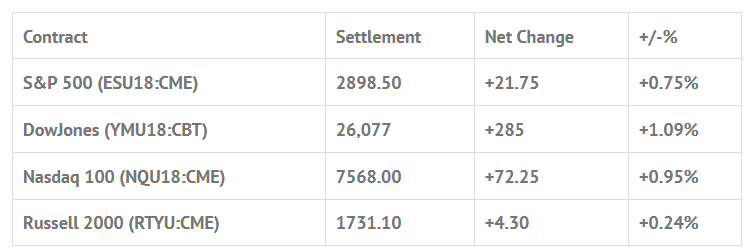

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp -0.10%, Hang Seng +0.28%, Nikkei +0.06%

- In Europe 12 out of 13 markets are trading higher: CAC +0.24%, DAX +0.11%, FTSE +0.37%

- Fair Value: S&P +0.57, NASDAQ +6.42, Dow +2.11

- Total Volume: 945k ESU & 197 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes International Trade in Goods 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, Redbook 8:55 AM ET, S&P Corelogic Case-Shiller HPI 9:00 AM ET, Consumer Confidence 10:00 AM ET, Richmond Fed Manufacturing Index 10:00 AM ET, and State Street Investor Confidence Index 10:00 AM ET.

S&P 500 Futures: Trump’s Art Of The Deal Pushes The S&P To New All-Time Highs, Adds $1.9 Trillion in market-cap in 2018

Like trading, President Trump’s ‘art of the deal’ is all about getting results. He passed the massive tax cuts, employment is at an all time high, leveling trade deals, and cutting regulations are just a few things on a list of many. I know some people will say that the president inherited a solid economy, but I think it’s more than that. He may have inherited it, but clearly he enhanced it, and its working. If the democrats pick up seats in the midterm elections, will they try and slow him down / impeach him? Yes, I do think they will try, but like I said, like him or hate him, all it will do is cause gridlock, something the S&P does not need.

On Globex Sunday night the S&P 500 futures traded up to 2889.00, up 22.25 handles. On the 8:30 CT futures open the ES printed 2888.50. After down ticking to 2887.00, the futures traded up to 2897.00 at 9:31, completing a MrTopStep 10 Handle Rule. For the next hour and a half the ES traded in a narrow range, and then made four higher highs up to 2899.25 at 12:06.

The afternoon saw a sideways to lower chop, as the benchmark future stayed in a 3.25 handle range, making an afternoon low of 2895.00 early in the last hour. The ES printed 2897.75 on the cash close, before settling the day at 2898.75, up +22.00 handles, or 0.76%.

In the end, the trade deal and low volume was what yesterday’s push was all about. In terms of the ES’s overall, tone it still feels higher to me.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.