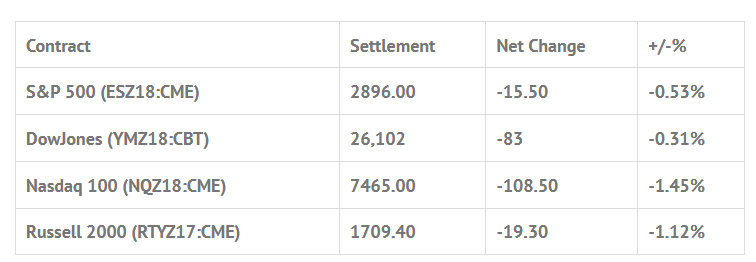

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp +1.82%, Hang Seng +0.56%, Nikkei +1.41%

- In Europe 9 out of 13 markets are trading higher: CAC +0.19%, DAX +0.16%, FTSE +0.05%

- Fair Value: S&P +5.87, NASDAQ +30.41, Dow +33.19

- Total Volume: 1.78mil ESZ & 11,294 SPZ traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Redbook 8:55 AM ET, Housing Market Index 10:00 AM ET, a 4-Week Bill Auction 11:30 AM ET, and Treasury International Capital 4:00 PM ET.

S&P 500 Futures: US / China Trade Wars Continue

China newspapers warned it won’t play defense on trade as Trump lauds tariffs, but as the trade wars drag on, China’s stocks have lost over $5 trillion in market capitalization. During Sunday nights Globex session Shanghai stocks closed at their lowest levels since 2014. Thats getting serious!

European stocks were also weak, and that weakness showed up in US stocks.

After trading in a 7.25 handle range in the overnight session, the S&P 500 futures opened yesterday’s regular trading hours at 2909.75, down down -1.25 handles. The first move after the bell was up to an early high at 2910.25, followed by a wave of sell programs that pulled the index futures down to a mid morning low of 2899.25 just before 10:00.

The late morning saw a push higher, printing 2905.50, before sellers once again took over going into the afternoon, taking the ES down to a new low of day at 12:30 of 2897.75. From there, the futures up bounced to 2903.00, then traded back down to 2897.25 just before 2:00 pm.

With the S&P making a series of lower highs and lower lows throughout the day, the overall tone felt like a slow drain lower.

In the final hour the ES continued to make its way lower as the headlines posted that Trump would make a trade announcement later in the day. The weight was too strong for the ES, and a new low were made late in the day at 2892.25. The futures went on to print 2895.25 on the 3:00 cash close before settling the day at 2896.00, down -15.50 handles, or -0.53%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.