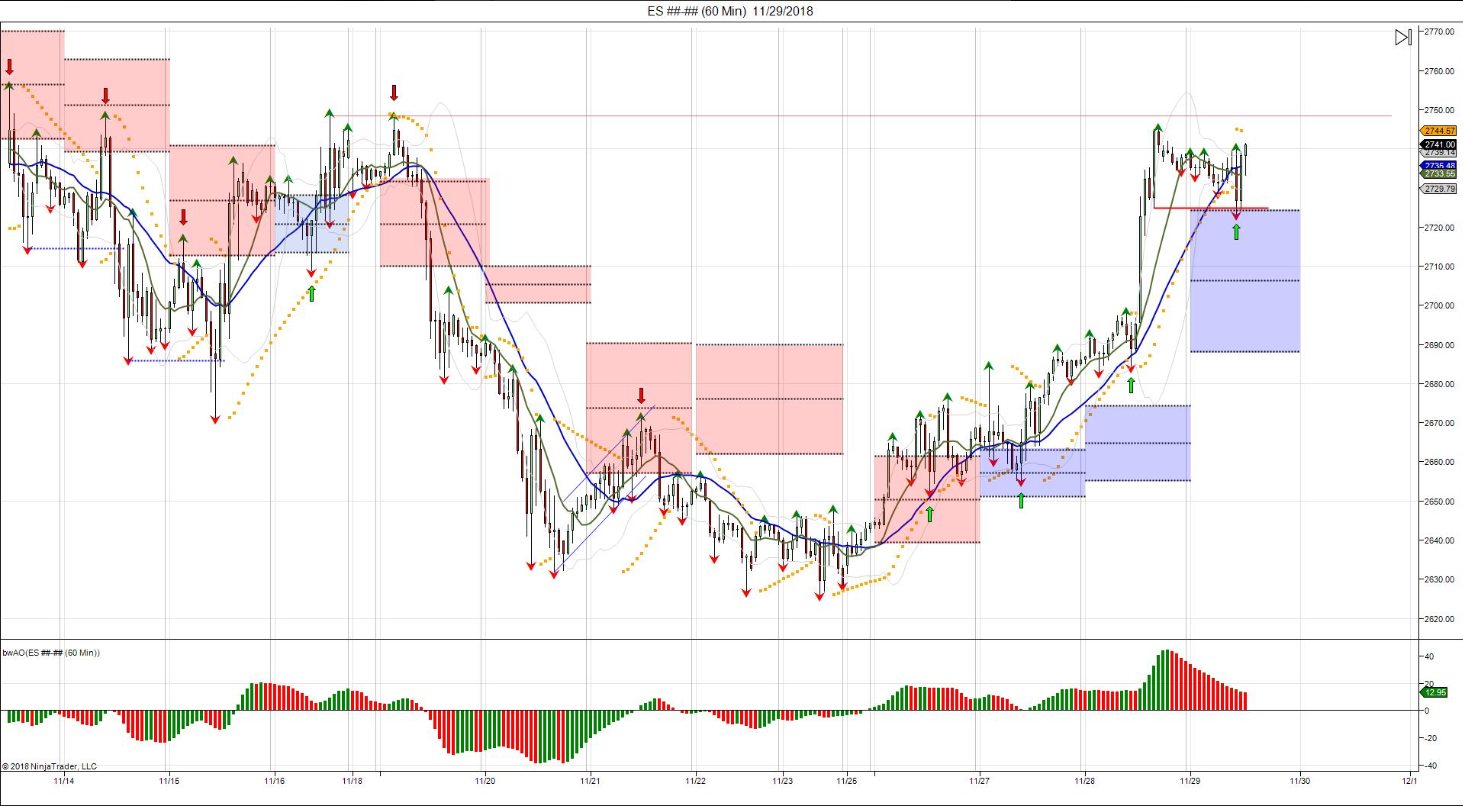

S&P 500 Futures: #ES 2754.50

Chart courtesy of @Chicagostock – $ES_F Got 3D pivots? Since Monday’s close above the 3D pivot to reverse the negative trend, along with Tuesday’s follow through, trend reversed higher, putting pressure back up. 3D pivot ranges acting as support on new found bull trend that began Monday.

After trading lower for much of the overnight session, the S&P 500 futures opened yesterday’s regular session at 2736.25. The benchmark futures chopped around early before turning lower, after 9:00, and finding the morning low of 2723.25 heading into the 10:00 hour. The late morning saw a rally to a high at 2742.00 after news broke that Trump and China were working for a compromised trade deal.

The afternoon saw an early 2737.00 low before chopping higher up to 2744.00, and then buy programs hit pushing the ES up to 2749.50. Then, after a 3.25 handle pullback, there was another push up to 2754.50 heading into the final hour. After 2:00 the futures began to turn a little lower, the result of some profit taking into the close, finding a late low of 2737.25. The ES went on to print 2738.75 on the 3:00 cash close before settling the day at 2744.00, up +2.50 handles, or +0.09%.

Overall, the story of the day was about three sides; the early weakness following poor jobless claims and pending home sales, then the rally on China/Trump rumors, followed by late day selling as T+2 for the end of the month created a 1.1 billion MOC sell side imbalance, forcing the futures to retrace the day’s gains.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.