Unique “Double Trigger” Option Setup

Very few traders know about this unique market phenomenon. Those who do could capture short term option returns – of up to 320%. How it works is simple: if a stock crosses one red line the setup is “armed” And, if it crosses the second red line? We get an explosive move.

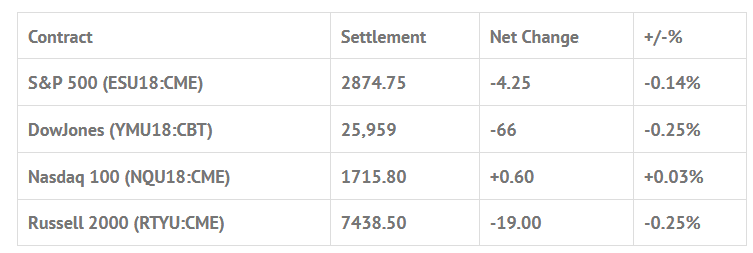

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -1.21%, Hang Seng -1.33%, Nikkei +0.30%

- In Europe 12 out of 13 markets are trading higher: CAC +0.49%, DAX +0.42%, FTSE +0.37%

- Fair Value: S&P +0.69, NASDAQ +3.08, Dow +16.18

- Total Volume: 1.69mil ESU & 235 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Raphael Bostic Speaks 11:30 AM ET, TD Ameritrade IMX 12:30 PM ET, and Consumer Credit 3:00 PM ET.

S&P 500 Futures: Headline Algo’s Crush S&P After Trump Threatens More Tariffs

The S&P 500 futures were weak Thursday night into Friday mornings open on Globex. The ES made an ealy low at 2868.00, and then opened at 2867.50 on the 8:30 CT futures open. Just after the bell the futures down ticked to 2865.00 at 8:34, which would remain the low for the day, and then made nine higher highs up to 2885.00 at 10:42. From there, the headline algos took over when this headline hit the tape : Trump 11:09 (US) Pres Trump: there is another $267B in tariffs ready to go, in addition to the $200B that have been announced.

After the headline the ES quickly dropped down to 2868.25. The next move was back up to the vwap at 2874.75 and then back down to 2767.00. After the pullback the ES resisted at the vwap again at 2874.50, sold back off down to 2828.75, and then rallied up to 2876.75. Total volume at 1:37 was huge, 1.27 million ES contracts had traded. The S&P’s drifted lower into the close to 2870.25 before printing 2873.75 at 3:00, and then settled the day at 2875.00 down -4.00 handles, or -0.14%.

In the end it was a week that was all about the headlines. Every time the ES rallied a new headline hit the tape causing another selloff. In terms of the days overall trade, it was a fairly busy day, 1.69 million contracts traded. In terms of the ES’s overall tone, it seemed like the futures wanted to rally early on, but when the additional tariff headlines hit the tape it was “down she goes.”

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.