Today is the day that US President Donald Trump will launch his new and improved tax reform agenda. If successful, this will be the first major upgrade to the US tax code since 1986.

Just about everybody agrees that the code needs to be fixed but almost nobody can agree on how it should be done. Trump's way seems good enough if he can get it done. So far his powers of legislation have been less than impressive.

Trump's tax agenda has been the number one driver of market movements so far this year so today is a really big day. Oh, and there are other things affecting markets too, which we'll explore below.

Today's Highlights

Harvey and Kim Continue

It's May in Japan

$5 Billion Day!

Please note: All data, figures & graphs below are valid as of August 30th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

The driving factors that we mentioned yesterday are still very much at play. Hurricane Harvey has made another pass at Texas and Kim Jong Un has made another pass at Trump by hinting that he may soon be targeting the US Navel Base in Guam.

Yet somehow, magicians on Wall Street were able to turn their frowns upside down and pulled off a winning session. Asian stocks have followed suit and are currently up on the day. If Europe can keep the momentum going it will be a very pleasant surprise given all the sour news.

In this chart, we can see the major indices from around the world over the last two days. Dow Jones in white, China 50 in green, and Dax 30in blue.

May in Japan

Today Theresa May will visit the Island nation in an attempt to convince the Japanese people and the rest of the world that the UK will remain a financial powerhouse after Brexit.

Prime Minister Shinzo Abe has other matters on his mind of course. With missiles being flown at this country whether or not Japanese car factories will continue to operate in the UK in 2 years from now may be the least of his concerns at the moment.

The Japanese yen, which has gained a lot of strength following the missile that flew over Hokkaido, has been on the losing end today while the UK's pound sterling has been relatively stable over the last few months.

The GBP/JPY is a favorite pair of volatility currency traders and seems to have found itself a nice pattern on the daily chart.

Can you name this common candlestick formation?

Cryptos Surging Again

Ladies and Gentlemen the value of all cryptocurrencies in circulation has risen by another $5 Billion over the last 24 hours alone.

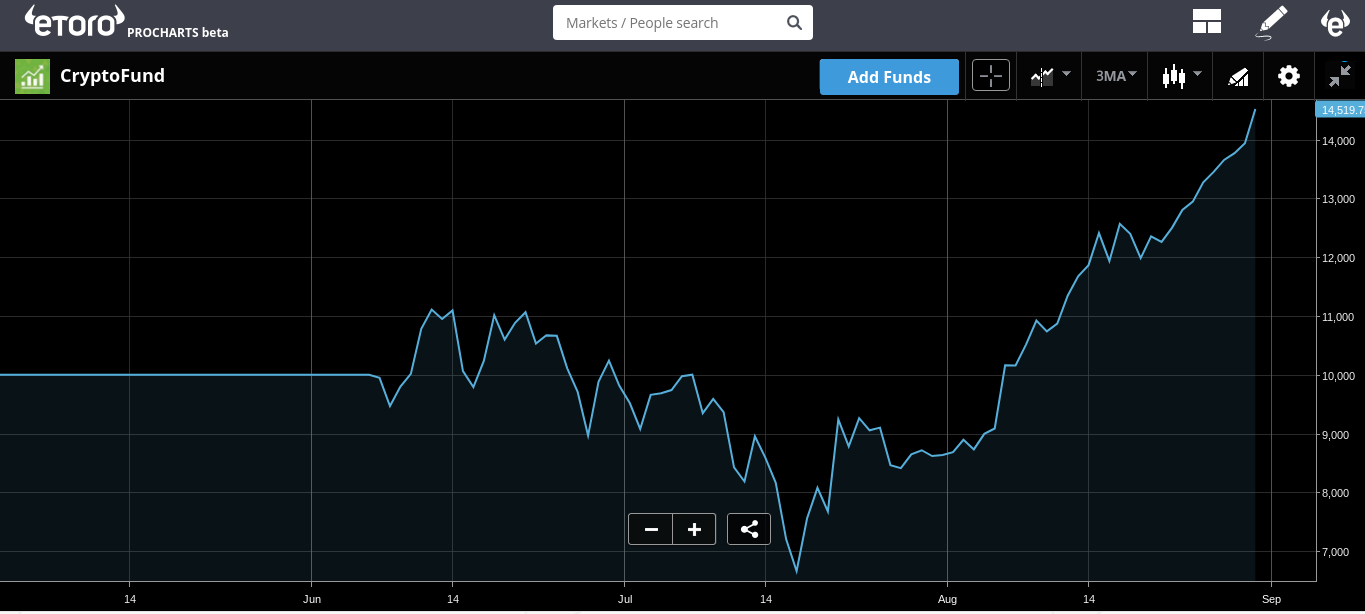

The brand new eToro Crypto CopyFund is already showing a massive 45% return on investment since it was launched in mid-June.

Here we can see the copy simulation of the CopyFund that shows how much you would make had you invested $10,000 since the start.

I'd like to take this opportunity to thank you and all readers of the daily market update. Your well thought out comments and feedback are extremely valuable and always appreciated.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.