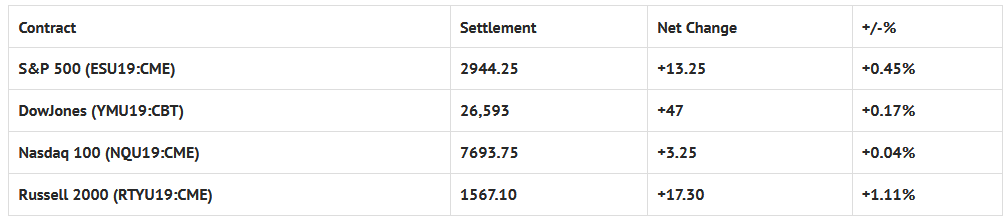

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp +2.22%, Hang Seng -0.28%, Nikkei +2.13%

- In Europe 13 out of 13 markets are trading higher: CAC +0.83%, DAX +1.22%, FTSE +1.33%

- Fair Value: S&P +3.98, NASDAQ +25.09, Dow -5.50

- Total Volume: 1.28 million ESU & 387 SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the PMI Manufacturing Index 9:45 AM ET, ISM Mfg Index 10:00 AM ET, and Construction Spending 10:00 AM ET.

S&P 500 Futures: Tariff Front Run

Chart courtesy of Scott Redler @RedDogT3 – $spx futures opening above 2954-2964 key area. We’ll see if it stays above it and builds. Or not! New quarterly flows can help.

After being held to just a 10 handle range during Thursday nights Globex session, the S&P 500 futures (ESU19:CME) rallied to open Friday’s regular trading hours (RTH) at 2938.50, and print a new high at 2941.00 just after the 8:30 CT bell.

It was a quiet morning, for the most part, with the ES trading down to 2932.75 after the RTH open, then drifting sideways in an 8 handle range for the next three hours. The next move next that came into play was after 11:30, when the ESU popped up to a new high at 2944.75, and the walk-away-trade started to set up.

The Walk Away Trade is a MrTopStep trading rule setup. This is an end of the quarter trade. On the last day of the quarter, the portfolio managers have a tendency to run out of money after marking up stocks earlier.

So, by 12:00-1:00ish CST, the S&P is susceptible to a decline through the afternoon. Traders look to set up a short position in the early to mid afternoon, as the professional money managers walk away, leaving the equities ready for an afternoon fade.

It was a textbook setup, with the ES trading 10 handles lower over the next three hours. From there, the end of the quarter rebalance took over, and the close got a little wild.

It was fairly obvious that the guys with the better seats bought on Globex, on the 8:30 CT open, and on the early and late pullbacks. People can say what they want, but we think the 20 handle rip in the last half hour of trading was a big tariff front run.

Also, after factoring in the MiM getting as high as $4 billion to buy, it would have been hard for the ES not to close out the day on its highs.