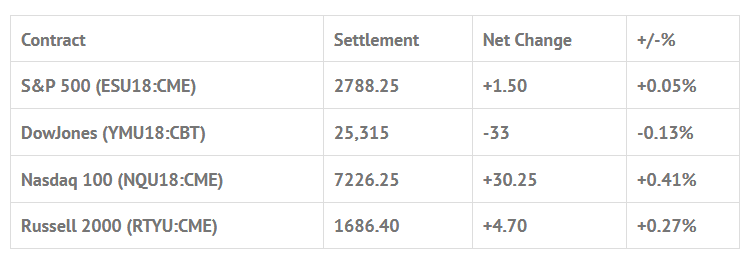

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -0.97%, Hang Seng -1.22%, Nikkei +0.38%

- In Europe 11 out of 13 markets are trading higher: CAC +0.32%, DAX +0.37%, FTSE +0.46%

- Fair Value: S&P +3.80, NASDAQ +27.37, Dow +11.41

- Total Volume: 1.49mil ESU & 8,556 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, PPI-FD 8:30 AM ET, Atlanta Fed Business Inflation Expectations 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, FOMC Meeting Announcement 2:00 PM ET, FOMC Forecasts 2:00 PM ET, and the Fed Chair Press Conference 2:30 PM ET.

S&P 500 Futures: Nasdaq Futures (NQM18:CME) Rip Takes The #ES and #Dow For The Ride

There is little doubt about the direction of the US stock market right now. Investors have been piling back into tech stocks and the Russell 2000, and its taking the S&P and Dow for the ride.

Yesterday’s trade started with subdued Asian markets. South Korea closed down -0.1%, Japan’s Nikkei up +0.3%, and Hong Kong’s Hang Seng up +0.1%. In Europe at midday the Stoxx 600 was flat.

The S&P 500 futures had a 9.75 handle trading range on globex, 2782.25 to 2792.00, with 395,000 (ESM18:CME) contracts traded before the open. The first print of the day on the 8:30 CT open came in at 2791.00 followed by a pullback to 2786.00 at 8:55. After the low the ES rallied up to 2790.75 and then traded in a 4 handles range for the next hour and twenty minutes. From there, the futures shot up to 2794.00 at 11:10 as the Nasdaq (NQM18:CME) ‘triple topped’ at 7236.00.

After the high the ES traded back down to 2782.75 going into 2:00 CT as the MiM went from $366 million to sell to $580 million to sell at 2:08. The ES then bounced up to the vwap at 2789.25 as the MiM flipped to sell $109 million at 2:42. On the 2:45 cash imbalance reveal the ES traded 2787.00 as the final MiM showed $116 million for sale. On the 3:00 cash close the ES traded 2790.50, and then went on to settle at 2787.75, up +1.00 handle on the day, or up +0.04%.

In the end it’s all about the trend, and right now that’s up. While the S&P may be the world’s leading index, the Nasdaq has been running the wheel. Where the Nasdaq goes, so does the S&P. In terms of yesterday’s overall trade, it was another day of very low volume. In terms of the markets overall tone, we just do not see the weakness.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.